Miniso (MNSO) rockets ahead with bullish momentum – How high can it go? [Video]

![Miniso (MNSO) rockets ahead with bullish momentum – How high can it go? [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/Chartism/generic-chart-19151967_XtraLarge.jpg)

MINISO Group Holding Limited (MNSO) is a Chinese low-cost retailer with a wide range of design-led lifestyle products. It specializes in household and consumer goods, including stationery, cosmetics, kitchenware, and toys, and has expanded into global markets, with 4,200 stores across six continents. In 2016, Miniso’s sales revenue was $1.5 billion. The company collaborated with Marvel Entertainment in 2019 to sell branded products.

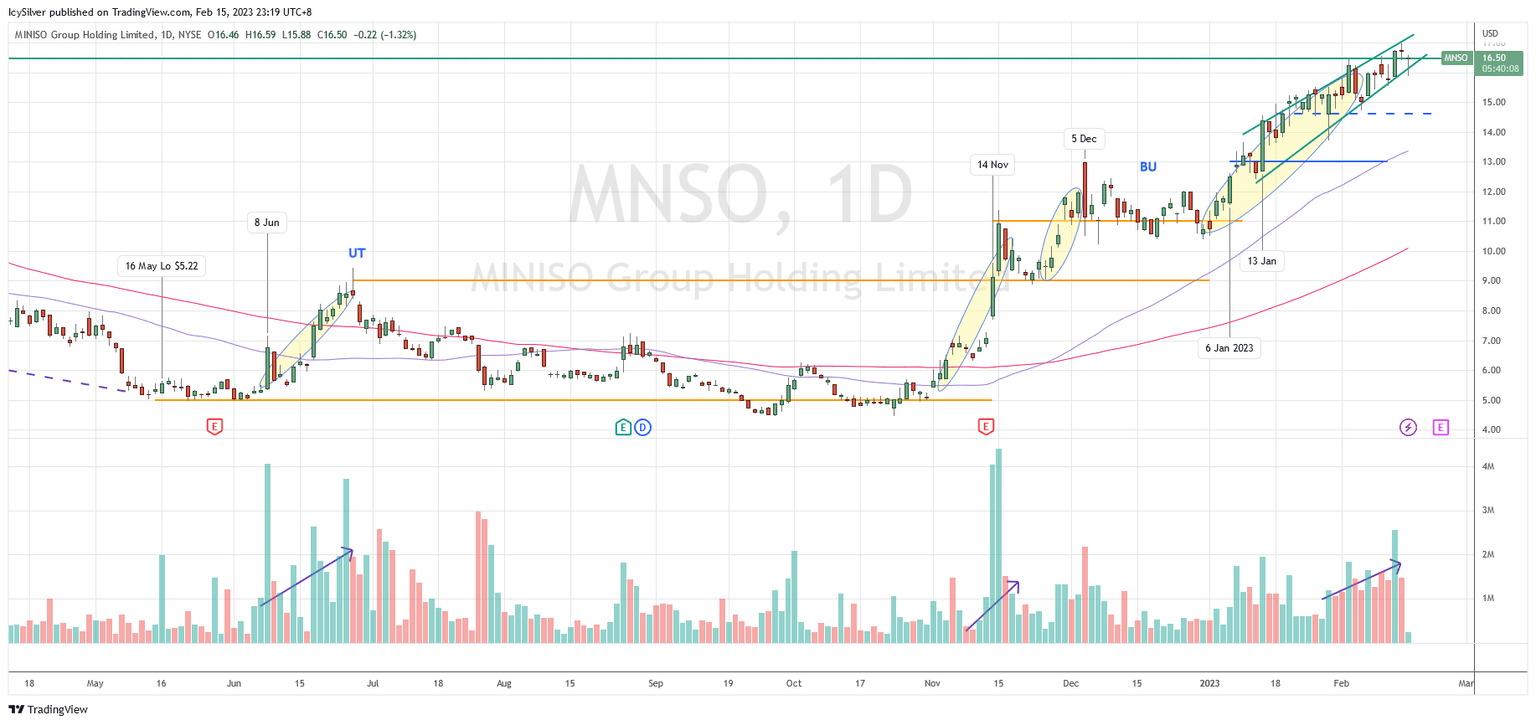

MNSO has been in a down trend since June 2021. This carried on for almost a year. On 8 June 2022, a momentum bar coupled with a spike of volume occurred. This was followed by a Wyckoff sign of strength (SOS) rally with a spike of volume to hit around $9. This swing up was considered as the Wyckoff change of character (CHoC) to transform the down trend to a potential Wyckoff accumulation phase. The price then retraced back into trading range, forming a Wyckoff upthrust (UT) that failed to commit above the resistance at $9.

The price grinded down to retest the support of $5 several times and it is worth noting that during this period, the volume has been decreasing. This has hallmark characteristics of bullish bias. The SOS rally in early November was the best rally in the last 12 months. It broke out of the $9 resistance on 14 Nov with a spike of volume. The price was able to commit above $9 followed by a minor pull back tested the resistance-turned-support at $9. The bar on 5 Dec came with localized increase of volume suggesting presence of supply and the price consolidated in a Wyckoff backup (BU) phase.

The next breakout on 13 Jan 2023 signifies MNSO entering Wyckoff phase E markup. The follow through price action to rally up continued until it hit around $16.50 which is a long term resistant line. The bar spreads since the breakout is also narrower with increasing volume together shortening of the thrust to the upside. This would suggest exhaustion of the up momentum and profit taking activities around the $16.50 axis.

Bias

Bullish. According to the Wyckoff method, MNSO has completed an accumulation phase and is now in phase E mark up. However, the upcoming earning results and long term resistance area of $16.50 might cause the price to retest the $14.50 support in the near term. If it can continue to commit above $16.50, the next target would be $20 and $27.

If the price breaks below $14.50, it is likely to retest the support of $13. MNSO was discussed in detail in my weekly live group coaching on 31 Jan 2023 before the market opened. The improving market breadth together with many bullish trade entry setups could suggest a new bull run as discussed in the video below.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.