Mexican Peso depreciates against US Dollar as USD/MXN rises above 18.30

- Mexican Peso depreciates over 1% against USD, trades above 18.30.

- INEGI’s mid-month inflation data reveals mixed results, halting disinflation and raising concerns.

- Political uncertainty grows as Mexican Congress prepares to discuss judicial reforms impacts the Mexican currency.

The Mexican Peso depreciated over 1% against the Greenback after the National Statistics Agency (INEGI) revealed mixed mid-month Inflation data. Market participants, who remain risk averse, overlooked this, while the carry trade that favored the emerging market currency began to unwind, according to ING. The USD/MXN trades at 18.37 after bouncing off daily lows of 18.13.

On Wednesday, INEGI revealed that headline inflation rose above estimates while underlying prices ticked lower on monthly figures but not annually. The disinflation process seems to be halting due to the reacceleration of inflation that began in March and rose above the 5% threshold, hitting its highest level since May 2023.

Meanwhile, political woes hurt the Peso after newswires revealed that the Mexican Congress will begin to discuss President Andres Manuel Lopez Obrador's reform of the judiciary system on August 1. This is to prepare the bill for approval once the new Congress begins its three-year period on September 1.

ING mentioned that the low volatility environment I not favoring any rotation back to the carry trade. They said, “On the contrary, markets appear to be unwinding positions in some selected high yielding currencies like MXN and ZAR, while the funding JPY continues to perform very well.”

In the meantime, USD/MXN traders are also eyeing the release of crucial US economic data. On Thursday, the docket will feature Gross Domestic Product (GDP) data, followed by the release of the Federal Reserve’s (Fed) preferred gauge for inflation, the Core Personal Consumption Expenditure (PCE) Price Index.

Daily digest market movers: Mexican Peso plummets amid weaker US Dollar

- Mid-month Inflation for July rose by 0.71% MoM, which was higher than the 0.39% expected and crushed the previous reading of 0.21%. On a yearly basis, prices rose by 5.61% above forecasts of 5.27% and crushed the previous report of 4.78%.

- Mid-month core Inflation expanded by 0.18% MoM, a tenth higher than the previous report, lower than expected, and in the twelve months to mid-July, it dropped from 4.17% to 4.02% as foreseen.

- Citi Research Expectations survey shows that analysts estimate inflation to end at 4.30% YoY, up from 4.20%, while underlying inflation is foreseen to finish 2024 at 4.0%.

- Regarding growth, Mexico’s economy is expected to grow 1.9%, down from 2.0% in the last poll.

- The US Dollar Index (DXY), which tracks the buck’s value against the other six currencies, drops 0.24% to 104.22.

- US S&P Global PMIs expanded as expected in the Services and Composite sectors, but the Manufacturing figure contracted for the first time since December 2023

- The CME FedWatch Tools show that the chances of a quarter-percentage-rate cut to the federal funds rate in September are 100%.

- Data by the Chicago Board of Trade (CBOT) shows that traders are pricing in 53 basis points (bps) of easing towards the end of the year, as shown by the December 2024 fed funds rate futures contract.

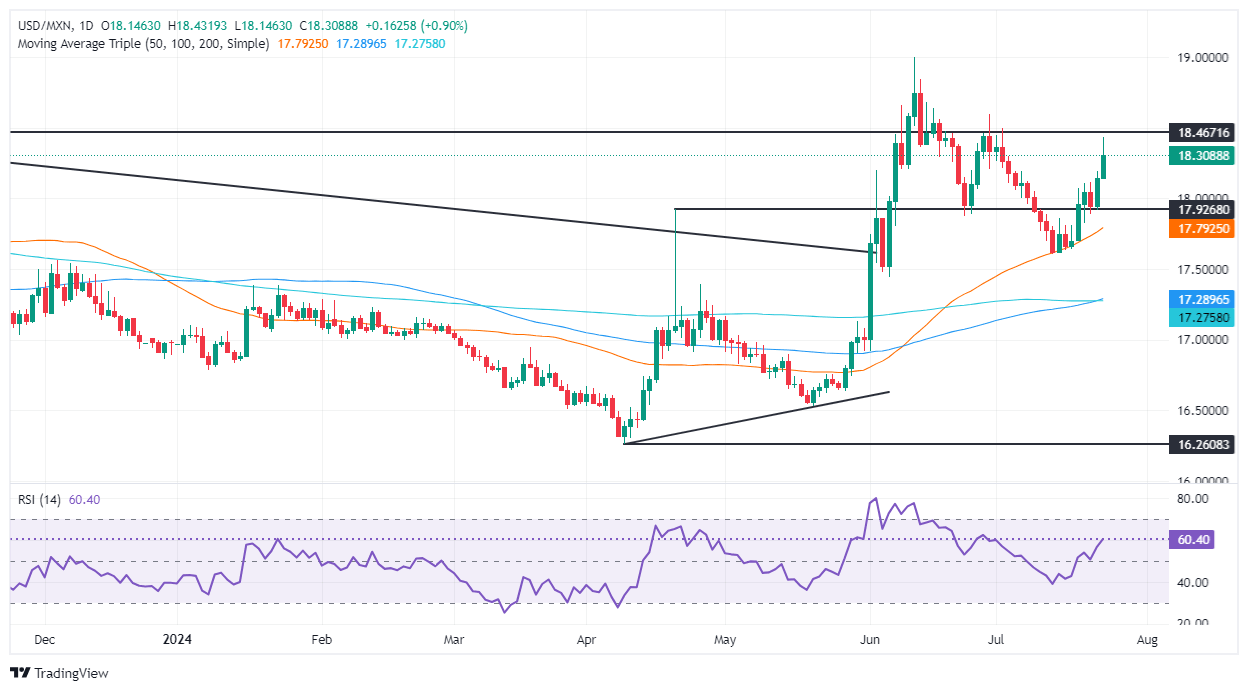

Technical analysis: Mexican Peso drops as USD/MXN sticks above 18.00

The USD/MXN extends its gains above the psychological 18.00 figure and is set to extend its gains if it reclaims key resistance levels. Buyers are gathering momentum, as shown by the Relative Strength Index (RSI), aiming upwards after the exotic pair’s pullback from 18.59 to 17.58

If USD/MXN clears 18.50, the next resistance would be the year-to-date (YTD) high at 18.99.

Conversely, if USD/MXN retreated beneath 18.00, that would pave the way to challenge the 50-day Simple Moving Average (SMA) at 17.74, the first support level. The next support would be the latest cycle low of 17.58; the July 12 high turned support. A breach of the latter will expose the January 23 peak at 17.38.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.