Microsoft Stock News and Forecast: MSFT confirms system hack

- Microsoft stock closed up 1.64% on Tuesday as tech stocks rallied.

- MSFT stock trading lower on Wednesday as Bloomberg report says MSFT confirms system hack.

- Microsoft stock is trading at $301.90, down 0.7% in Wednesday premarket.

Microsoft stock (MSFT) continued its recent recovery on Tuesday as tech shares continued their strong performance. This may be set for an abrupt halt on Wednesday as Microsoft confirms limited access by hacker group Lapsus$, according to Bloomberg.

Microsoft Stock News

According to the Bloomberg report, the hacker group claimed it got access to the source code for the Bing internet search engine as well as to the voice assistant Cortana. Microsoft responded in a blog post: "In recent weeks, Microsoft Security teams have been actively tracking a large-scale social engineering and extortion campaign against multiple organizations with some seeing evidence of destructive elements...The activity we have observed has been attributed to a threat group that Microsoft tracks as DEV-0537, also known as LAPSUS$. DEV-0537 is known for using a pure extortion and destruction model without deploying ransomware payloads... No customer code or data was involved in the observed activities. Our investigation has found a single account had been compromised, granting limited access. Our cybersecurity response teams quickly engaged to remediate the compromised account and prevent further activity."

Microsoft is not alone in being targeted. Bloomberg says Nvidia (NVDA) and Samsung were recent targets of the hacking group and that Lapsus$ has also claimed to have accessed system privileges at Okta (OKTA). The customer identity company determined that the maximum potential impact is 366 (approximately 2.5% of) customers. OKTA stock is also lower on Wednesday by about 3%.

Okta's Chief Security Officer said in a blog post on Wednesday: "On January 20, 2022, the Okta Security team was alerted that a new MFA factor had attempted to be added to a Sitel customer support engineer’s Okta account. Although that individual attempt was unsuccessful, out of an abundance of caution, we reset the account and notified Sitel who engaged a leading forensic firm to perform an investigation."

Separately, the Microsoft Activision Blizzard merger vote is due to be held on April 28.

Microsoft Stock Forecast

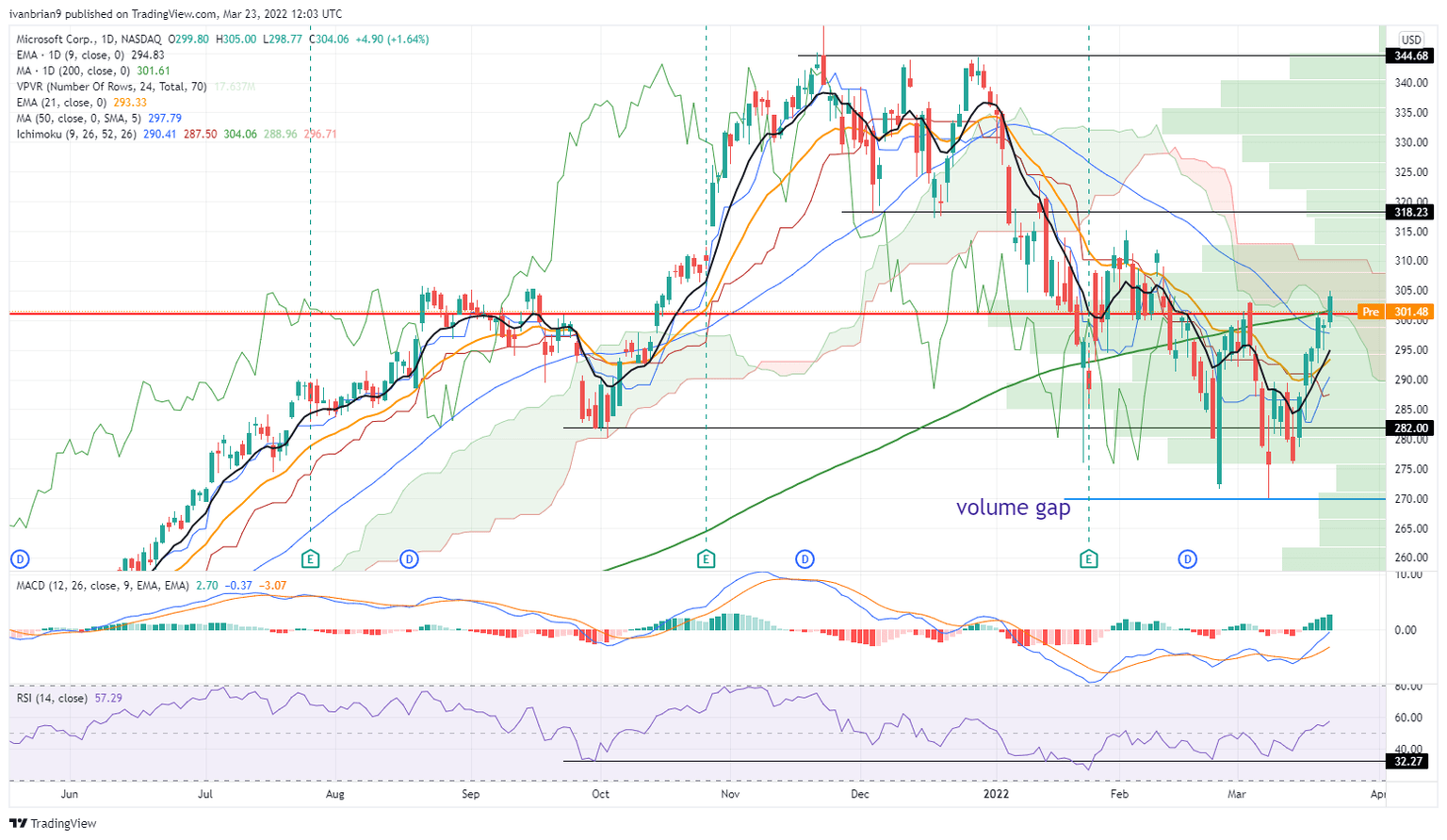

MSFT has been displaying textbook double top and double bottom formations, which have played out perfectly. The double top from November and December at $344 set up the bearish move lower. This bottomed out at $270 when Microsoft put in a bullish double bottom. In line with the recent recovery in tech stocks, Microsoft (MSFT) has put in six straight days of green candles. This latest news, however, may put the brakes on further gains.

MSFT has now moved up into a high-volume zone, making gains likely harder. The trend is still bearish as evidenced by the red Ichimoku cloud. This is a trend following indicator. Microsoft is also putting in a smaller potential double top at $303. If confirmed, the target for MSFT stock would be $240.

Microsoft (MSFT) chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.