Mexican Peso climbs boosted by high inflation data

Most recent article: Mexican Peso rallies following inflation data, ahead of Banxico meeting

- Mexican Peso appreciates for third consecutive day, hits daily low below 18.00 against US Dollar.

- June’s mid-month inflation data shows core figures declining, while general inflation expands but stalls compared to May.

- Analysts revise Banxico rate cut expectations from June to August, with Citibanamex survey adjusting USD/MXN forecast from 18.00 to 18.70.

The Mexican Peso recovered and appreciated for the third consecutive trading day against the US Dollar as investors braced for the Bank of Mexico's (Banxico) next monetary policy decision on Thursday. Analysts became more skeptical that the Mexican institution would lower rates following a more than 6.90% depreciation of the Peso following the June 2 general election. The USD/MXN trades at 17.94, down 0.77%.

Mexico’s economic docket featured June’s mid-month inflation data. Core figures continued to decline, while general inflation expanded above estimates but stalled compared to May’s data. After the data, the USD/MXN tumbled to an 11-day low and tested the 18.00 psychological level as investors brace for Banxico’s decision.

The Citibanamex survey showed that most analysts seemed sure Banxico would continue to ease policy but shifted the next rate cut from June to August. Additionally, economists priced out fewer rate cuts by the central bank while adjusting the USD/MXN exchange rate forecast from 18.00 in the previous report to 18.70.

Regarding economic growth, the consensus revised the Gross Domestic Product (GDP) for 2024 downward from 2.2% to 2.1% YoY.

Across the border, Federal Reserve (Fed) officials remained cautious. Chicago Fed President Austan Goolsbee expressed that policy is restrictive and that he’s optimistic that he’ll see an improvement in inflation data.

Daily digest market movers: Mexican Peso advances as inflation jumps in June

- Mexico’s June mid-month Consumer Price Index rose by 0.21% MoM, above estimates, and expanded by 4.78% annually, unchanged from the previous reading and higher than the 4.70% estimate.

- Core inflation rose below estimates of 0.18% MoM, reaching 0.17%. Annually, it was below estimates and the previous reading of 4.17%.

- Citibanamex Survey showed that most analysts estimate Banxico’s next rate cut will come at the August 8 meeting and that interest rates will be lowered from 11.00% to 10.25%, up from 10%.

- USD/MXN stabilizes following last week’s verbal intervention by Banxico Governor Victoria Rodriguez Ceja, who stated that the central bank is attentive to volatility in the Mexican currency exchange rate and could restore "order" in the markets.

- USD/MXN is extending its losses due to a softer US Dollar. The US Dollar Index (DXY), which tracks the Greenback’s value against a basket of six other currencies, dropped 0.28% to 105.53.

- CME FedWatch Tool shows odds for a 25-basis-point Fed rate cut at 61.1%, up from 59.5% last Friday.

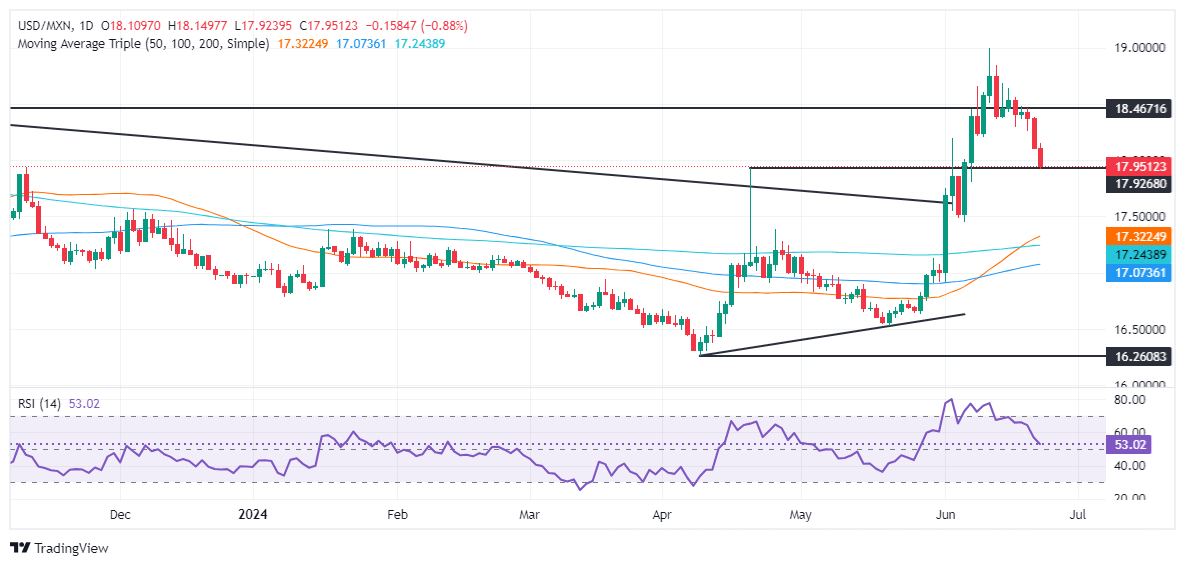

Technical analysis: Mexican Peso surges as USD/MXN falls below 18.00

The USD/MXN uptrend remains in place, though the ongoing pullback from around 18.37 to below the 18.00 figure could pave the way to challenge the 50-day Simple Moving Average (SMA) at 17.37 before testing the 200-day SMA at 17.23. Once those two levels are cleared, the next stop would be the 100-day SMA at 17.06.

Although momentum shows sellers are in charge, the Relative Strength Index (RSI) remains above the 50-neutral line. That said, traders should be cautious about whether the USD/MXN could reverse its ongoing downtrend.

For a bullish continuation, the USD/MXN must clear 18.50 if buyers want to retest the year-to-date high of 18.99. A breach of the latter will expose the March 20, 2023, high of 19.23. If that price is cleared, this will sponsor an uptick to 19.50.

Economic Indicator

1st half-month Core Inflation

The 1st half-month core inflation index released by the Bank of Mexico is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services, excluding taxes and energy. The purchase power of Mexican Peso is dragged down by inflation. The inflation index is a key indicator since it is used by the central bank to set interest rates. Generally speaking, a high reading is seen as positive (or bullish) for the Mexican Peso, while a low reading is seen as negative (or Bearish).

Read more.Last release: Mon Jun 24, 2024 12:00

Frequency: Monthly

Actual: 0.17%

Consensus: 0.18%

Previous: 0.15%

Source: National Institute of Statistics and Geography of Mexico

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.