- MICT up as subsidiary Micronet Enertec Technologies got its first significant order.

- Equities trading with a cautious stance ahead of FOMC Meeting’s Minutes.

- MICT trading below Tuesday’s low ahead of Wall Street’s opening.

(NASDAQ: MICT) surged on Tuesday following news showing that its subsidiary Micronet Enertec Technologies, Inc.y received the first significant order for its SmartCam a new telematics product, which received US Federal Communications Commission authorization, Integrates advanced software and AI functionality with camera technology to improve driver safety. The company expects even more substantial orders for 2021.

MICT stock news

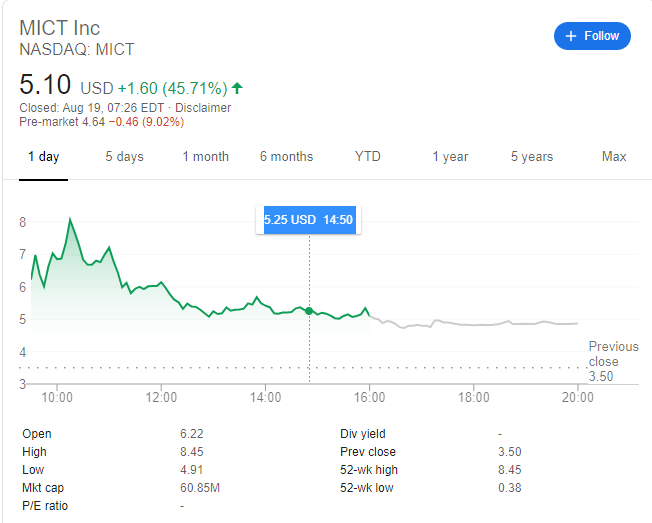

MICT shares closed up 45.71% at $5.10, after adding roughly 100% with the encouraging news. The company currently has a market cap of $77.8 million. Yet as it has been happening these days, equities are taking a hit from US political news.

Wall Street grabbed temporal momentum mid-US-afternoon but pulled back ahead of the close, despite encouraging news related to the coronavirus fiscal stimulus package. House Speaker Nancy Pelosi hint her party might be willing to make cuts to their proposal to seal a deal with Republicans. Despite the fact that NASDAQ was the best performer, it was barely able to add 0.73% or 81 points in the day. The DJIA, on the other hand, closed in the red, shedding 0.24% or 66 points.

Fears about the future of US economy weigh on equities. The country has reported over 5.6 million coronavirus cases, while the death toll has surpassed the 175K. On Tuesday, the country reported 44,000 new contagions, better than the peak above 70K but increasing from weekend encouraging figures.

MICT stock chart

Ahead of the opening, NASDAQ: MICT is trading 9.02% lower at $4.64. Wall Street is aiming to start the day around Tuesday’s closing levels, as speculative interest is in wait-and-see mode ahead of the release of the FOMC Meeting’s Minutes, to be out later in the day. MICT 52-wk high stands at $8.45, yesterday’s high. At the current level, it is already below yesterday’s low at $4.91.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

GBP/USD slides toward 1.2600 ahead of Bailey's testimony

GBP/USD is seeing a fresh selling wave, approaching 1.2600 n Tuesday. The latest leg down in the pair could be linked to escalating Russia-Ukraine geopolitical tesnions, which lift the safe-haven US Dollar. BoE Governor Bailey's tesitmony awaited.

EUR/USD remains heavy near 1.0550 amid escalating Russia-Ukraine conflict

EUR/USD stays under heavy selling pressure near 1.0550 in Tuesday's European trading. The US Dollar finds fresh haven demand on escalating goeopolitical tensions amid reports that Kremlin is threatening a nuclear response amid Ukraine's use of Western missiles against Russia.

Gold price consolidates intraday gains to one-week high amid mixed cues

Gold price (XAU/USD) trims a part of its modest intraday gains to a one-week top and trades around the $2,620 level during the first half of the European session on Tuesday, still up for the second straight day.

Canada CPI expected to rise 1.9% in October, bolstering BoC to further ease policy

The Canadian Consumer Price Index is seen ticking higher by 1.9% YoY in October. The Bank of Canada has reduced its policy rate by 125 basis points so far this year. The Canadian Dollar navigates multi-year lows against its American counterpart.

The week ahead: Powell stumps the US stock rally as Bitcoin surges, as we wait Nvidia earnings, UK CPI

The mood music is shifting for the Trump trade. Stocks fell sharply at the end of last week, led by big tech. The S&P 500 was down by more than 2% last week, its weakest performance in 2 months, while the Nasdaq was lower by 3%. The market has now given back half of the post-Trump election win gains.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.