Mexican Peso bounces back as US Dollar tumbles

- Mexican Peso climbs some 0.12% following 2% drop since late Monday on Trump’s rhetoric.

- Mexican President Sheinbaum warns of retaliation with higher tariffs on US imports.

- Economy Minister Ebrard highlights potential job losses in the US and economic slowdown due to US tariffs.

The Mexican Peso recovered some ground after depreciating more than 2% since Monday, following Trump’s remarks that he would impose tariffs on Mexico. The Peso shrugs off Trump’s comments and appreciates amid broad US Dollar weakness. The USD/MXN trades at 20.62, down 0.12%.

On Tuesday, Mexican President Claudia Sheinbaum said that Mexico would raise tariffs on imports from the US in retaliation for Mexican exports. In the meantime, Economy Minister Marcelo Ebrard commented that a 25% tariff on Mexican products exported to the US would cause the loss of over 400,000 jobs in the United States, slow growth, and hurt US companies and consumers.

Barclays analysts said that imposing a 25% tariff against Canadian and Mexican imports “could wipe out effectively all profits” from the three Detroit automakers.

The Mexican Balance of Trade for October printed a surplus of $0.37 billion, improving compared to September’s -$0.579 billion deficit.

In the US, the schedule was busy. October’s Durable Good Orders improved, and Initial Jobless Claims came in below estimates. Further data revealed the second estimate of the Gross Domestic Product (GDP) for the third quarter and the Federal Reserve’s (Fed) preferred inflation gauge, the Core Personal Consumption Price Expenditures (PCE) Price Index.

Ahead this week, the Mexican economic docket will feature the release of the latest meeting of the Bank of Mexico (Banxico).

Daily digest market movers: Mexican Peso ignores Trump’s tariffs rhetoric to appreciate

- Mexico’s Chamber of Deputies, after approving the dissolution of autonomous bodies, proposed adjustments to the details of a contentious reform that abolished several regulatory bodies to ensure compliance with the USMCA trade agreement.

- “The fact that MORENA is taking a more cautious approach with two of the most important regulators, antitrust and telecoms, is a positive sign,” said Rodolfo Ramos of the Brazilian bank Bradesco BBI.

- Last week, Banxico Governor Victoria Rodriguez was dovish and hinted that the central bank might look to decrease rates by more than 25 bps due to disinflation progress. Headline inflation during the first two weeks of November dipped from 4.68% to 4.56% YoY.

- US Durable Goods Orders in October came in at 0.2% MoM, below estimates of 0.5%, but higher than September’s -0.4% contraction.

- US GDP for Q3 in its second estimate was 2.8% QoQ, as expected, below Q2 2024’s 3%.

- Initial Jobless Claims for the week ending November 23 reached 213K, below estimates of 217K and unchanged compared to the previous figure.

- US core PCE expanded by 2.8% YoY as expected, up from 2.7%.

- The CME FedWatch Tool suggests that investors see a 66% chance of a 25-basis-point rate cut at the US central bank’s December meeting, up from 59% a day ago.

- Data from the Chicago Board of Trade, via the December fed funds rate futures contract, shows investors estimate 24 bps of Fed easing by the end of 2024.

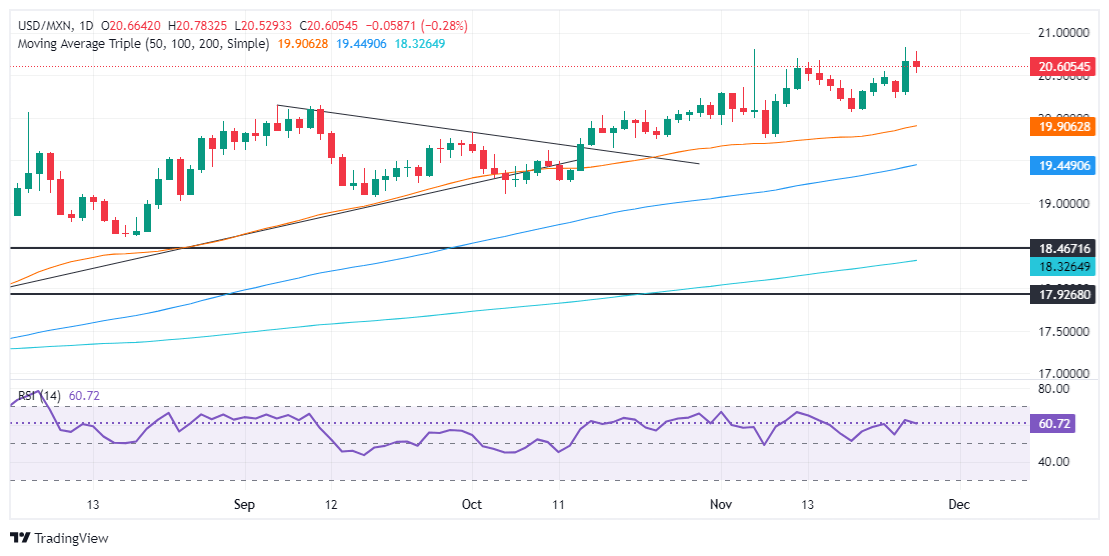

USD/MXN technical outlook: Mexican Peso recovers as USD/MXN dives beneath 20.60

The USD/MXN uptrend remains intact, even though the pair edges lower at the time of writing. If the exotic pair drops below the psychological 20.50 figure, this could pave the way to test the previous year-to-date (YTD) peak at 20.22, before dropping to 20.00.

A bullish resumption would happen once buyers lift the USD/MXN above the YTD high of 20.83, ahead of the 21.00 mark. A breach of the latter will expose the March 8, 2022, peak at 21.46, followed by the November 26, 2021 high at 22.15.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.