Mexican Peso strenghtens amid weak US services sector outlook

- Mexican Peso capitalizes on mixed economic data from the US.

- Mexico's economic indicators show a slowdown, with housing construction down 5.2% YoY in September.

- Fed's mixed messages on future rate cuts keep markets guessing, with further US data awaited this week.

The Mexican Peso registers decent gains versus the US Dollar after mixed US economic data augmented the chances that the Federal Reserve (Fed) could lower interest rates at the December meeting. The USD/MXN trades at 20.26, down 0.20%.

Mexico’s economic docket remained absent, yet September Gross Fixed Investment figures revealed on Tuesday hinted that the economy is slowing down. Figures showed that housing construction plunged 5.2% YoY in September, posting back-to-back months of losses, the most profound fall since March 2021.

Capex in machinery and equipment witnessed a mild advance of just 0.8%, the lowest level since the post-Covid-19 recovery in March 2021.

Across the border, the US jobs market revealed solid figures. Still, business activity witnessed a dip in the services sector, according to S&P Global and the Institute for Supply Management (ISM).

In the meantime, Fed speakers crossed the newswires. St. Louis Fed President Alberto Musalem said that time might be near to slow or pause rate cuts. Musalem added that the labor market is consistent with full employment and that inflation can converge toward 2% in the next two years.

At the same time, the Richmond Fed’s Thomas Barkin said that risks on inflation and maximum employment remain balanced.

Ahead this week, Mexico’s schedule will feature the release of automobile production data. In the US, the docket will feature Fed speakers, Initial Jobless Claims and Nonfarm Payrolls (NFP) figures.

Daily digest market movers: Mexican Peso boosted by falling US Dollar

- The latest Citi Mexico survey showed that most economists estimate Banxico will cut rates by 25 basis points at the December meeting. Analysts project the economy will grow 1.5% in 2024 and 1% in 2025.

- US ADP National Employment report for November revealed that private hiring jumped by 145K, below forecasts of 150K, and beneath the downwardly revised October figures from 238K to 184K.

- The ISM Services PMI in November retreated from 56 to 52.1, below estimates of 55.7. Earlier, S&P Global Services PMI dipped from 57 to 56.1, missing forecasts of 57.

- US Durable Goods Orders improved from 0.2% to 0.3% MoM in October, according to the US.

- The CME FedWatch Tool suggests that investors see a 79% chance of a 25-basis-point (bps) rate cut at the Fed’s December meeting.

- Data from the Chicago Board of Trade, via the December fed funds rate futures contract, shows investors estimate 19 bps of Fed easing by the end of 2024.

- Banxico’s November survey shows that analysts estimate inflation at 4.42% in 2024 and 3.84% in 2025. Underlying inflation figures will remain at 3.69% in 2024 and 2025. GDP is forecasted at 1.55% and 1.23% for 2024 and 2025, respectively, and the USD/MXN exchange rate at 20.22 for the rest of the year and 20.71 in 2025.

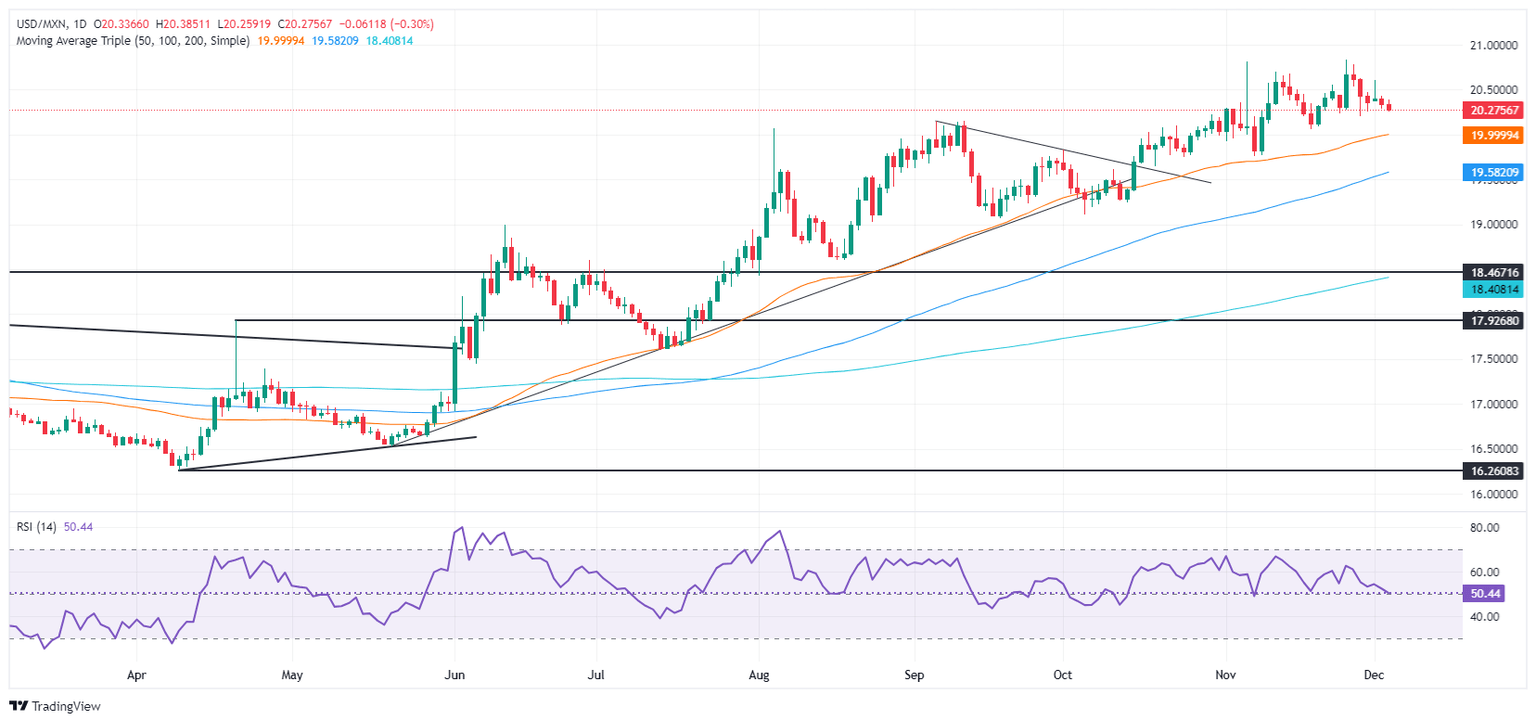

Mexican Peso technical outlook: USD/MXN drops below 20.30 on Peso’s strength

The USD/MXN uptrend remains intact, although the exotic pair fell below 20.50. Momentum shows that bears are in charge, as depicted by the Relative Strength Index (RSI) aiming toward its neutral line.

If USD/MXN drops below the November 19 low of 20.06, the next stop would be 20.00. On further weakness, the exotic pair will test the 50-day Simple Moving Average (SMA) at 19.97. A breach of the latter will expose the 100-day SMA at 19.61 before the psychological 19.00 figure.

On the other hand, if USD/MXN reclaims 20.50, the next resistance would be the year-to-date peak at 20.82. If surpassed, the next stop would be 21.00, ahead of the March 8, 2022 peak at 21.46, followed by the November 26, 2021 high at 22.15.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.