Mexican Peso ends week lower against US Dollar amid dovish Banxico shift

Most recent article: Mexican Peso slips against US Dollar amid anticipation of key US, Mexican data

- Mexican Peso drops, reflecting concerns over Mexico's economic performance and potential Banxico rate cuts.

- Recent Mexican data shows inflation decline, GDP slowdown and significant drop in Retail Sales.

- Banxico minutes hint at possible easing in March with a shift toward a less hawkish monetary policy stance.

Mexican Peso loses steam for the second straight day against the US Dollar as market sentiment has shifted negatively. The Mexican currency is headed to end the week with losses after economic data witnessed inflation edging lower, the Gross Domestic Product (GDP) decelerating, and Retail Sales plummeting. At the time of writing, the USD/MXN exchanges hands at 17.14, up 0.20%.

The economic docket across the Bravo River is empty. Economic data revealed from Mexico showed the impact of higher interest rates set by the Bank of Mexico (Banxico). Although inflation dipped sharply in the first 15 days of February, the GDP for Q4 came in as expected at 2.5% YoY, exceeding forecasts but 0.8% lower compared to Q3 2023. Additionally, Retail Sales plunged, signaling that consumers reduced their spending.

In the meantime, Banxico’s latest minutes showed that the Governing Council could cut rates at the March 21 meeting as expressed by three of the five voting members. Two members added they can’t disregard maintaining rates at current levels. One of those members added he/she requires that underlying inflation shows a downward trajectory before beginning the easing cycle.

The language of the minutes was less “hawkish,” indicating a more flexible approach, according to analysts cited by El Economista. Analysts at Goldman Sachs commented that the Banxico Governing Council is tilting toward easing monetary policy unless exogenous shocks impact the USD/MXN exchange rate.

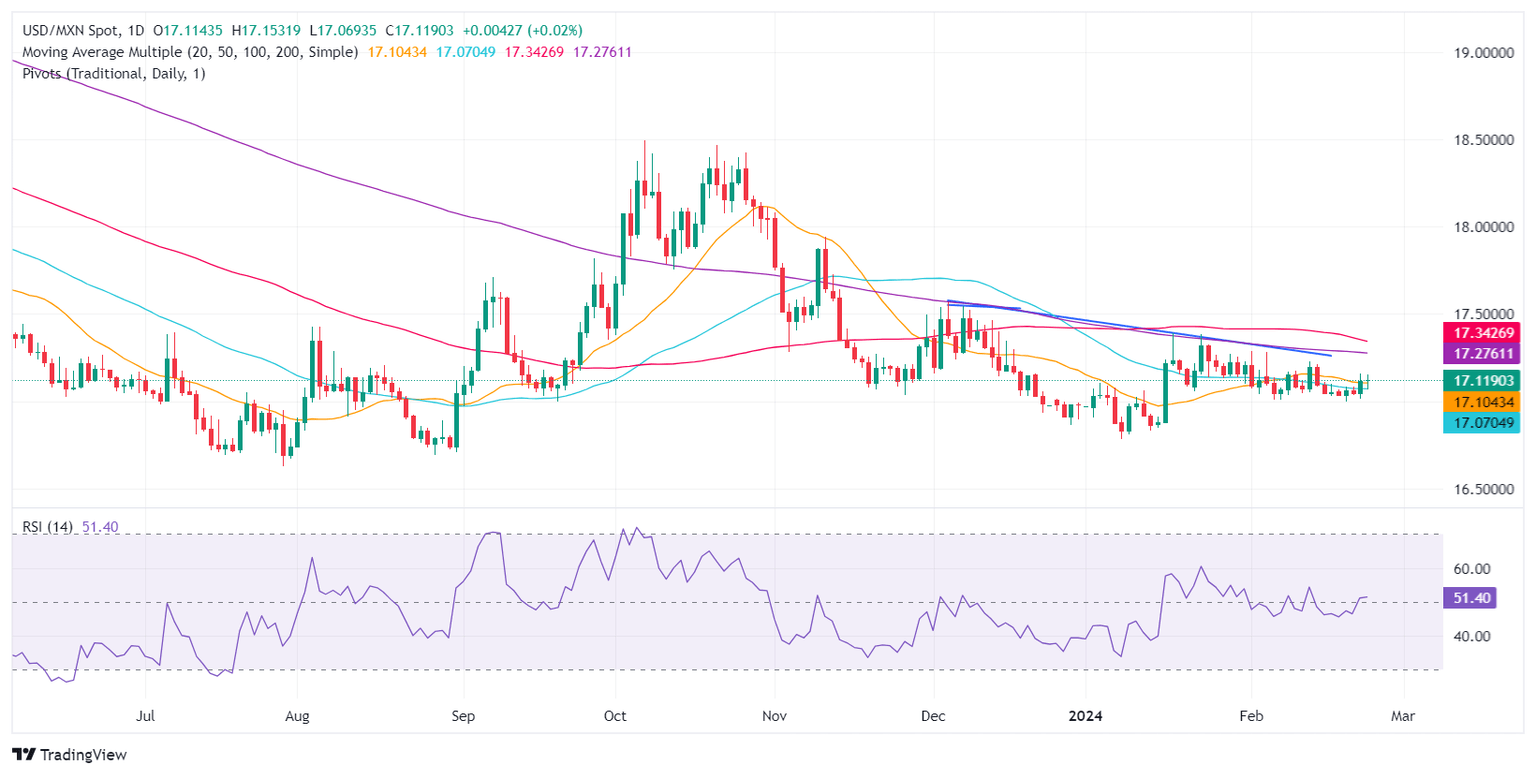

The USD/MXN has resumed its uptrend above the 50-day Simple Moving Average (SMA) following the release of last Thursday’s inflationary figures, while the sudden shift in Banxico’s rhetoric keeps the pair afloat above the 17.10 area.

Across the border, the Minutes of the US Federal Reserve (Fed) meeting showed that policymakers remain hesitant to cut rates amidst fears of a second round of inflation. Recently, the US Bureau of Labor Statistics (BLS) revealed that unemployment claims rose below estimates, while business activity, despite moderating, expanded.

Daily digest market movers: Mexican Peso hits seven-day low despite trimming some losses

- Mexico’s Consumer Price Index (CPI) in the first half of February dipped from 4.9% YoY to 4.45%, while core CPI slowed from 4.78% to 4.63% in the yearly data.

- GDP expanded in the fourth quarter by 0.1% QoQ but was lower than Q3’s 1.1% expansion. Annually based, GDP exceeded estimates of 2.4% and hit 2.5%, less than Q3’s 2023 3.3%.

- Mexico’s Retail Sales dropped -0.9% MoM, below estimates of 0.2%. Yearly figures plummeted -0.2% vs. a 2.5% forecast.

- The Mexican currency could depreciate further if the Mexican government fails to resolve its steel and aluminum dispute with the United States. US Trade Representative Katherine Tai warned the US could reimpose tariffs on the commodities.

- With no major events on the US economic calendar, recent unemployment claims figures and robust S&P Global Flash PMIs have backed Federal Reserve officials' hawkish remarks. Policymakers have expressed willingness to adjust policy when necessary but remain cautious, indicating no urgency to act. This stance is supported by current economic data suggesting strength in the economy, which could potentially revive inflationary pressures.

- Market players are expecting the first rate cut by the Federal Reserve at the June monetary policy meeting as they have trimmed odds for March and May.

Technical analysis: Mexican Peso extends losses to two-straight days as USD/MXN stays above 50-day SMA

The USD/MXN remains consolidated despite breaking above the 50-day Simple Moving Average (SMA) at 17.07. If buyers like to regain control, they must lift the exotic pair above 17.20, so they can threaten the 200-day SMA at 17.27. Once cleared, the 100-day SMA at 17.38 would be up next, ahead of the 17.50 figure.

On the other hand, if sellers step in and cap USD/MXN’s upside, they need to push prices below the 17.00 figure. Once cleared, the next support would be the current year-to-date (YTD) low of 16.78, followed by the 2023 low of 16.62.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.