Mexican Peso recovers on elevated Mexican inflation data

- The Mexican Peso has rebounded after hitting multi-year lows during the US presidential election.

- The Federal Reserve’s November meeting on Thursday could be pressuring the US Dollar.

- Mexican inflation data remains elevated in October, keeping the Peso supported.

The Mexican Peso (MXN) maneuvers a U-turn that an F1 driver would be proud of during the volatility accompanying the US presidential election. On Wednesday, the Peso took a beating as it became increasingly clear that President-elect Donald Trump would win the election. His vow of putting tariffs on Mexican imports – of between 25% and 300%, depending on which comments you take – was the main cause of MXN’s steep sell-off.

Yet, after Trump was actually “crowned Caesar”, MXN recovered and made back all its earlier losses. On Thursday, the Mexican Peso continues marginally outperforming its peers in its three most heavily traded pairs: USD/MXN, EUR/MXN and GBP/MXN.

The Peso retains its upbeat tone after the release of Mexican inflation data for the month of October on Thursday. Mexican 12-Month Inflation rose to 4.76% in the tenth month of the year, from 4.58% in September, and beat expectations of 4.72%.

Headline inflation rose by 0.55% in October from 0.05% in September and beat expectations of 0.53%, according to INEGI.

Core Infaltion, meanwhile, stayed the same as the previous month ar 0.28% and fell below the 0.33% expected.

The slightly higher inflation could reduce the chances that the Banco de Mexico (Banxico) will cut interest rates as aggressively in the months to come.

Mexican Peso bounces from multi-year low

The Mexican Peso leaps out of its grave as markets settle down following the tumult that accompanied Donald Trump’s victory over his rival Democrat candidate, Kamala Harris, in the 60th US presidential election.

Part of the Peso’s recovery – against the US Dollar (USD) at least – could be put down to the proximity of the US Federal Reserve’s (Fed) November meeting on Thursday, as the Fed is still expected to deliver a 25 basis point (bps) (0.25%) cut to US interest rates, despite the inflationary outlook from Trumponomics. Lower interest rates are negative for the Dollar since they reduce foreign capital inflows.

30-Day Fed Funds futures prices continue to show a 100% probability that the Fed will announce a 25 bps rate cut and even a slim 2.6% chance of a larger 50 bps (0.50%) reduction, according to the CME FedWatch tool. Strangely, this was not the case before the election result when markets saw no chance of a 50 bps cut and a circa 5% probability of the Fed not cutting at all. Additionally, swap rates are showing a high probability of another 25 bps cut coming down the pipe in December. If these predictions continue, the US Dollar is likely to see its upside capped for the time being in all pairs, including against the Mexican Peso.

A further reason for the Peso’s recovery could be the realization that much of Trump’s policies, such as his threats to place tariffs on Mexican imports, may be difficult to implement. The United States-Mexico-Canada Agreement (USMCA) free trade deal stipulates that Mexican car imports to the US must contain a high percentage of US components, for example. According to the US International Trade Administration, 49.2% of Mexican imported cars are made up of US-made parts. Adding punitive tariffs would, therefore, hurt US companies that supply those components. That said, it is also possible Trump could wish to have more of the manufacturing process repatriated, ultimately to Mexico’s detriment.

On the data front, Auto Exports in Mexico rose to 5.0% YoY in October from 4.8% previously and Auto Production declined to 1.1% YoY in October from 11.7% in the previous month. A positive for the Peso since relatively elevated interest rates increase foreign capital inflows.

Congressional win for Republicans could add pressure to Peso

Trump won the presidency by passing the 270 threshold of electoral votes required to win the race. He currently has 295 electoral votes to Harris’ 226, according to Associated Press. The Republican party also gained a majority in the United States (US) Senate – 52 over 44 – and is in the lead to win a majority in the US Congress, with 206 seats versus the Democrat’s 191 so far, although 38 have still to be called.

If the Republicans win a majority in Congress, they will have a “clean sweep,” and Trump will be able to implement his policies with less friction and delay.

According to forecasts by Mexican financial news website El Financiero, a Republican majority in Congress with Trump as President could lead the Peso to weaken even further against the USD. They estimate a band of between 21.14 and 22.26 for USD/MXN in such a scenario. The pair is currently trading in the 19.80s.

If the Republicans fail to win a majority in Congress, the pair is likely to end up in a range between 19.70 and 21.14, says El Financiero.

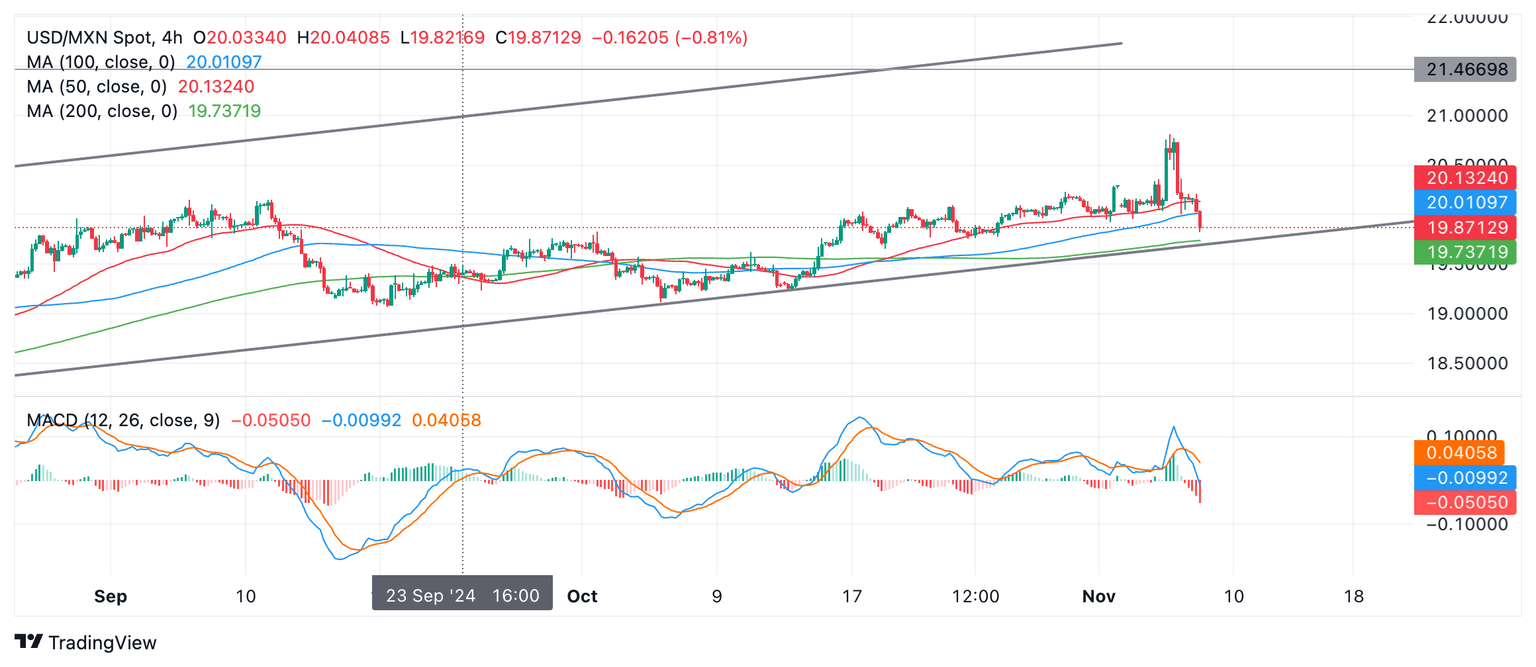

Technical Analysis: USD/MXN executes U-turn after peaking

USD/MXN shot to an over two-year high on Wednesday but promptly rolled over, eating back up all the prior gains.

USD/MXN 4-hour Chart

However, USD/MXN is in an overall uptrend on a short, medium and long-term basis. Further, it is trading in a bullish rising channel. Given the technical principle that “the trend is your friend,” the odds favor an eventual continuation higher.

The Moving Average Convergence Divergence (MACD) momentum indicator has crossed below its signal line, which is a bearish sign. However, it remains above its zero line, suggesting the trend remains bullish.

A break above the 20.80 high set on Wednesday would probably confirm more gains, with 21.00 as the next key target and resistance level (round number, psychological support).

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.