Microsoft (MSFT) short term support area [Video]

![Microsoft (MSFT) short term support area [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/PointFigure/hand-drawing-chart-show-70075327_XtraLarge.jpg)

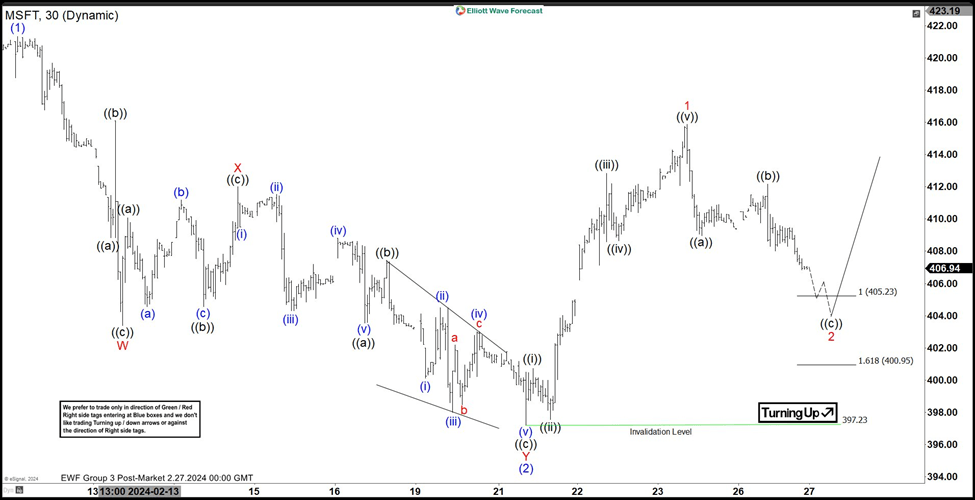

Cycle from 12.4.2023 low ended with wave (1) at 421.33 as the 30 minutes chart below shows. The stock then is pulling back in wave (2) with internal subdivision as a double three. Down from wave (1), wave ((a)) ended at 408.84 and wave ((b)) ended at 416.1. Wave ((c)) lower ended at 403.39 which completed wave W in higher degree. Up from there, wave ((a)) ended at 410.07 and wave ((b)) ended at 404.57. Wave ((c)) higher ended at 412 which completed wave X. The stock then resumed lower in wave Y.

Down from wave X, wave ((a)) ended at 403.53 and wave ((b)) ended at 407.45. Wave ((c)) lower ended at 397.23 which completed wave Y of (2). The stock has turned higher in wave (3), but it still needs to break above wave (1) at 421.33 to rule out a double correction. Up from wave (2), wave ((i)) ended at 400.71 and wave ((ii)) ended at 397.56. Wave ((iii)) higher ended at 412.83 and wave ((iv)) ended at 408.64. Wave ((v)) ended at 415.86 which completed wave 1 in higher degree. Down from wave 1, wave ((a)) ended at 408.97 and wave ((b)) ended at 412.16. Expect wave ((c)) lower to reach 400.9 – 405.2 before it completes wave 2 and turns higher. Near term, as far as pivot at 397.23 low stays intact, expect pullback to find support in 3, 7, 11 swing for more upside.

Microsoft (MSFT) 30 Minutes Elliott Wave chart

MSFT Elliott Wave video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com