Mexican Peso defies odds, rises despite Trump's tariffs tensions

Most recent article: Mexican Peso defies gloomy data, rockets higher on USD weakness

- Mexican Peso appreciates as USD/MXN dives toward 20.00 amid Fed easing expectations.

- Weak Mexican Industrial Production data was overshadowed by improved risk appetite, boosting MXN against the softer Greenback.

- US-Mexico tariff tensions intensify; Mexican officials confirm ongoing discussions ahead of critical April 2 tariff deadline.

The Mexican Peso (MXN) is rallying sharply against the US Dollar (USD) on Thursday as traders seem confident that the Federal Reserve (Fed) could lower interest rates thrice in 2025. Positive inflation and jobs reports in the United States (US) pushed traders to price in additional easing, which weighed on the US Dollar. USD/MXN trades at 20.08, down 0.44%.

Data from Mexico was worse than expected as Industrial Production in January fell. Nevertheless, a mild improvement in risk appetite keeps the Emerging Market (EM) currency appreciating as the Greenback continues to pare earlier losses.

Meanwhile, Mexican Economy Minister Marcelo Ebrard said the Mexican and US governments were having intensive talks over threats to impose a 25% tariff on all goods from its No. 1 trade partner by April 2.

On Wednesday, Mexican Finance Minister Edgar Amador Zamora said the national economy is expanding but shows signs of slowing down linked to trade tensions with the US.

Across the border, US data revealed that factory gate inflation was unchanged primarily, dipping some tenths though Goldman Sachs revealed that some of the measures of inflation used to calculate the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index, could underpin the latter.

Based on CPI and PPI, the US investment bank revealed that February’s Core PCE estimates rose by 0.29%, corresponding to a 2.7% YoY reading.

Other data showed the labor market remains solid, though most economic data continue to be subdued amid US President Donald Trump's trade rhetoric.

Daily digest market movers: Mexican Peso unfazed by dismal Industrial Production data

- Mexico's Industrial Production fell -0.4% MoM in January, below forecasts for a 0.2% expansion. In the twelve months to January, production plunged -2.9% YoY, missed an improvement to -1.8%, worse than December’s -2.7 fall.

- The economy in Mexico is slowing down sharply, as projected by private analysts polled by Banco de Mexico (Banxico), with them expecting growth at 0.81%. The evolution of the disinflation process and a stagnant economy push Banxico to lower borrowing costs at the upcoming March 27 meeting.

- The February US Producer Price Index (PPI) came in softer than expected, rising 3.2% YoY, below the 3.3% forecast and down from 3.7% in the previous month.

- Core PPI, which excludes volatile items, increased 3.4% YoY, missing estimates of 3.5% and easing from 3.6% in January.

- Despite recent cooler-than-expected inflation reports, economists warn that tariffs on US imports could trigger a renewed inflationary uptick in the coming months.

- Meanwhile, Initial Jobless Claims for the week ending March 8 declined slightly to 220K, beating expectations of 225K and improving from the previous 222K reading.

- Money market futures traders had been priced in 74 basis points of easing by the Federal Reserve (Fed) toward the end of the year.

- A Reuters poll showed that 70 out of 74 economists say the risk of recession has risen in the US, Canada and Mexico.

- In the boiler room, trade disputes between the US and Mexico remain front and center. If the countries reach an agreement, it could pave the way for a recovery of the Mexican currency. Otherwise, further USD/MXN upside is seen as US tariffs could trigger a recession in Mexico.

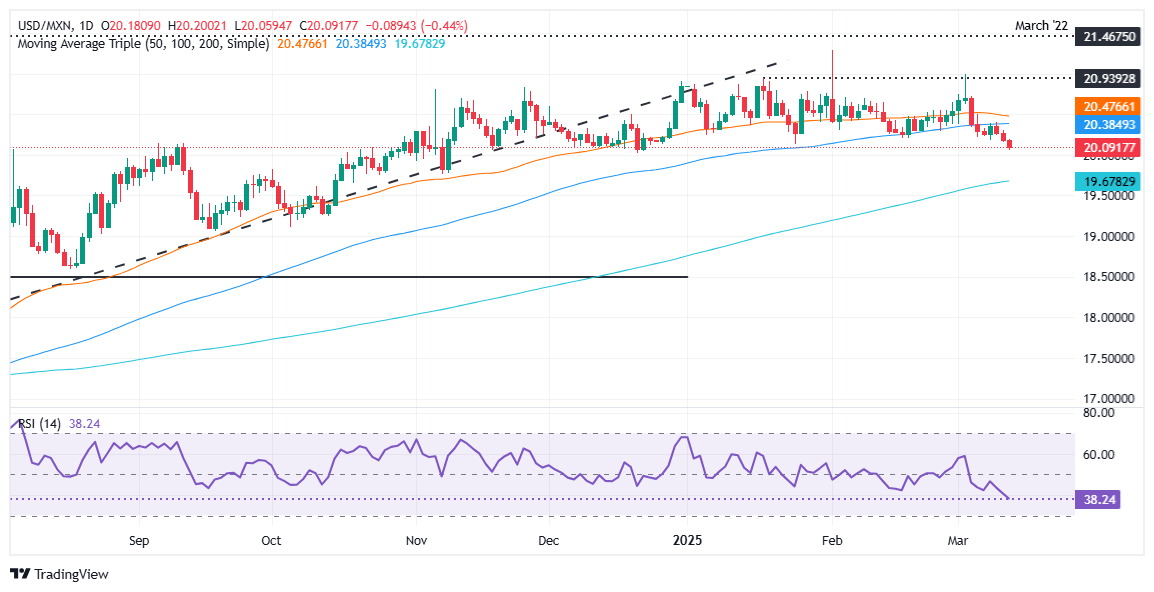

USD/MXN technical outlook: Mexican Peso surges as USD/MXN tumbles below 20.10

USD/MXN shifted from neutral to downward biased, with sellers eyeing a test of the psychological 20.00 figure. A breach of the latter will pave the way to test the 200-day Simple Moving Average (SMA) at 19.63 before dropping to 20.50. On the flip side, a clear break above 20.20 could keep the exotic pair trapped once again within the 20.20 – 20.50 range before buyers can challenge the 20.99 March 4 peak.

Economic Indicator

Industrial Output (YoY)

The Industrial Output released by the INEGI shows the volume of production of Mexican industries such as factories and manufacturing. An uptrend is regarded as inflationary which may anticipate interest rates to rise. If there is industrial production growth, this may generate a positive (or bullish) sentiment for the Mexican Peso.

Read more.Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.