Mexican Peso plummets as Trump’s said tariffs to start as promised

Most recent article: Mexican Peso sinks as Trump’s tariffs send Peso to four-week low

- USD/MXN rallied 0.72% on Monday as tariffs would begin on March 4, said Trump.

- Mexico’s business confidence deteriorates, manufacturing contracts for the eighth straight month.

- US economic data mixed with weak ISM PMI fueling growth concerns.

The Mexican Peso reversed course and plunged against the Greenback on Monday after US President Donald Trump said that Mexico could not make anything against tariffs beginning on March 4 as promised. At the time of writing, the USD/MXN trades at 20.68, flat as Tuesday’s session begins but up 0.77% in the week.

Over the weekend, the US Commerce Secretary said that tariffs on Mexico and Canada commence on Tuesday but that Trump would determine whether to stick to the planned 25% level. If tariffs proceed as projected, it could prompt traders to seek the security of the US Dollar (USD) and push the USD/MXN higher. Otherwise, the Peso could sustain a relief rally, and the pair could continue to edge lower.

Mexico’s economic data showed that business manufacturing activity contracted for the eight straight month, revealed S&P Global. At the same time, Business Confidence in February continued to witness a deterioration, revealed by the National Statistics Agency (INEGI), underscoring the gloomy economic outlook.

Banco de Mexico (Banxico) private economists’ poll was revealed, and analysts expect growth to remain below 1%, while inflation expectations remain unchanged.

Across the border, Manufacturing PMI data revealed by S&P Global and the Institute for Supply Management (ISM) was mixed. The former expanded compared to January’s figures, while the ISM dipped but remained in expansionary territory.

Daily digest market movers: Mexican Peso rises despite soft economic data

- Mexico’s Manufacturing PMI in February, according to S&P Global, contracted 47.6, down from 49.1. That was due to “demand conditions remaining on a downward path and cashflow pressures intensifying,” said Pollyanna de Lima, Economics Associate Director at S&P Global Market Intelligence.

- Business Confidence in Mexico fell 1.4 points, down from 51.5 to 50.1. Compared to last year, the index plunged 4.9 points, though the index has expanded for the last 25 straight months above the 50 threshold.

- Banxico’s poll showed that Gross Domestic Product (GDP) is expected at 0.81%, down from 1% for 2025. Headline inflation is predicted to end at 3.71%, down from 3.83%, and core Consumer Price Index (CPI) is estimated to end at 3.75%, up from 3.75%.

- Economists estimate the USD/MXN exchange rate to end 2025 at 20.85, down from 20.90, but for 2026 they eye a depreciation of the Peso far beyond the 21.30 figure expected in the January poll.

- The US ISM Manufacturing PMI showed that business activity in February remained steady at 50.3, down from 50.9 and below economists’ estimates of 50.5.

- S&P Global revealed that manufacturing activity in February increased by 52.7, up from 51.2 and exceeding forecasts of 51.6.

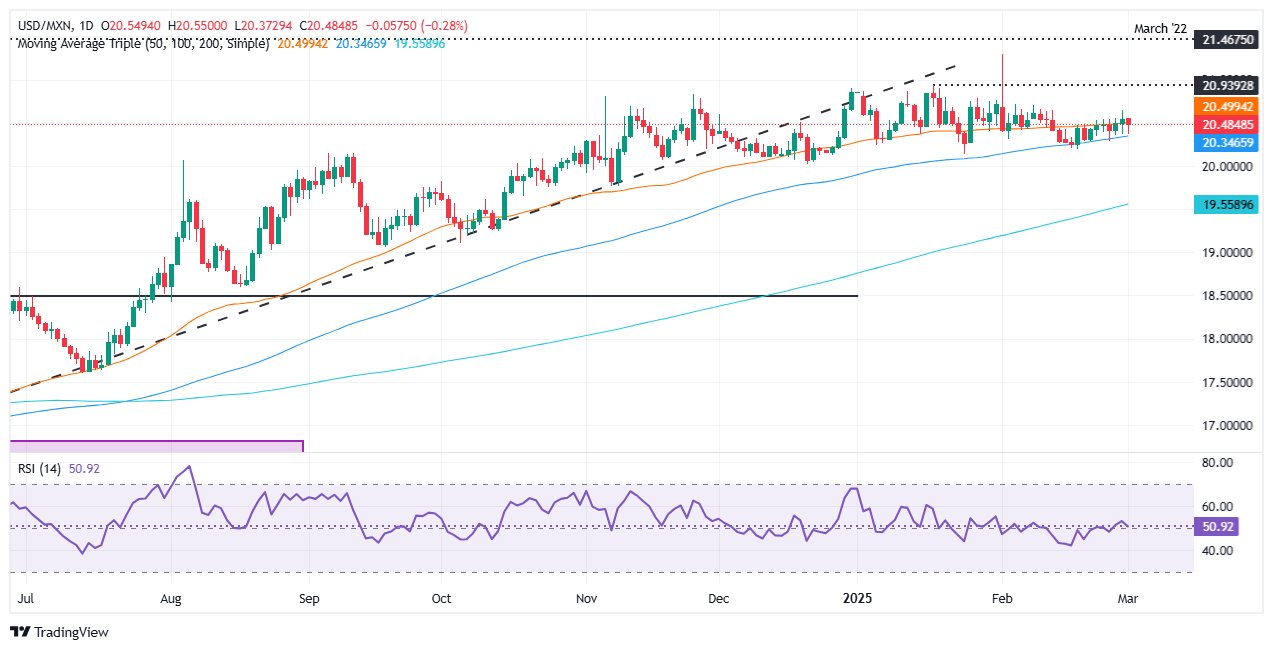

USD/MXN technical outlook: Mexican Peso climbs as USD/MXN drops below 20.50

The USD/MXN uptrend remains in place, though the exotic pair has consolidated within the 20.20–20.70 range for the latest 18 days, hinting that buyers are not committed to pushing spot prices higher. Short term, momentum is tilted to the downside as depicted by the Relative Strength Index (RSI) turning bearish.

For a bearish continuation, the USD/MXN must clear the 100-day Simple Moving Average (SMA) at 20.30. Once surpassed, the next stop would be the 20.00 figure ahead of the 200-day SMA at 19.50. On the other hand, if buyers push the exchange rate past 20.50, they must clear the latest peak seen at 20.71 on February 6, before testing the February 3 high at 21.28.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.