Mexican Peso edges lower as geopolitical tensions remain high

- The Mexican Peso edges lower in its key pairs as markets absorb heightened geopolitical tensions and idiosyncratic factors.

- The Peso has completed five up days in a row on a more optimistic outlook and the expectation of interest rates remaining elevated in Mexico.

- USD/MXN trades sideways within a larger rising channel, falling closer to support at the channel’s base.

The Mexican Peso (MXN) trades marginally lower in its key pairs – USD/MXN, EUR/MXN and GBP/MXN – on Wednesday. A sudden ramping up of geopolitical uncertainty is causing ripples in global financial markets, and idiosyncratic factors are also an ingredient to the mix. Markets are jittery after Russia’s announcement that it has lowered the bar for the deployment of nuclear weapons in response to the US agreeing to allow Ukraine to use US-made missiles to strike targets in Russia.

This follows a five-day winning streak for the Mexican Peso built on the back of the waning effect of the Trump-trade on the US Dollar (USD), optimistic growth and deficit-reduction plans of the Mexican government, and a positive lift from the outcome of the Bank of Mexico’s (Banxico) November policy meeting.

Mexican Peso trades mixed in volatile market environment

The Mexican Peso trades lower on Wednesday amid heightened market volatility following Russian President Vladimir Putin’s announcement that Russia had amended its so-called Nuclear Doctrine – its conditions for using nuclear weapons – to include conventional attacks from non-nuclear nations if they are backed by a nuclear state. The revision was interpreted as a direct warning to the US after it allowed Ukraine to strike targets in Russia using US-made long-range ATACMS (Army Tactical Missile System) missiles. According to Russian state media, Ukraine fired six such missiles at a Russian military facility in the Kursk Oblast on Tuesday.

According to the Associated Press, “Putin.. (..) emphasized that Russia could use nuclear weapons in response to a conventional attack posing a “critical threat to our sovereignty,” a vague formulation that leaves broad room for interpretation.”

Mexican Peso recovers on Trump fade, however, risks remain

The Mexican Peso has been in a steady uptrend over the last five days as the USD-bullish effect of the Trump-trade fades. The Peso could still face further headwinds, however, as the scope and size of the US’s intended trade tariffs clarify.

US President-elect Donald Trump still has to name the US Trade Representative. However, rumors continue circulating that he may give the role to Robert Lighthizer, who has been described as an “arch hawk on trade” by ING bank. Such a move would probably end the Mexican Peso’s brief recovery.

Trump’s choice of Marco Rubio as Secretary of State suggests further risks for the Mexican economy and the Peso, as Rubio is known for his tough stance on left-wing Latin American governments. Apart from taking a harder line on obvious targets such as Venezuela, Cuba and Nicaragua, Rubio could also attack Mexican ties with Beijing.

“He is also likely to push governments in the region to clamp down on Chinese investment and influence in their countries,” writes Kimberley Sperrfechter, Emerging Markets Economist at Capital Economics. “Mexico is likely to bow to that pressure, whereas others’ willingness to comply with US demands will be influenced by the depth of their geopolitical ties with Beijing and their trade balances vis-à-vis China,” she adds.

Banxico raises inflation forecast

The Peso has also seen gains after the Bank of Mexico revised up its forecast for inflation in 2024 to 4.7% from 4.3%. The change suggests the central bank will probably not cut interest rates as aggressively as previously expected – a positive for the Peso since maintaining elevated interest rates increases capital inflows into a country, supporting its currency.

Moody’s downgrades Mexico before publication of 2025 Budget

The Mexican Peso successfully shrugged off Moody’s Ratings cut Mexico’s credit rating from Baa2 “Stable” to “Negative” last Thursday. The rating agency based its decision on expectations that the country will run a high budget deficit of 5.9% of Gross National Product (GDP) in 2024 (its highest since the 1980s). It also highlighted risks to the economy from the government’s judiciary reforms, which Moody’s views as threatening the rule of law and “eroding checks and balances” to the executive’s power.

However, Mexican Finance Minister Rogelio Ramírez de la O quickly pushed back at the downgrade, saying that Moody’s had not taken into account his budget for 2025, which was published the following day, Friday.

In the 2025 budget, Ramírez de la O forecast an increase in GDP of between 2% and 3% and a much lower budget deficit of 3.9% of Gross Domestic Product (GDP) (from a projected 5.9% in 2024). Large cost savings to the Departments of Security and Health, backed by robust growth, will lower the deficit. The Peso seems to have been buoyed by his optimism.

Analysts' responses have been mixed, with Gabriela Siller, an analyst at Banco BASE, arguing that "The rosy estimates make it unlikely that the deficit and debt forecasts are reached,” according to Reuters.

However, others were more positive: “In general terms the budget proposal meets expectations: it shows a considerable reduction in the deficit without fueling concern of a potential economic recession," said analysts at CIBanco in a note. “The economic outlook is optimistic,” which "should be enough to remove one more fear from investors,” they added.

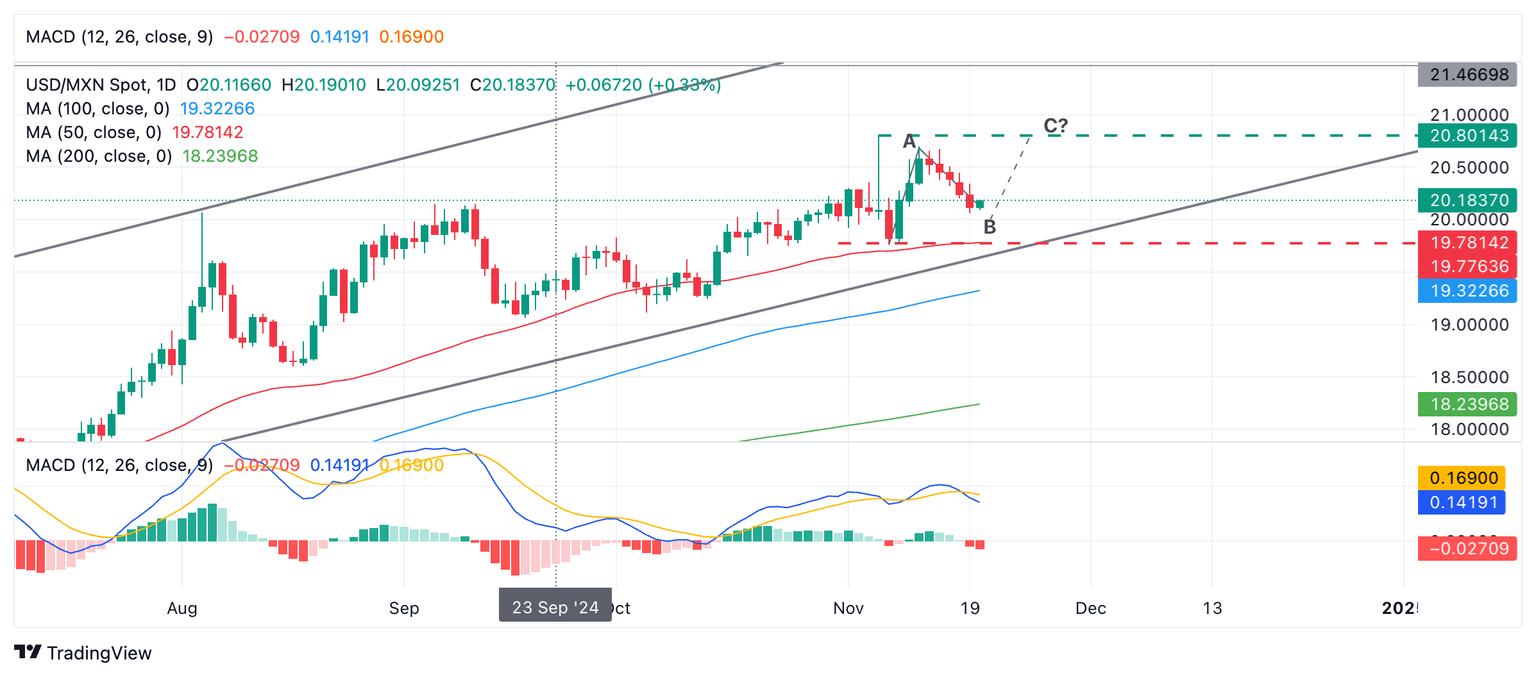

Technical Analysis: USD/MXN extends pullback towards support

USD/MXN continues pulling back within a rising channel. The short-term trend is unclear and possibly sideways – but the longer-term trend remains bullish.

The pullback (wave “B” on the chart below) from the November 12 high (top of wave “A”) is still declining and could fall down to support at 19.78 (red dashed line) at the November 7 swing low, 50-period Simple Moving Average (SMA) and base of the channel.

USD/MXN Daily Chart

After that, however, USD/MXN will probably extend a new leg higher in line with its broader up cycles, and this could see prices return to the zone between 20.80 (November 6 high) in a wave “C?” (green dashed line) of a three-wave Measured Move pattern which might be currently evolving (waves A, B and C?).

Further, a break above 20.80 would confirm a higher high and an extension of the medium and long-term bullish trend and unlock the next upside target at 21.00 (round number), where buyers could start to meet resistance.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.