Mexican Peso climbs unfazed by underperforming Retail Sales

- Mexican Peso gains although Retail Sales declined for the fourth consecutive month.

- A gloomy economic outlook for Mexico pressures the Bank of Mexico to cut rates at the upcoming meeting.

- IMF revises Mexico’s 2024 growth forecast to 1.5%, widening the divergence with the US, projected to grow at 2.8%.

- Traders eye Mexican mid-month inflation data, Fed speakers later this week to sway the direction of USD/MXN.

The Mexican Peso stages a comeback against the US Dollar on Wednesday, after further data revealed the economy continues to underperform, which could push the Bank of Mexico (Banxico) to lower borrowing costs at the upcoming meeting. At the time of writing, the USD/MXN trades at 19.88. down 0.33%.

Mexico’s National Statistics Agency, known as INEGI, revealed that monthly August Retail Sales were lower than expected, while annual basis figures plunged for the fourth straight month. Wednesday’s data, along with the contraction of the Economic Activity Index, paint a gloomy scenario for the new administration of President Claudia Sheinbaum.

Ahead of the week, October mid-month inflation data is expected on Thursday. Estimates suggest that headline inflation would drop from 4.66% to 4.65%, while the underlying inflation is projected to fall from 3.95% to 3.82%.

Last week, the International Monetary Fund (IMF) projected the Mexican economy will grow 1.5% in 2024, lower than in its previous forecast. In its annual report, the IMF estimates a widening divergence between the economies of Mexico and the US, with the former expected to grow at a 2.8% pace, while the latter deepens its economic slowdown. For 2025, Mexico is projected to grow 1.3%, while the US economy is foreseen growing at a 2.2% pace.

On the US front, the economic schedule featured housing data for September, which missed projections. In the meantime, Federal Reserve (Fed) speakers will continue to cross the wires.

San Francisco Fed President Mary Daly favors further adjustments to the fed funds rate, saying the central bank will remain data-dependent and that she hasn’t seen anything that would suggest pausing the rate cutting.

Meanwhile, Kansas City Fed President Jeffrey Schmid adopted a more cautious stance, adding that he prefers to avoid outsized rate cuts, noting that they’re seeing a normalization of the labor market rather than a deterioration.

Ahead this week, Mexico’s economic schedule will be featuring the release of Mid-Month Inflation for October. In the US, Fed speakers, jobs data, and S&P Global Flash PMIs should influence the direction of USD/MXN.

Daily digest market movers: Mexican Peso climbs, shrugs off economic slowdown

- Mexico’s Retail Sales dipped to 0.1% MoM, below the 0.2% expansion foreseen by analysts and July’s 0.7% increase.

- On an annual basis, Retail Sales plummeted -0.8%, below estimates of -0.4% and the previous month of -0.6%.

- A Reuters poll showed most economists expect headline prices to rise while core prices decrease in the first half of October.

- If Mexico’s inflation dips further, the Bank of Mexico (Banxico) will likely lower rates at the upcoming November 14 meeting.

- Data from the Chicago Board of Trade, via the December fed funds rate futures contract, shows investors estimate 48 bps of Fed easing by the end of the year.

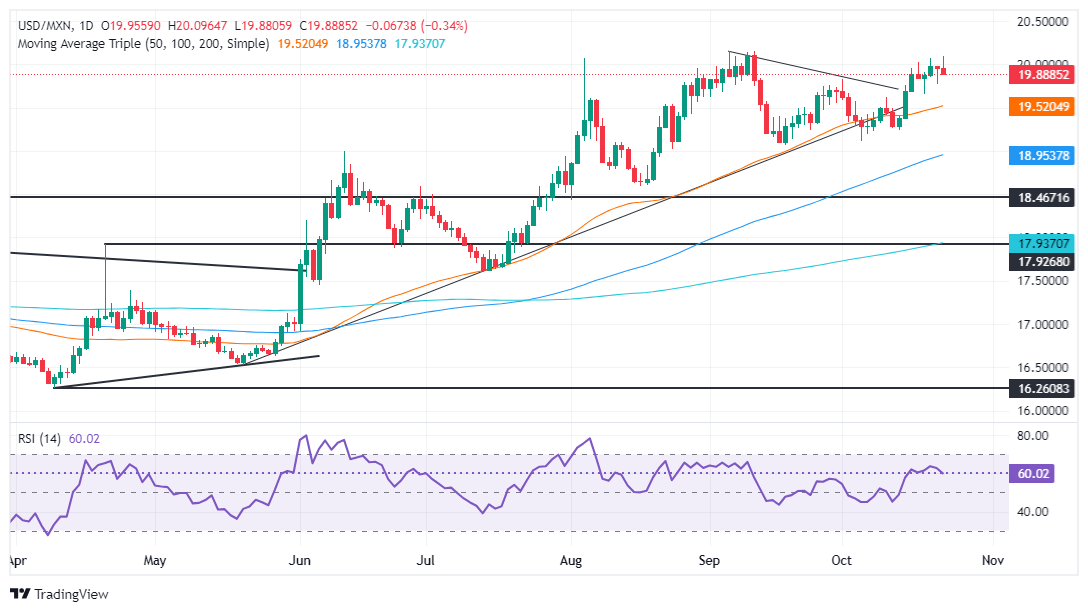

USD/MXN technical outlook: Mexican Peso appreciates though remains tilted to the downside

The USD/MXN remains upwardly biased despite retreating below the 20.00 figure. Momentum shows that bulls remain in charge with the Relative Strength Index (RSI) above its 50 neutral line despite aiming lower.

If USD/MXN clears the 20.00 figure, the next resistance would be the September 5 high at 20.14 and the year-to-date (YTD) high at 20.22. On further strength, the next stop would be 20.50, ahead of 21.00.

Conversely, if the USD/MXN extends its losses below the October 18 low of 19.64, a test of the October 10 daily peak at 19.61 is on the cards. Next would be the October 4 swing low of 19.10 before testing 19.00.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.