Mexican Peso rises against USD after US PCE inflation falls below estimates

- The Mexican Peso is rising against the US Dollar after the release of US Core PCE inflaiton data falls below estimates.

- The data indicates inflation continues falling in the US, cementing expectations the Federal Reserve will begin an easing cycle.

- The Peso is further supported by a generally upbeat market mood which helps riskier assets as the week comes to a close.

The Mexican Peso (MXN) trades higher against the US Dollar (USD) and also in its other key pairs on Friday, after the release of US Core Personal Consumption Expenditure (PCE) Price Index inflation data – the Federal Reserve's prefered inflation metric – comes in below expectations, whilst an imporvement in market sentiment, overall benefits the risk-on MXN.

US Core PCE data for July shows an annual increase in prices of 2.6% which is below the 2.7% forecast but the same as the 2.6% of the previous month. The monthly data shows prices rising 0.2% in line with estimates and up from the 0.1% of June, according to the US Bureau of Economic Analysis.

Headline PCE rises 2.5% which was below the 2.6% forecast but the same as the reading in June.

Although up on the day, the overall trend for the Peso over the last few weeks has been bearish as slowing economic growth, political factors and expectations the Bank of Mexico (Banxico) will continue with its easing cycle, all weigh.

At the time of writing, one US Dollar (USD) buys 19.71 Mexican Pesos, EUR/MXN trades at 21.84, and GBP/MXN at 25.91.

Mexican Peso tracks riskier assets higher

The Mexican Peso trades higher on Friday, tracking riskier assets in general after the release of US annualized Gross Domestic Product (GDP) for the second quarter was revised up to 3.0% growth compared to the preliminary estimate’s 2.8%, in data released Thursday.

Spirits were further lifted after US Initial Jobless Claims data came out slightly lower than expected at 231K, when 232K had been forecast. This was also below the upwardly-revised 233K of the previous week. Given the Fed’s new focus on “the risks to employment,” this helped instill more confidence the economy might manage to achieve a soft landing.

That said, the Mexican Peso still faces domestic headwinds. The Bank of Mexico (Banxico) quarterly report for Q2, released on Wednesday, revealed a downward revision to the bank’s GDP forecasts for 2024 and 2025. Banxico now expects growth to slow to 1.5% in 2024, down from 2.4% in the previous report. In 2025, it expects the economy to grow by 1.2% from 1.5% previously anticipated. These revisions indicate Banxico will feel more pressure to lower interest rates to support growth.

On the subject of adjusting interest rates, the report stated: “Looking ahead, the Board foresees that the inflationary environment may allow for discussing reference rate adjustments.”

Banxico did not change its inflation forecasts from those announced in its August policy meeting, but said it had included new factors such as the (inflationary) impact of a weaker Peso. It continues to see inflation falling steadily towards the bank’s 3.0% target, which it expects to hit in the last quarter of 2025. It mentioned the course of services sector inflation as a key factor in its decision making.

Most analysts foresee Banxico making substantial rate cuts before the end of the year.

- Banorte expects a 25 basis point (bps) rate cut in September and interest rates to end the year at 10.25% (rates are at 10.75% currently).

- Citibanamex expects a quarter of percentage rate cuts in September, November, and December, with Banxico’s reference rate hitting 10.00% by year-end.

- Monex expects the bank’s reference rate to end the year at 10.25% with a cut in September, and November and December meetings “live”.

- Goldman Sachs anticipates rate cuts of 25 bps each in the three remaining meetings of the year, bringing the interest rate down to 10.00% by year’s end.

- Capital Economics foresees 50 bps of cuts before the end of 2024, bringing the reference rate down to 10.25%.

Political risks are a further bearish background factor for the Peso. The government’s proposed reform of the judicial system has elicited criticism from members of the judiciary themselves – with protests in Mexico City – foreign diplomats and investors alike.

The Mexican government chose to “pause” diplomatic relations with the US after the US ambassador publicly criticized the reforms, and Canada has also broken diplomatic ties. If the stand-off escalates, there is a chance it could negatively impact free trade between the three countries, with negative implications for the Mexican Peso.

At the same time, the Peso potentially stands to benefit from an escalating trade war between North America and China. Given its role as an intermediary manufacturer for Chinese goods entering North America, the escalation of tariffs – most recently by Canada – could find it well positioned to benefit from the fallout.

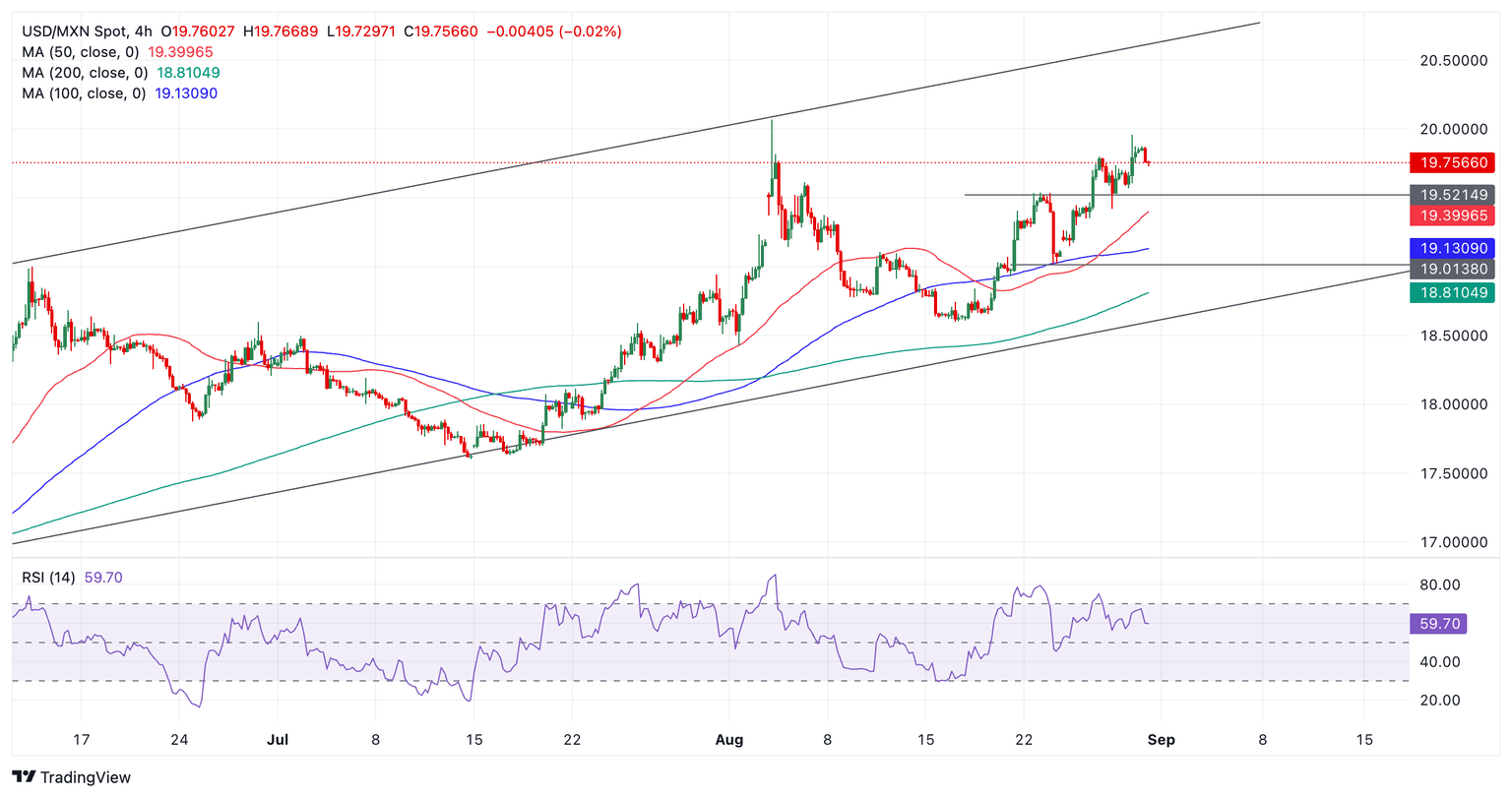

Technical Analysis: USD/MXN makes higher highs

USD/MXN trades steadily higher within a broader rising channel. It has established an uptrend and given “the trend is your friend” the odds favor longs over shorts.

USD/MXN 4-hour Chart

The pair made a higher high of 19.95 on Thursday, from which it is currently pulling back. Once the correction has finished, however, it will probably resume its uptrend towards a target at the upper channel line in the 20.60s.

That said, the Relative Strength Index (RSI) is making lower highs at the same time as price is making higher highs – a sign of bearish divergence. This suggests an underlying lack of bullish strength in the rally, which could be a warning signal of deeper downside corrections to come.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.