MicroStrategy (MSTR Stock) continues to move higher

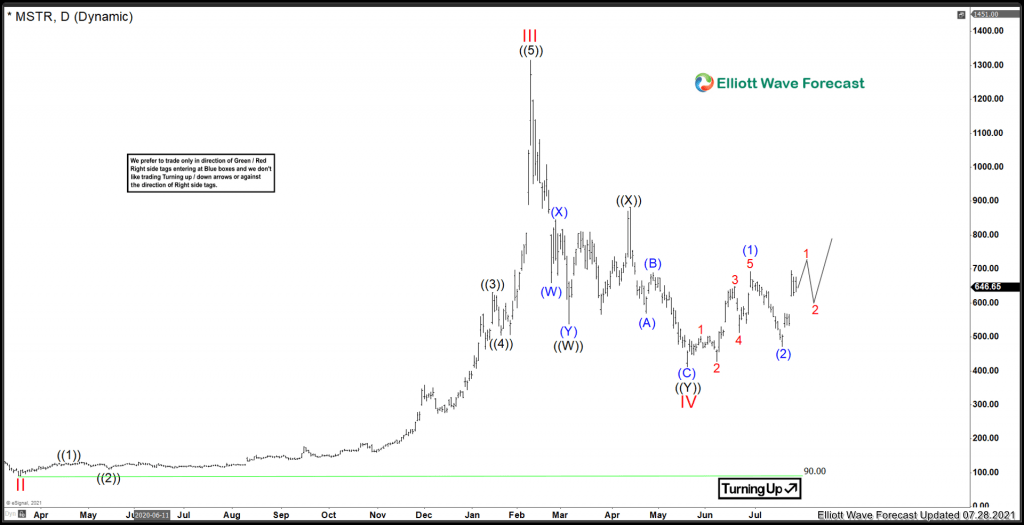

The last time I charted this name was back in the summer of 2021. At the time, the price of the stock was 646.00. I was looking for some continuation higher against the low set in May 2021. Firstly, in short summary, MSTR is a large holder of bitcoin, essentially making it a crypto currency company. Now that the company overview is out of the way, let's take a look at what I had charted out previous in July 2021:

Microstrategy Elliottwave view July 2021

At the time, I was looking for another nest in Red 1 and 2 to take place. Now let's take a look at the current chart:

MicroStrategy Ellottwave view November 2021

As expected, the Red 2 correction did take place and prices have now surpassed Red 1 peak. RSI momentum has also confirmed that there is a wave 3 of 3 underway in the shorter cycles. Further continuation is favoured to take place at this time.

With all this said, there is also another view which should be considered. It is the fact that perhaps ((1)) and ((2)) are set where (1) and (2) are currently placed on the chart. If this is the case, then a bigger breakout is possible. At this time, new all time highs are favoured to take place as long as the Red IV lows remain intact. The bulls remain in control and the trend is higher in shorter cycles.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com