Mexican Peso corrects after release of lower-than-expected inflation data

- The Mexican Peso pulls back after the release of lower-than-expected inflation data

- MXN is overall trending higher and has risen to almost nine-year highs against the US Dollar (USD).

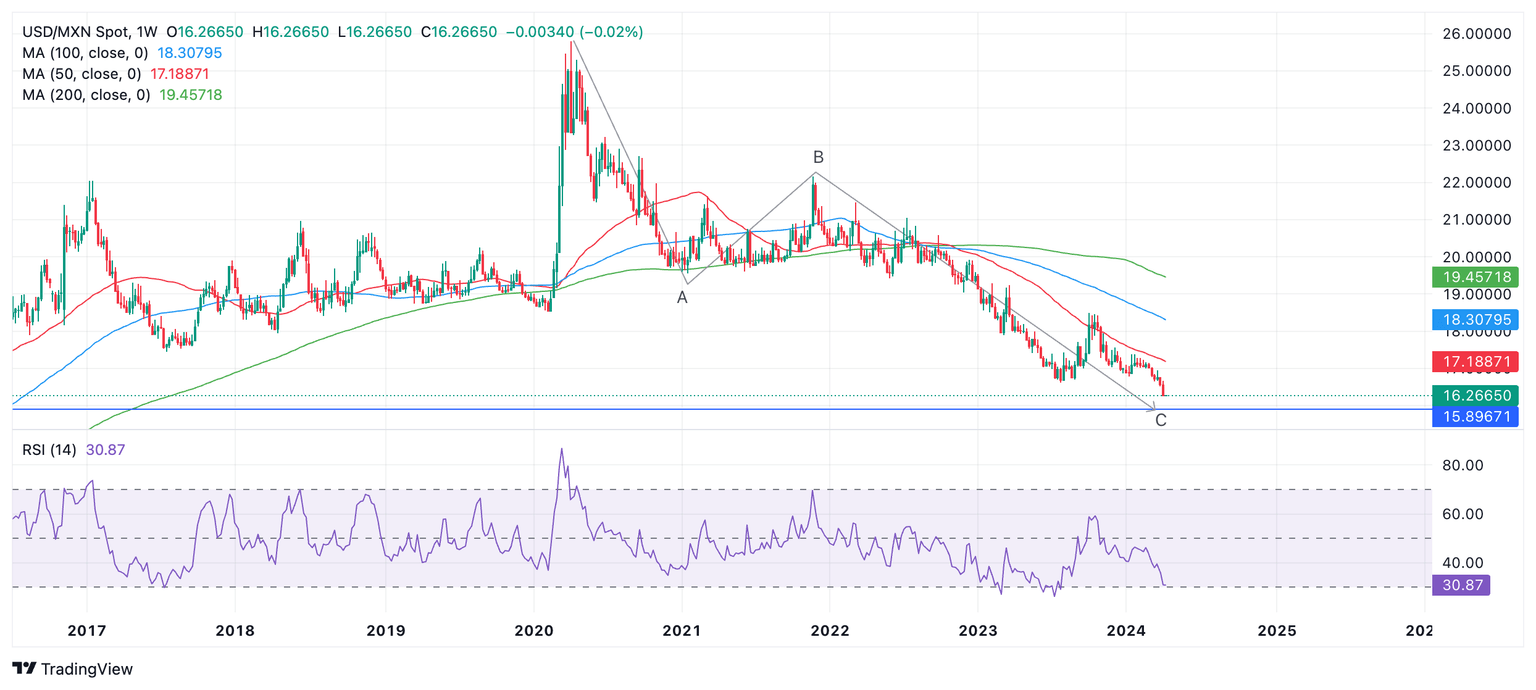

- USD/MXN is probable unfolding a Mesured Move pattern on the weekly chart with a target in the 15.00s.

The Mexican Peso (MXN) is pulling back after the release of cooler-than-expected inflaiton data for March, on Tuesday. Despite this small correction, the Mexican Peso continues trading at eight almost nine-year highs around 16.30 against the US Dollar (USD) after extending its long-term bull trend.

Mexican Peso fades after cooler-than-expected CPI data

The Mexican Peso fades after Mexican inflation data for March deviates from economists' expectations.

Mexican Headline Inflation showed a 0.29% MoM rise according to data from the National Institute of Statistics and Geography of Mexico. This was lower than the 0.36% increase expected and higher than the 0.09% rise noted in February.

Core Inflation registered a rise of 0.44%, which was more muted than the 0.51% economists had forecast, but below the 0.49% increase in February.

The Mexican Peso weakened about a tenth of a percentage point against the US Dollar (USD) immediately after the release as it increases the probabilities that the Banco de Mexico (Banxico) will cut interest rates. Lower interest rates tend to reduce demand for a currency as they attract less foreign capital inflows.

The bank reduced interest rates from 11.25% to 11.00% at its March meeting after seeing a gradual decline in inflation, however, the meeting minutes made it clear that future decisions will be data-dependent, and that the overall outlook for inflation remains elevated.

Technical Analysis: USD/MXN quickens downtrend

USD/MXN has quickened the pace of its long-term downtrend. The trend started after the pair peaked at 25.76 in April 2020 – it has now fallen to the 16.20s. Since “the trend is your friend,” it is likely to extend.

The pair is probably unfolding a large three-wave Measured Move pattern. These are composed of an A, B, and C wave, with wave C extending to a similar length to wave A, or a Fibonacci 0.618 ratio of A.

USD/MXN Weekly Chart

If this is the case, price has almost reached the point at which C will equal A, calculated as lying at 15.89.

It has also by now surpassed the conservative target for the end of C at the 0.618 Fibonacci extension of A (at 18.24).

Once the pattern is complete the market usually reverses or undergoes a substantial correction.

The Relative Strength Index (RSI) is converging acutely with price – a sign the downtrend could be losing momentum. USD/MXN has pushed lower than the 2023 lows but RSI has not followed suit. This non-correlation is a bullish indication. It could lead to a correction higher eventually.

There has been no reaction from price yet, however, so the expectation of upside remains speculatory and unconfirmed.

(This story was corrected on April 9 at 10:39 GMT to say that the Mexican Peso has extended its uptrend to almost nine-year highs not lows).

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.