Mexican Peso depreciates, defying further slide below key technical level

Most recent article: Mexican Peso on the offensive as Mexico’s inflation escalates

- Mexican Peso plummets as the USD/MXN tests key resistance level, which could shift the pair bullish.

- Risk appetite is mixed, though elevated US Treasury yields underpin the US Dollar.

- Upcoming economic data from Mexico, including the Economic Activity report and mid-month inflation figures, are closely watched by traders

The Mexican Peso (MXN) plunges sharply against the US Dollar (USD) on Tuesday on risk aversion in the FX space. This benefits safe-haven currencies to the detriment of the emerging market currency. That, along with a jump in Treasury yields in the United States, underpins the USD/MXN, which trades at 17.31, up by almost 0.80%.

Wall Street is trading mixed, weighed down by the sudden rise in US Treasury bond yields. The increase in yields is led by the belly and the long end of the yield curve, rising between four and seven basis points. The US Dollar Index (DXY), which tracks the buck’s performance against a basket of six other currencies, gains 0.37%, up at 103.74. The Greenback has been bolstered by traders pushing back their expectations of Federal Reserve (Fed) rate cutting from March until May, according to the CME FedWatch Tool data.

Across the border, Mexico’s economic docket will feature the release of the Economic Activity report, along with January’s mid-month inflation data.

Daily Digest Market Movers: Mexican Peso weakens the most since January 16, ahead of crucial data

- The former Bank of Mexico (Banxico) Governor and current General Manager of the Bank of International Settlements, Agustin Carstens, said that the central bank must not lower interest rates prematurely, adding that, “Recent developments allow us (central bankers) to look at the future with cautious optimism.” Carstens said that even though there’s progress on the disinflation process, “inflation is still above central bank targets in most countries and needs to fall further.”

- Agustin Carstens's posture and that of former Banxico Deputy Governor Everardo Elizondo suggest that policy should remain restrictive, which could deter the Mexican central bank from cutting rates, which currently sit at 11.25%, as traders await mid-January’s inflation report.

- Mid-month inflation in Mexico is expected to edge toward 4.78%, while the core is expected to dip further below the 5% threshold.

- The recent economic figures from Mexico indicate a deceleration in the economy, evidenced by Retail Sales falling short of expectations and being lower than those of October. Concurrently, projections for economic growth stand at 2.6%, which is under the anticipated 3%.

- On the US front, last week’s economic data paints a soft-landing outlook. Even though housing data was mixed, American household sentiment improvement, and lower inflation expectations underpinned the USD/MXN.

- Atlanta GDPNow model suggests last year’s Q4 likely expanded by 2.4%, spurred by strong retail sales, firm industrial production, a tight labor market and consumer sentiment improvement.

- Traders trimmed their bets for a dovish Federal Reserve in 2024. They stand at 139 basis points (bps) of cuts from 175 bps last week.

- Mexico witnessed a jump in headline inflation, but core data suggests the Bank of Mexico (Banxico) has done a good job, curbing elevated prices after hiking rates toward 11.25%.

- Despite indications from the December meeting minutes of Banxico (the Central Bank of Mexico) that it may consider easing its monetary policy, the inflation report for January poses a potential obstacle to any such policy relaxation.

- Standard Chartered analysts estimate the Bank of Mexico (Banxico) will lower rates to 9.25% in 2024.

- On January 5, a Reuters poll suggested the Mexican Peso could weaken 5.4% to 18.00 per US Dollar in the 12 months following December.

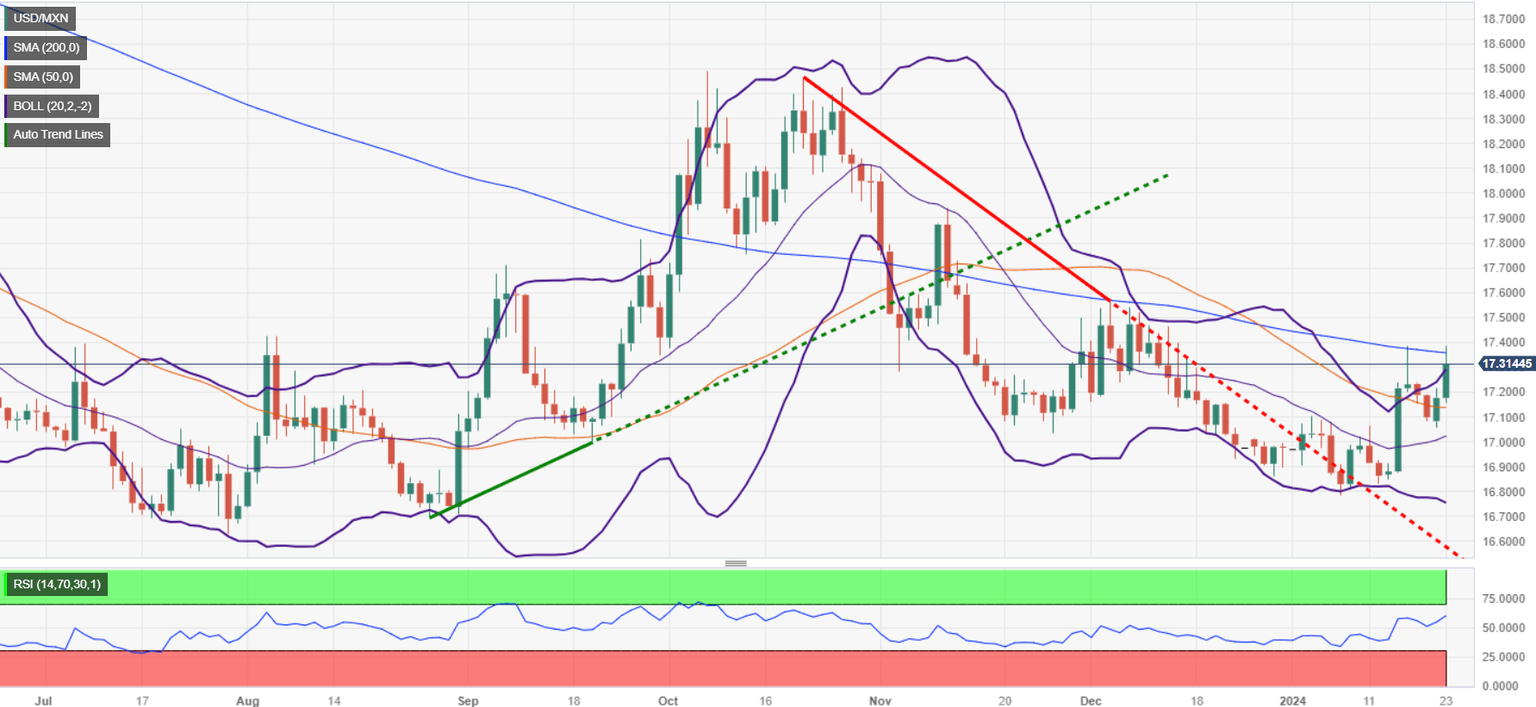

Technical Analysis: Mexican Peso falls to four-day low as USD/MXN meanders around 200-day SMA

The USD/MXN daily chart depicts buyers gathering momentum as they dragged the exchange rate to the brisk of breaching the 200-day Simple Moving Average (SMA) at 17.36. Once cleared, this could open the door to test the 100-day SMA at 17.42. Further upside is seen at the psychological 17.50 barrier, ahead of aiming toward the May 23 high at 17.99.

Failure to decisively break the 200-day SMA could open the door for a leg up, with first support at the 50-day SMA at 17.14, followed by the 17.05 swing low reached on January 22, ahead of the 17.00 figure.

USD/MXN Price Action – Daily Chart

Central banks FAQs

What does a central bank do?

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

What does a central bank do when inflation undershoots or overshoots its projected target?

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

Who decides on monetary policy and interest rates?

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Is there a president or head of a central bank?

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.