Moderna Inc (MRNA) Stock Price and Forecast: Moderna works on Omicron booster

- Moderna shares rally as Omicron booster jab becomes possible.

- MRNA stock still struggling for momentum since last earnings report.

- Is covid coming to a close and can Moderna (MRNA) replace this income stream?

Moderna shares jumped on Monday as the vaccine maker says it is working on a covid booster shot targeting the Omicron variant. This and an increase to earnings guidance were welcomed by investors. The shares closed 9% higher at $233.70.

Moderna (MRNA) stock news

Moderna shares have been struggling since the last earnings report in November. MRNA price broke below $300, and it took the emergence of Omicron to reverse that trend. However, as more and more evidence mounted that Omicron appears less severe, Moderna has resumed the downtrend with the occasional spike as witnessed yesterday.

The big question surrounding investment in this one is how to replace the massive revenue stream that is covid vaccination. We are assuming this covid winter is the last one. Perhaps vaccinations will be needed next year, but it is highly unlikely to be anywhere near the extent of the current take-up globally.

How will they replace that income? A flu vaccine is a possibility or treatments aimed at other diseases and conditions. MRNA vaccines may target other diseases, but in reality this pandemic is hopefully a once-in-a-century event. Pharma stocks go back then to being what they often are, speculative development pipelines with investors needing to carefully watch upcoming pipelines and put a probability on the relative success or failure of each potential treatment. You can see Moderna's pipeline here.

Moderna (MRNA) stock forecast

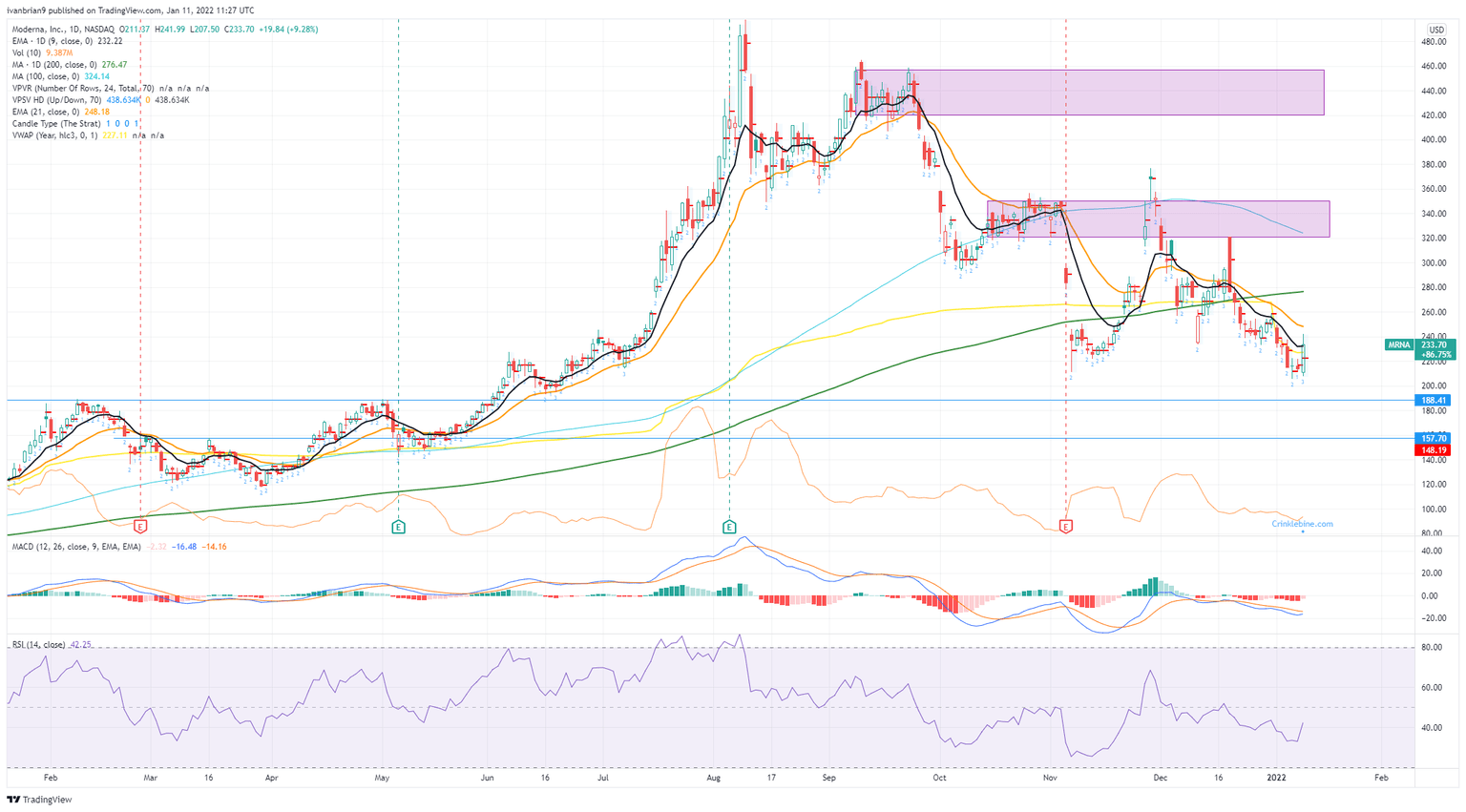

Monday's move looks impressive, but on the chart below it has failed to dent the downtrend. While a guidance upgrade is always welcome and strong vaccine sales as well, the trend is still bearish in our view. Two key pieces of evidence support our view.

First, MRNA has set a lower low than the post-earnings slump. Secondly, Monday's spike has not yet resulted in a higher high. Breaking $260 will change this and make the short-term view bullish. That will then bring a big test of resistance at the big spike from December at $321. Support at $188.41 remains the target otherwise and then onto $157.

Moderna (MRNA) chart, daily

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.