Mexican Peso climbs despite signs of cooling economy

- Mexican Peso recovers despite INEGI reporting a sharp decline in August economic activity, reinforcing IMF’s lowered 1.5% growth forecast.

- Mid-month inflation data due Wednesday is expected to decrease slightly with headline inflation projected to drop.

- Fed officials remain cautious on rate cuts with traders watching for further guidance from Fed speakers and US jobs data later this week.

The Mexican Peso recovered some ground against the Greenback on Tuesday after touching a two-month low, shrugging off worse-than-expected data that hinted at the economy slowing down. Federal Reserve (Fed) officials continued to grab the headlines on the US front amid a scarce economic schedule. At the time of writing, the USD/MXN trades at 19.94, down 0.14%.

The Insituto Nacional de Estadística Geografía e Informatica (INEGI) revealed that economic activity in August plummeted sharply in monthly figures, while it dipped annually. The data reassures the latest review by the International Monetary Fund (IMF), which estimated that the economy would grow at a 1.5% pace, contrary to the 3% economic expansion that the Secretaria de Hacienda y Credito Public (SHCP) foresees.

On Wednesday, Retail Sales for the same period are also expected to show the ongoing economic slowdown.

USD/MXN traders are eyeing the release of October’s mid-month Inflation figures. The headline inflation is expected to drop from 4.66% to 4.65%, while the underlying inflation is estimated to fall from 3.95% to 3.82%.

Across the border, San Francisco Fed President Mary Daly favored further adjustments to the fed funds rate, said the central bank would be data-dependent, and that she hasn’t seen anything that wouldn’t suggest continuing cutting rates.

Meanwhile, Kansas City Fed President Jeffrey Schmid adopted a more cautious stance, adding that he prefers to avoid outsized rate cuts, noting that they’re seeing a normalization of the labor market, not a deterioration.

Ahead this week, Mexico’s economic schedule will be slightly busy with the release of Retail Sales and Mid-Month Inflation for October. In the US, Fed speakers, jobs data, and S&P Global Flash PMIs should influence the direction of USD/MXN.

Daily digest market movers: Mexican Peso climbs amid economic slowdown

- Mexico’s Economic Activity plunged -0.3% MoM, down from 0.6% and worse than the forecast of -0.1%.

- Economic Activity on an annual basis expanded by 0.4%, beneath forecasts of 0.7%, and down from July’s 3.8% growth.

- A Reuters poll mentioned that most economists expect headline prices to rise while core prices decrease in the first half of October.

- If Mexico’s inflation dips further, the Bank of Mexico (Banxico) will likely lower rates at the upcoming November 14 meeting.

- The International Monetary Fund (IMF) projected the Mexican economy to grow 1.5% in 2024, lower than in its previous forecast. The IMF estimates a deeper economic slowdown for the next year, estimating 1.3% GDP growth, and forecasts inflation to hit Banxico’s 3% goal in 2025.

- The IMF said that a recent judicial reform creates "important uncertainties about the effectiveness of contract enforcement and the predictability of the rule of law."

- Data from the Chicago Board of Trade, via the December Fed funds rate futures contract, shows investors estimate 47 bps of Fed easing by the end of the year. This is somewhat lower than a week ago.

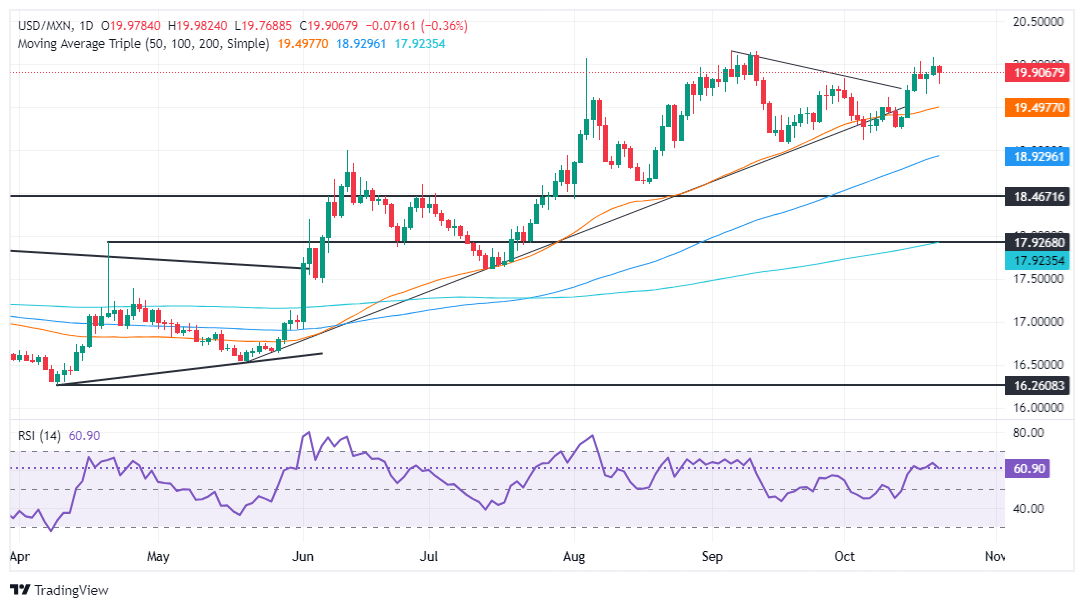

USD/MXN technical outlook: Mexican Peso recovers as USD/MXN tumbles under 19.90

The USD/MXN uptrend remains in place despite dipping to a daily low of 19.76. Momentum shows buyers are losing pace as depicted by the Relative Strength Index (RSI). However, the RSI remains bullish, an indication that the exotic pair might consolidate before printing a leg-up.

If USD/MXN clears the 20.00 figure, the next resistance would be the September 5 high at 20.14 and the year-to-date (YTD) high at 20.22. On further strength, the next stop would be 20.50, ahead of 21.00.

Conversely, if the USD/MXN extends its losses below the October 18 low of 19.64, a test of the October 10 daily peak at 19.61 is on the cards. Next would be the October 4 swing low of 19.10 before testing 19.00.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.