Mixed Magnificent Seven results as mid cap rally powers on

The stock market rally faces a big hurdle this week, as it is the peak of earnings season for the S&P 500. The picture so far has been mixed. On Tuesday evening the focus was on the Magnificent 7. Tesla and Google both reported earnings. In post-market trading Tesla’s share price is lower by 7%, and Alphabet’s share price is also lower after eroding earlier gains. This suggests that the market is not impressed with the start of earnings season for the mega tech stocks.

Alphabet beats revenue expectations, but there are pockets of weakness elsewhere

Digging deeper into Alphabet’s earnings, these were always going to be a test of the impact AI investments are having on the company’s bottom line and revenue. The company reported weaker than expected earnings per share at $1.89 vs. $1.90 expected. However, revenue was higher than analysts had predicted, rising by $71.35bn, vs. $70.7bn expected. Ebitda was well below expectations at $31.13bn, vs. $36bn expected.

Google’s search function still batting off AI challenge for now

The average one day move for the past 8 periods after Alphabet’s earnings release is usually 6.43%, however, this earnings report has left the market feeling flat in the immediate aftermath of the earnings release. The details of this report, in particular how Google’s AI investments are paying off, were always the most important part for investors. Google cloud is one of its revenue streams that it is investing in intensively. It brought in revenues of $1.17bn, better than the $982mn expected. The company said that it was attracting demand from AI startups, which is positive for its future growth. Added to this, last quarter’s search advertising revenue also surprised on the upside, it was $48.5bn vs. estimates of $47.6bn. This is good news for the business and suggests that its search business is far from being swallowed up by chatbots like OpenAI, which are seen as a threat to traditional search engines.

Google continues to burn through cash

However, clouding the picture for Alphabet was weaker revenue at YouTube, which has a history of delivering volatile results, and Google’s cash and cash equivalents fell sharply last quarter to $100.7bn down from $108bn. This is still a decent cash load on its balance sheet, but it does suggest that continued AI investment along with rising costs for some of its moonshot businesses are taking their toll.

Google’s future growth is likely to be hampered by antitrust rulings that have already blocked two of its acquisition potentials: Wiz and HubSpot. These deals would have given Google a decent foothold into the lucrative cyber security business, and it would have given it extra exposure to cloud computing.

Costs weigh on Google’s share price

Overall, Google’s second quarter performance was driven by search and cloud, it maintained its operating margin target, which is the same as 2023, net income margin for Q2 was 28.7%, which is not bad for a company with a 12-month forward P/E ratio of 22.45. It said that the majority of its top 100 customers are using its AI products, however, the market will want to see more penetration later this year. The company said that it intends to boost headcount in Q3, and that it still expects quarterly expenditure of $12bn.

While Google can afford its planned expenditure, the market may have preferred a lower number, which is why its share price is lower in the afterhours trading market.

Tesla continues to disappoint

Tesla managed to beat revenue forecasts for the last quarter, and posted revenues of $25.5bn vs, expectations of $24.62bn, however, net income, EBITDA and EPS were all considerably weaker than expected. EPS was $0.52 vs. $0.60 expected. EPS is a good measure of a company’s profitability, this suggests that although Tesla is profitable, it is far less profitable than other Magnificent 7 companies, added to this, even the market thought it could do better than this. With a 12-month forward P/E ratio of 84.58, the stock continues to look extremely expensive, which may exacerbate the decline in its share price.

Tesla suffers as EV competition heats up

Looking at the detail of its earnings report a bit more closely, Tesla’s energy storage business is growing at a much faster rate than its car sales business, and it doubled revenue in Q2 relative to Q2 2023. However, the rest of its forecasts for the business were torrid. It expects a notably lower volume growth rate for 2024, plans for a more affordable Tesla have been pushed back slightly to the first half of 2024, previously it had been early 2025. Added to this, registrations for new Tesla’s in the state of California, the EV capital of the world, were down for the third straight quarter on an annual comparison basis. This highlights the tough spot for EV makers right now: there is more competition than ever, consumers are buying second hand EVs and hybrids are also becoming more appealing. Thus, the macro environment is also not supportive for Tesla.

Politics and AI delays weigh on Tesla’s share price

The robotaxi, Tesla’s AI masterpiece, was meant to be announced in August, however this has been pushed out to October. This could also impact market sentiment towards the stock in the medium term. Tesla’s share price has rallied hard in the past month and is higher by more than 35%, however, this means it could have further to fall as investors do not seem to be too impressed by these results, and after a strong rally in Tesla’s share price in recent weeks, the stock price sell off could be brutal.

Elon Musk has also addressed concerns about a potential Trump victory in November and what that means for EVs and exports. Musk is an enthusiastic supporter of President Trump, and he has said that all investments in its Mexico factory will be halted until after the election in November. This is another risk that investors need to price in.

AI hopes fall flat, as mid-caps play catch up for now

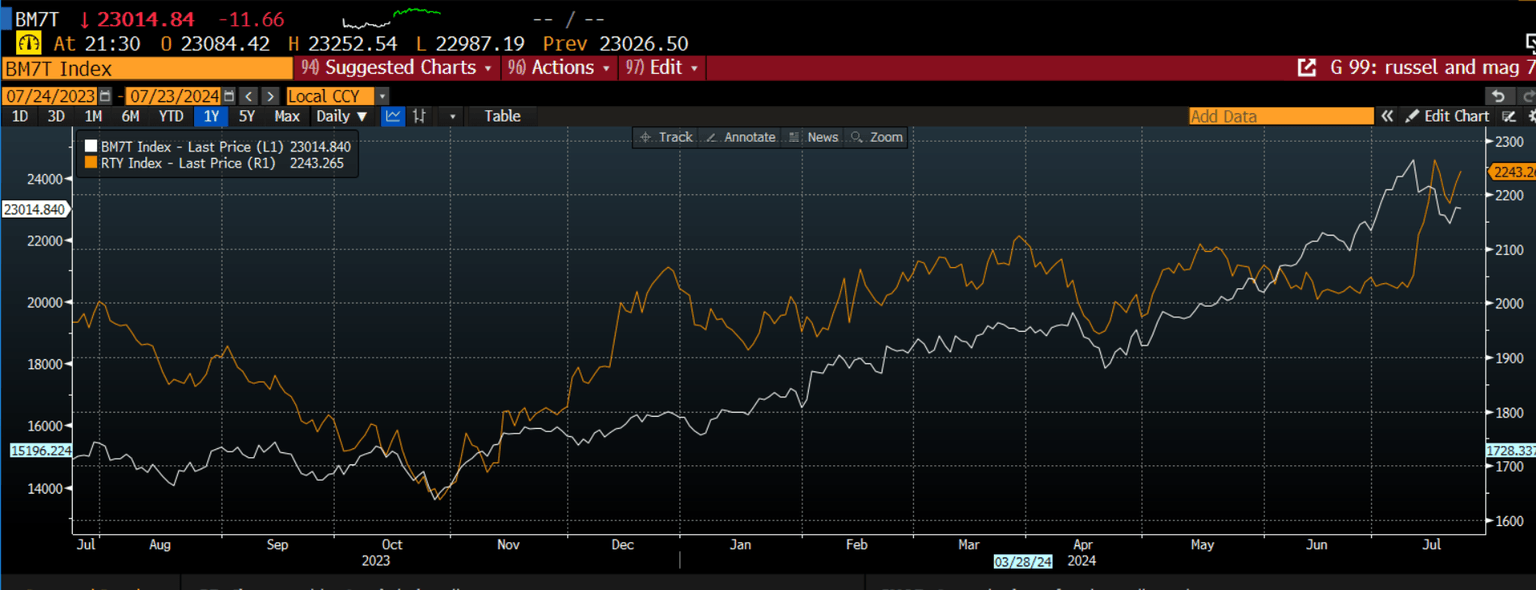

Overall, there was a lot resting on these results and we don’t think that they give clear answers to questions about the effectiveness and profit potential for AI right now. This could hinder big tech’s performance in the short term. On Tuesday, the broader US blue chip markets struggled, as the mid-cap rally gathered pace. The Russell 2000 is also outperforming the Magnificent 7, as you can see below. However, it is worth noting that value companies including the United States Postal Service saw its largest ever share price plunge on the back of disappointing earnings, and Southwest Airlines also saw its share price fall sharply after it said that it faced greater regulatory scrutiny after a series of incidents on its planes.

Thus, for now, the mid-cap rally looks set to continue, but if we continue to see some downbeat earnings reports from the non-tech sectors, then the mid-cap rally may also be in trouble.

Chart one: Russell 2000 and Magnificent Seven

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.