Mexican Peso falls as US Dollar recovers on risk-off mood

Most recent article: Mexican Peso softens, hitting three-day low against the US Dollar

- Mexican Peso depreciates even though inflation data in Mexico was mixed.

- Mexico’s inflation exceeded forecasts, which could deter Banxico from easing policy throughout the first quarter 2024.

- USD/MXN soared toward the 16.90 area due to the overall strength of the US Dollar.

The Mexican Peso (MXN) is losing steam against the US Dollar (USD) on Tuesday as the Greenback rises. December’s inflation was higher than expected in Mexico, which might deter the Bank of Mexico (Banxico) from easing policy, as two of its policy members expressed in December. At the time of writing, USD/MXN is trading at 16.97, gaining 0.88%.

Mexico’s National Statistics Agency (INEGI) announced that consumer prices rose above estimates in headline inflation, while core inflation reached its lowest level since October 2021. The data initially underpinned the Mexican currency, with the USD/MXN dropping toward 16.78. Buyers moved in and lifted the exchange rate.

Across the border, Federal Reserve (Fed) officials continued to support the current level of interest rates, based on comments from Atlanta Fed President Raphael Bostic and Fed Governor Michelle Bowman. Data-wise, US small business sentiment improved, while the Balance of Trade printed a narrower deficit in November, revealed the US Department of Commerce.

Daily digest market movers: Mexican Peso at the mercy of strong US Dollar

- Mexico’s Consumer Price Index (CPI) rose by 4.66% YoY in December, exceeding forecasts of 4.55%, and November’s was 4.32%. Core figures came at 5.09%, less than the consensus and the previous month’s 5.15% and 5.30%, respectively.

- Federal Reserve officials expressed that interest rates should remain at current levels. Bostic emphasized that policy needs to stay tight, while Bowman added that policy is sufficiently restrictive.

- The US Trade Balance deficit narrowed more than expected in November, from the $-65 billion estimate to $-63.2 billion and less than October’s $-64.5 billion.

- The US 10-year Treasury bond yield advances.

- Consumer Confidence in Mexico deteriorated in December as households remained concerned about the future economic outlook.

- The US economy continues to paint a mixed economic outlook as the latest US jobs data was mixed while business activity in manufacturing contracted and the service sector is deteriorating. Although a soft-landing scenario looms, the chance of a mild recession has increased, so caution is warranted.

- Although the latest Banxico meeting minutes indicate the central bank might consider easing policy, December’s inflation report might prevent the central bank from relaxing policy.

- Last Tuesday, Mexico’s S&P Global Manufacturing PMI for December peaked at 52.0, below November’s 52.5, suggesting the economy is slowing down amid Banxico’s tightening cycle.

- On Wednesday, Business Confidence in Mexico improved to 54.6 from 54.0 in November, although it failed to underpin the Mexican Peso, which remained weak during the session.

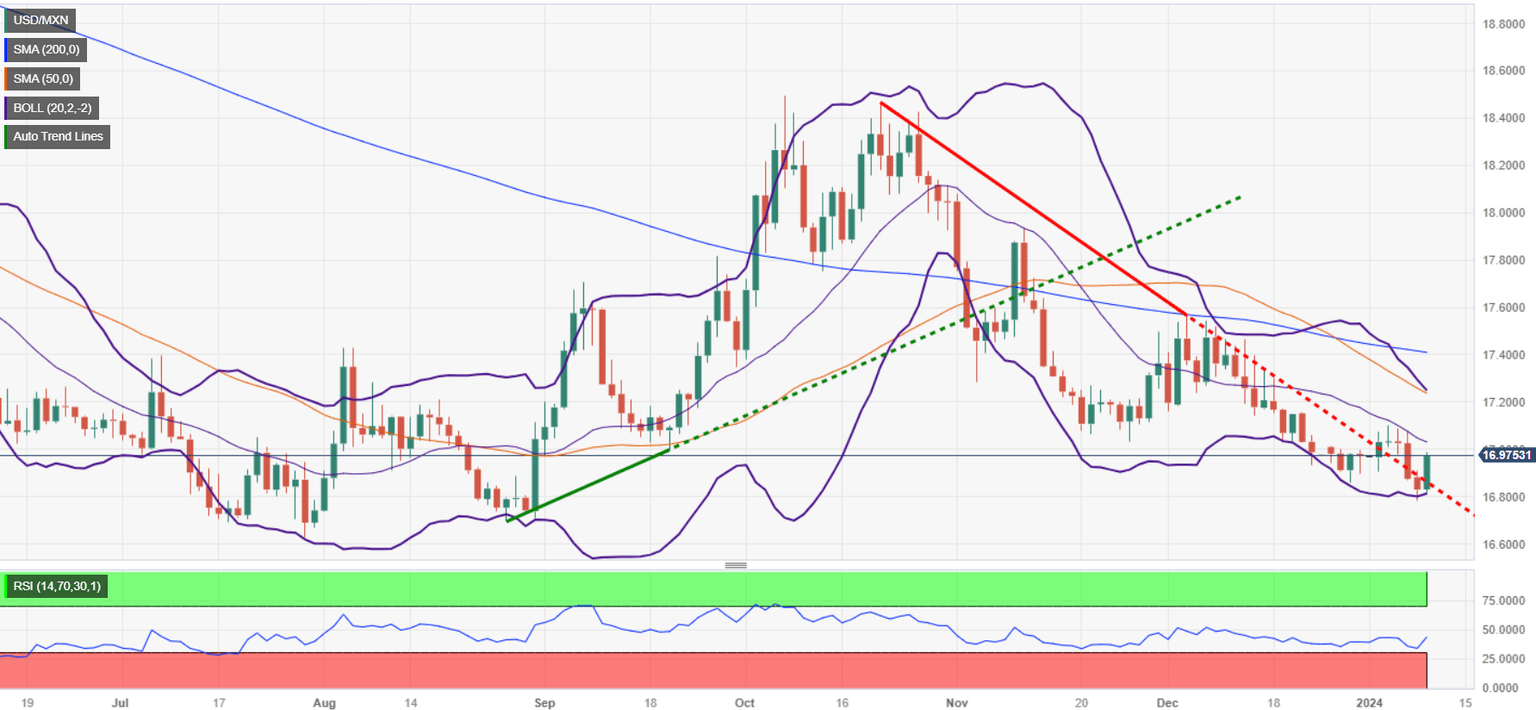

Technical analysis: Mexican Peso weakens as the USD/MXN rises and threatens to reach 17.00

Although the USD/MXN resumed its downtrend, the current leg-up toward the 16.90 area could pave the way for an upward correction past the 17.00 figure. A breach of the latter could exacerbate a test of the 17.20 figure, followed by the 50-day Simple Moving Average (SMA) at 17.26.

If sellers prevent the exotic pair from piercing the 17.00 figure, a test of last year’s low is on the cards. But sellers must conquer the 16.80 area, followed by the August 28 swing low of 16.69 ahead of the 2023 low of 16.62.

USD/MXN Price Action – Daily Chart

Risk sentiment FAQs

What do the terms"risk-on" and "risk-off" mean when referring to sentiment in financial markets?

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

What are the key assets to track to understand risk sentiment dynamics?

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

Which currencies strengthen when sentiment is "risk-on"?

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

Which currencies strengthen when sentiment is "risk-off"?

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.