Mexican Peso closes Wednesday lower ahead of Banxico's decision

- Mexican Peso declines as USD/MXN climbs over 1.80%, driven by expectations of further Banxico rate cuts.

- Cooling inflation in early September bolsters the case for a Banxico rate reduction at the September 26 meeting.

- Bloomberg survey: 20 of 25 analysts expect Banxico to cut 25 bps to 10.50%, with some predicting a 50 bps reduction.

The Mexican Peso tumbles against the Greenback on Wednesday as the latter appreciates sharply against most emerging market currencies. There are expectations for further easing by the Bank of Mexico (Banxico) at its September 26 meeting. This environment has sponsored a leg-up in the exotic pair. At the time of writing, the USD/MXN trades at 19.66, rallies over 1.80%.

Mexico’s economic docket remained absent on Wednesday, but data revealed on Monday and Tuesday paint a mixed economic picture. In annual data, Economic Activity improved in July, but Retail Sales extended its agony to three consecutive months of registering negative readings.

On Tuesday, the Instituto Nacional de Estadistica Geografía e Informatica (INEG) announced that monthly and yearly inflation figures for September's first half cooled.

The latest data set should allow Banxico to cut its interest rate by at least 25 basis points (bps) on Thursday. According to Bloomberg, 20 out of 25 analysts estimate that the central bank will lower borrowing costs to 10.50%. One expects rates to remain unchanged, and four estimate a 50 bps rate cut, following the Fed's footsteps.

If Banxico eases its policy, that would be negative for the Peso. Hence, the USD/MXN could extend its uptrend, with traders setting their sights on the psychological 20.00 figure.

Christian Lawrence, senior cross-asset strategist at Rabobank, noted, “We see room for bouts of downside on the back of tactical carry trade flows during periods of vol suppression. Still, our base is for further MXN weakness over the coming months as reforms and US elections add to MXN risk premia.”

Meanwhile, data in the United States (US) show that although the economy is slowing down, most market participants estimate a soft-landing scenario. On Tuesday, the Conference Board (CB) revealed that Consumer Sentiment in September deteriorated and hit its lowest level since August 2021 at 98.7, down from 105.6.

Daily digest market movers: Mexican Peso dips amid scarce economic docket

- USD/MXN extended its rally on Banxico rate cut expectations, alongside the Greenback’s recovery.

- US Dollar Index (DXY), which tracks the buck’s performance against a basket of six peers, climbs 0.56% and exchanges hands at 100.91.

- Banxico is expected to lower borrowing costs by 175 bps toward the end of 2025, according to the swaps markets.

- Market participants had fully priced in a 100% chance of a 25 bps rate cut by the Fed. However, the odds for 50 bps of easing are 60.8%, according to the CME FedWatch Tool.

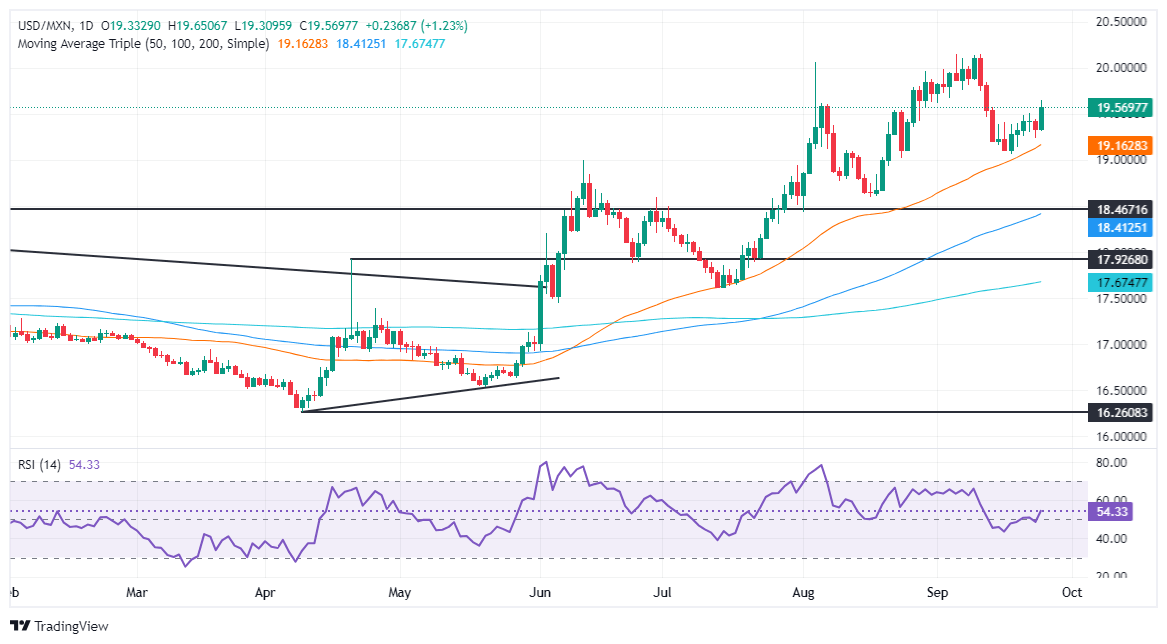

USD/MXN technical analysis: Mexican Peso slumps as USD/MXN surpasses 19.50

The USD/MXN resumed its uptrend on Wednesday and hit a daily high of 19.64 before stabilizing at current levels. Momentum favors further upside as the Relative Strength Index (RSI) is bullish.

The first key resistance level that buyers need to clear is the August 6 high at 19.61. Once surpassed, the next stop is 20.00, followed by the year-to-date (YTD) peak at 20.22.

On the flip side, if sellers drive USD/MXN below the September 23 low of 19.29, it will expose the confluence of the 50-day Simple Moving Average (SMA) and the September 18 low between 19.08 and 19.06.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.