Mexican Peso extends agonizing losses for third consecutive day

- Mexican Peso weakened as US Dollar gains despite falling US yields.

- IMF downgrades Mexico's 2024 GDP growth outlook, citing capacity constraints and tight monetary policy.

- US import prices fell sharply in September, while Fed’s Bostic remains optimistic about inflation hitting the 2% target.

The Mexican Peso depreciated in early trading on Wednesday as the US Dollar strengthened amid a mixed market mood with falling US Treasury yields. Softer inflation readings among developed countries suggest that further easing is coming, indicating that the global economy might slow down. The USD/MXN trades at 19.97, registering gains of 1.32%.

US equities are fluctuating as traders shifts focus toward small caps as the Russell 2000 outperforms the NASDAQ and S&P 500. Therefore, emerging market currencies sensitive to risk, like the Peso, remained on the back foot.

On Tuesday, the International Monetary Fund (IMF) revised Mexico’s economy downward to 1.5% in 2024 due to capacity constraints and a restrictive monetary policy. This is well below the 2.4% estimated by the Secretaria de Hacienda y Credito Publico (SHCP).

The IMF estimates GDP growth for the next year at 1.3% as inflation closes in on the Bank of Mexico’s (Banxico) 3% objective.

On the US front, the docket revealed that import prices fell the most in nine months in September due to the fall of energy prices. Meanwhile, Export prices fell on monthly and annual figures.

On Tuesday, Atlanta’s Fed President Raphael Bostic commented the US economy is performing well, and that he’s confident that inflation will hit the 2% target. He doesn’t foresee a recession, though he expects inflation to remain choppy and employment robust.

Ahead in the week, Thursday’s economic docket will feature the release of Retail Sales, Initial Jobless Claims, Industrial Production and further Fed speakers.

Daily digest market movers: Mexican Peso slumps as USD/MXN surges past 19.80

- Earlier during the North American session, the Mexican Peso touched a five-week low as the USD/MXN hit a high of 19.93, shy of the psychological 20.00 figure.

- The IMF said that a recent judicial reform creates "important uncertainties about the effectiveness of contract enforcement and the predictability of the rule of law."

- Banxico’s survey revealed that economists estimate the central bank will lower rates by 50 bps for the rest of the year. The USD/MXN exchange rate is projected to end at 19.69, and the economy is expected to grow by 1.45% in 2024.

- US Import Prices plunged -0.4% MoM as expected in September. Export prices plummeted -0.7% more than estimates of -0.4% contraction and less than August’s -0.9%.

- Data from the Chicago Board of Trade via the December fed funds rate futures contract shows investors estimate 50 bps of Fed easing by the end of the year.

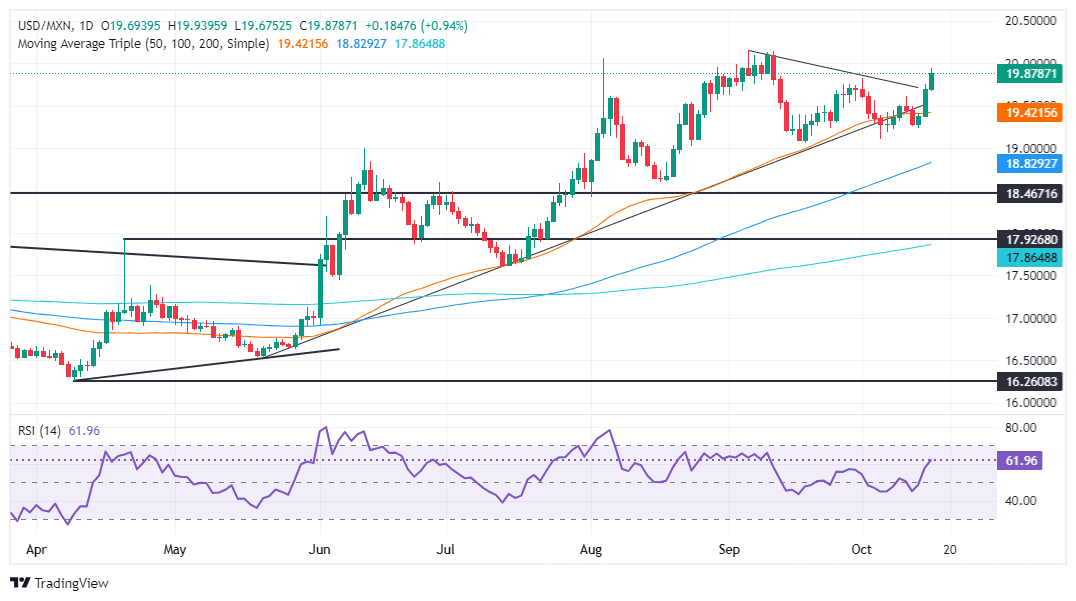

USD/MXN technical outlook: Mexican Peso nosedives as buyers eye USD/MXN at 20.00

The USD/MXN uptrend remains intact as the pair briefly surpassed 19.90 to hit multi-week highs. Momentum remains bullish as the Relative Strength Index (RSI) depicts. This would exert upward pressure on the exotic pair, which could clear the 20.00 figure as traders brace for safety ahead of the US election.

The USD/MXN next ceiling level would be 20.00. If surpassed, the next resistance would be the YTD high of 20.22, before challenging 20.50.

On the flip side, if USD/MXN tumbles below the October 1 high turned support at 19.82, it could exacerbate a test of the October 10 daily peak at 19.61. On further weakness, the next floor will be the October 4 swing low of 19.10 before testing 19.00.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.