Microsoft Corp Stock News and Forecast: MSFT earnings preview

- Microsoft to report earnings after the close on Tuesday.

- MSFT shares have fallen since Activision Blizzard mega-merger was announced.

- Microsoft was following the Nasdaq lower, but both closed up on Monday.

Microsoft (MSFT) earnings are due after the close tonight and will be watched perhaps even more closely than is usual. Microsoft is of course a tech bellwether and one of the largest companies on the planet. However, the recent announcement of its proposed takeover of Activision Blizzard (ATVI) will perhaps see even more scrutiny. Since the announcement on January 18, Microsoft shares have fallen nearly 3%. But as our chart below shows this is actually an outperformance versus the S&P 500.

Microsoft v S&P 500 15 minute

Microsoft Stock News

Microsoft will release earnings after the close on Tuesday. There will be a conference call afterward, and the link is here for the call. Microsoft is expected to post earnings per share (EPS) of $2.31 and revenue of $50.88 billion.

Microsoft has posted strong earnings, repeatedly beating analyst expectations over the last number of years. The last miss was back in 2016 on EPS. Revenue did miss slightly in 2019 and 2017 but only by tiny amounts. You have to travel back to 2013 to find when Microsoft had a more significant revenue miss.

The Wall Street Journal is reporting this morning that it expects Microsoft to beat forecasts based on demand for cloud services. Cloud services have been a remote working beneficiary, and this trend looks set to be a permanent feature of the working world going forward. Speculation of an earnings beat appears to have been behind a strong rally in Microsoft on Monday afternoon. Call option buying was more than 1.5 times put buying on Monday, according to Mike Khouw of Optimize Advisors.

Microsoft Stock Forecast

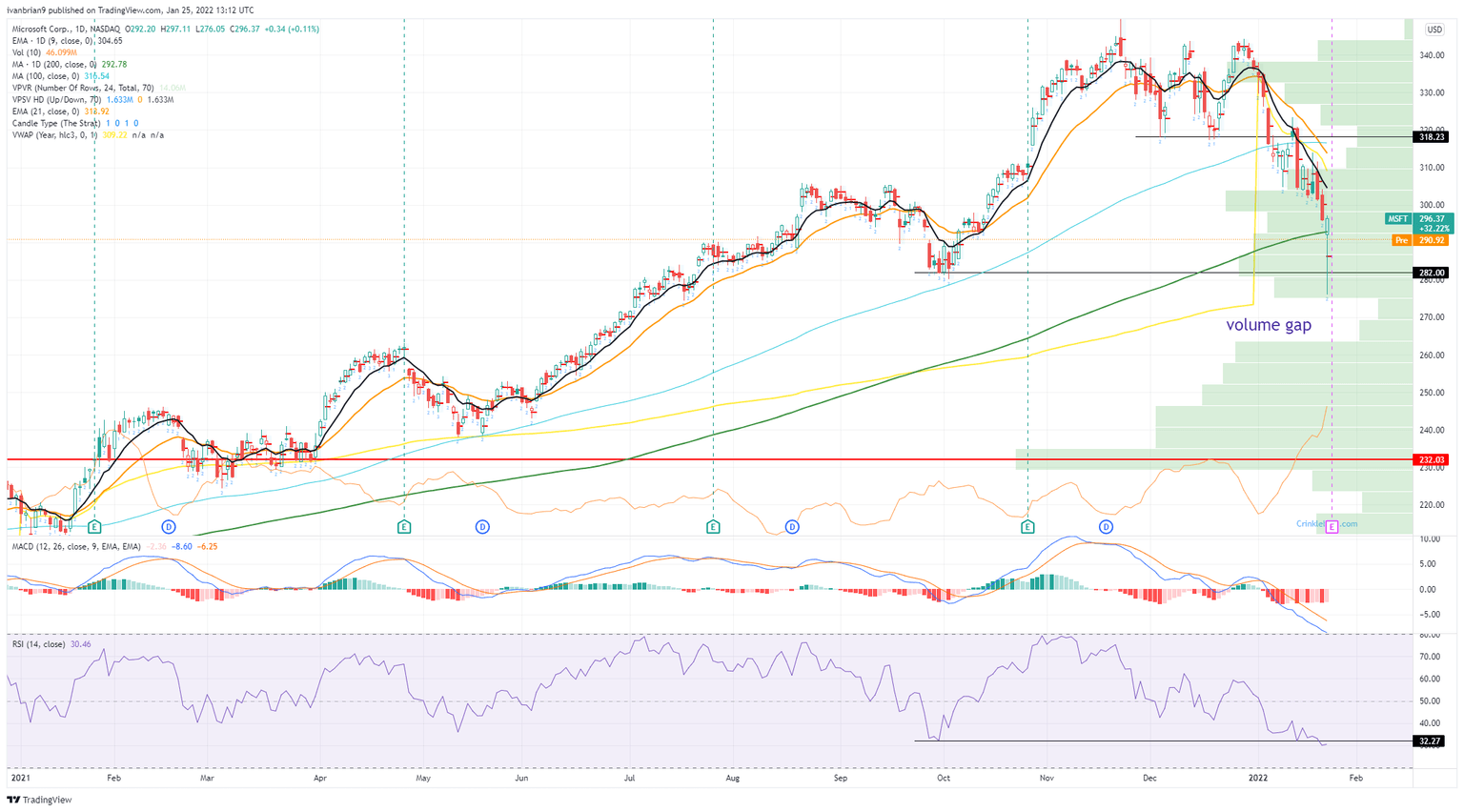

The huge intraday range yesterday does show some confusion in the chart. While MSFT shares are clearly in a short-term downtrend, the 9% rally intraday from low to high is significant. Some definitely has to do with position squaring ahead of earnings tonight and as mentioned call option buying ahead of results. For now the stock remains in a downtrend. However, some warning signs abound.

The Moving Average Convergence Divergence (MACD) is at its widest and lowest point for over a year though the Relative Strength Index (RSI) is still not oversold. The 200-day moving average is at $292, so MSFT is sitting just on this level. We are seeing this across a number of names today, especially in the tech space. There is a potential formation of a double bottom. $282 is significant. MSFT did break it intraday but only briefly, and the rally was sharp. The RSI also bottomed out at close to the same level. This level needs to be watched carefully as holding gives a move to the upside more potential. Break lower and the volume gap from $275 to $260 will then factor in a likely acceleration. $282 is our pivot for now.

Microsoft (MSFT) chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637787120884081818.png&w=1536&q=95)