Mexican Peso ticks downward in wake of Powell's remarks

- Mexican Peso stays flat against the Greenback, anticipating Claudia Sheinbaum's October 1 inauguration.

- Business Confidence for September, expected on October 2, could mark a fourth consecutive month of improvement.

- Despite Peso gains, the US Dollar Index rises by 0.20% as stronger US economic data bolsters the Greenback.

The Mexican Peso erased some of its earlier gains and is virtually unchanged against the Greenback amid a scarce economic docket in Mexico. The most important event will be on October 1, when President-Elect Claudia Sheinbaum takes the place of outgoing President Andres Manuel Lopez Obrador. However, Federal Reserve Chairman Jerome Powell is crossing the wires, strengthening the Greenback. The USD/MXN trades at 19.66 flatlines.

Mexico’s schedule will be light on Monday but will gather steam on Tuesday, October 1, when Claudia Sheinbaum's inauguration will be held. On October 2, Business Confidence for September will be revealed, though there are no estimates. It could continue to improve for the fourth straight month after the index bottomed at 52.9. Since then, confidence has been improving for three straight months.

Market participants will be eyeing Sheinbaum’s message regarding the state of the law, economics and fiscal comments.

Across the northern side of the border, the Chicago Fed National Activity Index exceeded estimates and August’s number, indicating that conditions are improving and that the economy remains solid.

Fed Chair Jerome Powell, speaking at the 66th NABE Annual Meeting, dismissed the possibility of a 50-basis-point (bps) rate cut at either of the central bank's two remaining policy meetings this year. Powell indicated that if the economy evolves as expected, two more 25 bps cuts will be implemented in 2024.

Recently, comments from Atlanta Fed President Raphael Bostic revealed that he will be watching jobs data to assess the Fed’s policy stance. He added that he’s open to cutting rates by 50 basis points (bps), though it would depend on jobs data. Bostic acknowledged that he was not ready to declare victory on inflation.

Even though the USD/MXN prints losses, the Greenback is strengthening across the board, as portrayed by the US Dollar Index (DXY), which is up by 0.20% to 100.61.

Daily digest market movers: Mexican Peso recovers despite strong Chicago PMI data

- Mexican political turmoil eases as market participants prepare for the change of president on October 1, a bank holiday in Mexico.

- Banxico is expected to lower borrowing costs by 175 bps toward the end of 2025, according to the swaps markets.

- The Chicago Fed National Activity Index, also known as Chicago PMI, improved for the third straight month, rising by 46.6 and overshadowing estimates and August’s data.

- The latest Personal Consumption Expenditures (PCE) Price Index report was mixed. In August, headline inflation rose by 2.2% YoY, down from 2.5% and a tenth lower than the consensus estimate.

- Conversely, as expected, the core PCE modestly increased from 2.6% to 2.7% for the same period.

- Market participants have put the odds of a 25 bps cut at 56.4%, up from 46.7% a day ago. The chances for a larger 50 bps cut stand at 43.6%, according to the CME FedWatch Tool.

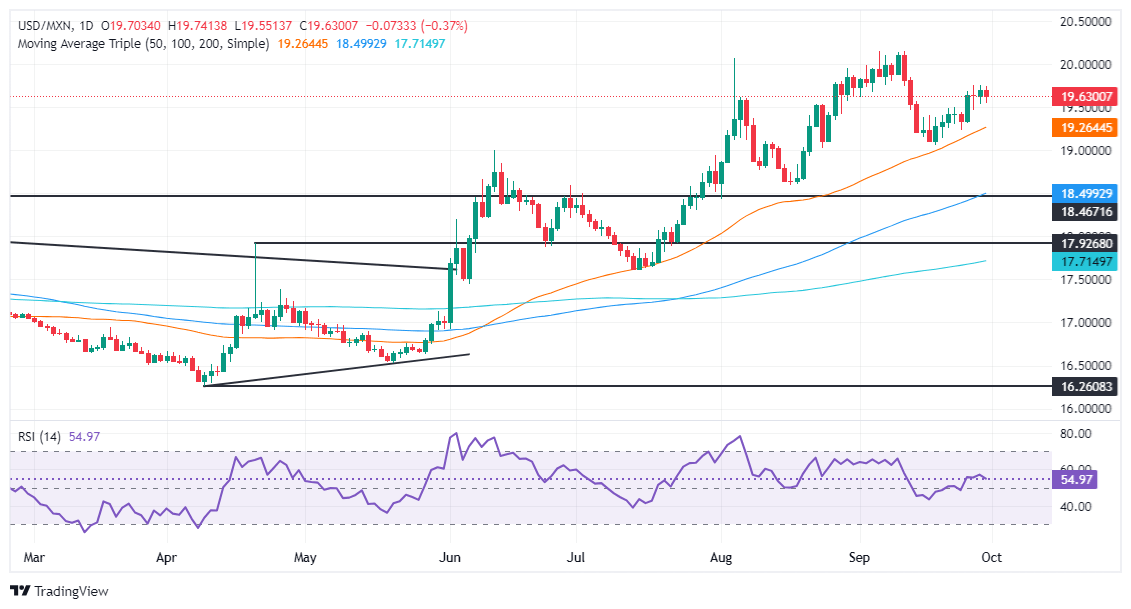

USD/MXN technical analysis: Mexican Peso recovers as USD/MXN tumbles below 19.65

The USD/MXN remains upwardly biased, though price action shifted sideways as traders remain uncertain about Sheinbaum’s message. The Relative Strength Index (RSI) remains bullish, though short-term sellers are stepping in.

If USD/MXN drops below 19.50, the next support would be the September 24 swing low of 19.23 before the pair moves toward the September 18 low of 19.06. Once those levels are surpassed, the 19.00 figure emerges as the following line of defense.

Conversely, for a bullish resumption, the USD/MXN would need to clear the September 27 high at 19.75, which, once removed, will expose the 20.00 mark. Once those levels are surrendered, the current year-to-date (YTD) high of 20.22 will be the next stop.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.