Mexican Peso takes a break after rallying on easing trade-war concerns

- The Mexican Peso has paused after rallying on easing fears about tariffs from the US and a trade war.

- The Mexican Trade Surplus grew in October and the economy is growing at a higher pace than expected.

- Technically, USD/MXN unfolds a down leg within its range.

The Mexican Peso (MXN) fluctuates between tepid gains and losses in its most-traded pairs on Friday as it stabilizes after the previous day’s rally. This came on the back of easing tariff fears after President-elect Donald Trump described his phone call with Mexican President Claudia Sheinbaum as “wonderful”, adding, “She has agreed to stop migration through Mexico.”

Mexican Peso recovers as trade-war tensions ease

The Mexican Peso rebounded on Thursday as fears subsided that Donald Trump would go ahead with his threat to place 25% tariffs on goods entering America from Mexico.

President Claudia Sheinbaum’s counter-threat to raise tariffs on US imports if Trump went ahead, as well as widespread unease in the investment community about the negative consequences of such a trade war on the US economy, could indicate Trump could take a more cautious approach. Many commentators have dismissed his threats as negotiation tools to get a better trade deal out of his close neighbors rather than literal pledges.

Official data on Thursday showed that Mexico recorded its first Trade Surplus in five months in October, of $370 million. This compared positively to the $370 million deficit recorded a year ago and was well up on the $579 million Trade Deficit in September. Of non-Oil exports, those directed to the US grew by 13.9%, while exports to the rest of the world rose by 11.6%, according to data from INEGI.

Banxico releases the Minutes from November meeting

The Bank of Mexico (Banxico) released the Minutes from its November meeting on Thursday. These showed that the board voted unanimously to cut interest rates to 10.25% in November compared to September when there was one dissenter, Banxico member Jonathan Heath.

The Banxico’s minutes were similar to those of September. However, they revealed a slightly more upbeat assessment of the Mexican economy.

The November meeting Minutes reported that, “Most members pointed out that during the third quarter of 2024, according to timely information, domestic productive activity is estimated to have grown at a higher rate than in the previous three quarters, when it remained practically stagnant.”

This compared to the September Minutes, when it was recorded that “All members agreed that Mexico's economic activity is undergoing a period of weakness. The majority indicated that it has registered a visible loss of dynamism since the last quarter of 2023.”

In regards to inflation, it was noted in the November Minutes that headline inflation had risen.

“All members noted that headline inflation increased in October. They pointed out that this

was due to the increase in non-core inflation, while core inflation continued declining,” recorded the November 14 meeting Minutes.

In September, members were overall positive about the downward trajectory of inflation in the economy.

“Most members agreed that Mexico's inflation outlook has been improving, after the significant

global shocks of previous years. However, they forewarned that it still faces challenges,” said the report.

A chart included in the November Minutes showing the future trajectory of Banxico’s prime interest rate based on Mexican TIIE Swaps, suggested a less steep decline in the future compared to September.

Given that maintaining elevated interest rates is positive for a currency because it increases net foreign capital inflows, the new shallower descent described in November should constitute an underpinning positive factor for MXN.

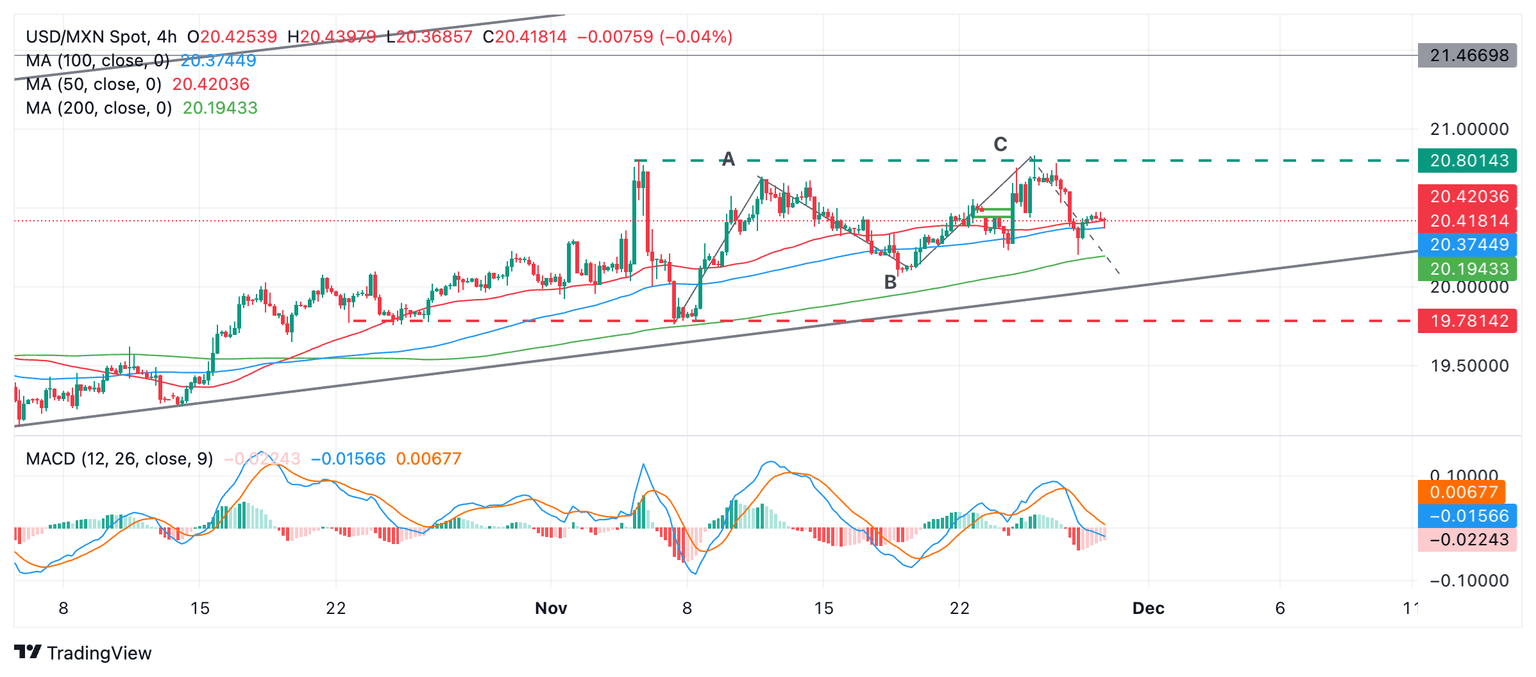

Technical Analysis: USD/MXN descending within range

USD/MXN unfolds a down leg within the mini range (green and red dashed lines on the chart below) formed during November.

USD/MXN 4-hour Chart

USD/MXN is probably range-bound in the short term as it oscillates within this mini range. In the medium and long term, however, it is still in an uptrend within a rising channel.

The pair is likely to continue trading up and down within the parameters of its range. The current move bottomed at 20.20 on Wednesday, but it could go even lower to support at either the 20.06 lows of wave B, the major trendline in the 19.90s, or support in the 19.70s (red dashed line).

The move is supported by the (blue) Moving Average Divergence Convergence (MACD) momentum indicator, which has entered negative territory – a bearish sign.

On the other side, a decisive break above the top of the range at 20.80 would be required to signal the start of a more bullish short-term trend in line with longer-term up cycles.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.