Mexican Peso plunges to two-week low as USD/MXN reclaims 18.00

- Mexican Peso plunges more than 2.30% in the week.

- Mexico’s creditworthiness remains solid as Fitch reaffirms Mexico's BBB rating but warns about the judiciary reform.

- Trump's comments on immigration and automotive industry relocation impact Mexican Peso sentiment.

The Mexican Peso prolongs its agony against the US Dollar and dips some 0.49% during the North American session, hurt by market mood deterioration as investors flock to safe-haven currencies. The official nomination of former President Donald Trump as a Republican Candidate and remarks linked to Mexico could be one of the reasons behind the USD/MXN advance, which traded at 18.05 above its opening price by 0.49%.

Sentiment remains sour, as depicted by worldwide indices trading with losses. The Mexican economic docket will gather pace next Monday, July 22, with the release of May's Economic Activity alongside Retail Sales for the same period. This, in turn, has left market participants adrift to US Dollar dynamics.

Across the border, Trump’s comments put Mexico in the spotlight, commenting that he will end illegal immigration “by closing the border and completing the wall.” He added, “China and Mexico have taken 68 percent of our automotive industry, but we are going to get it back.”

The remarks threaten to prevent companies from relocating to Mexico, which could weaken the Mexican Peso.

Meanwhile, Fitch ratings reaffirmed Mexico’s BBB- qualification with a stable outlook, though added that the proposed judicial reform would impact the country. The credit rating agency stated there’s uncertainty in the upcoming administration to narrow the fiscal deficit, expects a slight economic downturn in 2025, and added that trade tensions with the US could leave Mexico vulnerable.

A light US economic schedule will feature New York Fed President John Williams and Atlanta’s Fed President Raphael Bostic.

The US Dollar Index (DXY), which tracks the buck’s value against the other six currencies, climbed back above 104.30, gaining 0.12%.

Daily digest market movers: Mexican Peso hurt by risk aversion

- Mexico’s Economic Activity in May is expected to contract -0.6% MoM and expand by 5.4% YoY. Retail Sales are foreseen to stay positive at 0.5% MoM and 3.2% YoY.

- The International Monetary Fund (IMF) adjusted Mexico’s Gross Domestic Product (GDP) expectations for 2024 from 2.4% to 2.2% due to the country’s economic slowdown and the US economic downturn.

- Bloomberg’s interview of Donald Trump spooked investors as the former US President commented that he favors tax reductions, lower interest rates, and tariffs, including a 60% to 100% increase in China’s products and a 10% in the general rate in other countries.

- The CME FedWatch Tools show that the chances of a quarter-percentage-rate cut to the federal funds rate in September are at 98%.

- June consumer inflation figures were lower than expected in the United States, increasing the chances that the Federal Reserve would lower borrowing costs in 2024 by at least 50 basis points, according to the December 2024 fed funds rate futures contract.

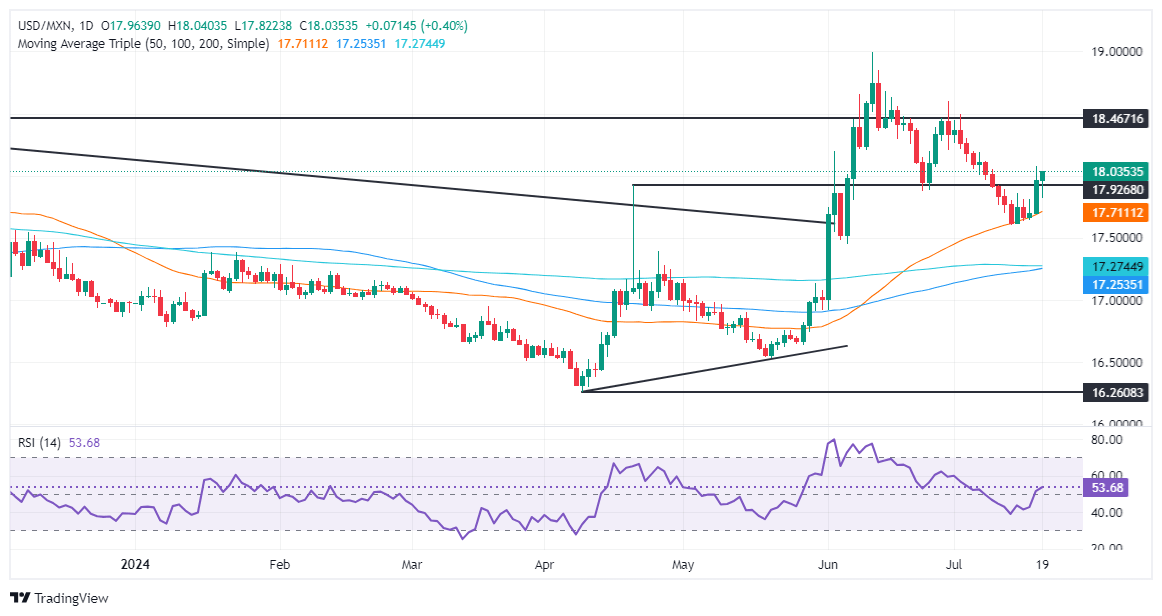

Technical analysis: Mexican Peso stumbles as USD/MXN hovers around 18.00

The USD/MXN has jumped off the floor formed at around 17.58-17.60 amid traders' nervousness about former President Trump's “upcoming” victory as they ditch the Mexican currency. Since Thursday, the exotic pair has gained 1.50% and challenged the psychological 18.00 figure but has failed to print a daily close above the latter.

If USD/MXN extends its gains above the psychological 18.00 figure, that will expose key resistance levels. Once breached, the next stop would be the July 5 high at 18.19, followed by the June 28 high of 18.59, allowing buyers to aim for the YTD high at 18.99.

On further weakness, if USD/MXN clears the 50-day SMA at 17.63, that would pave the way to challenge the December 5 high at 17.56, followed by the 200-day SMA at 17.27. Further losses would test the 100-day SMA at 17.21.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.