Mexican Peso slumps again on fears of ruling party dominance in Congress

Most recent article: Mexican Peso recovers after Finance Minister reassures markets

- Mexican Peso hits new yearly low of 18.19 during European session before retreating.

- Mexican finance minister reassures markets, emphasizes financial discipline and investment.

- US job openings hit three-year low, signaling economic slowdown alongside below-estimate Durable Goods Orders.

The Mexican Peso edges lower against the US Dollar for the second straight day on Tuesday, though it has trimmed some earlier losses after hitting a new yearly high of 18.19 during the European session. However, softer US jobs data and Mexican Finance Minister Rogelio Ramirez de la O's conference call tempered volatility in the exotic pair. The USD/MXN trades at 17.90, gaining 1.25%.

The Mexican currency has lost almost 5% during the last few days. Therefore, Mexico’s Finance Minister, Rogelio Ramirez de la O, held a conference call earlier during the North American session to calm the financial markets after the Peso depreciated more than 4% and the Mexican Stock Exchange plummeted more than 6%.

He said, “We want to confirm to international organizations and private investors that our project is based on financial discipline, abiding by the autonomy of the Bank of Mexico, adherence to the rule of law and facilitating national and foreign private investment,” according to El Financiero.

Ramirez de la O accepted Dr. Claudia Sheinbaum’s invitation to remain in charge of Mexico’s finances once President Andres Lopez finished his term on September 30.

Morena’s overwhelming victory in the general election sounded the alarms of possible constitutional reforms that could eliminate autonomous regulators and threaten Mexican democracy.

Once the election results are confirmed, Morena will have a two-thirds majority in both houses, which could lead to a change in the Mexican Constitution.

According to the Wall Street Journal, “The proposed initiatives include allowing for the direct election of judges, slimming down congress, and eliminating the autonomous election agency. It would also boost the government’s role in the energy sector.”

Goldman Sachs analyst Alberto Ramos said, “Some bills are perceived as leading to institutional erosion and weakening the current checks and balances, and several are not viewed as market-friendly.”

In addition, Mexico’s economic docket revealed that fixed investment slowed in March, according to the National Statistics Agency (INEGI).

Across the border, the US Bureau of Labor Statistics (BLS) revealed that job openings dropped to their lowest level in three years, as depicted by the JOLTS report. Other data shows the economy is slowing as April Durable Goods Orders missed estimates and ticked lower.

Daily digest market movers: Mexican Peso on defensive as selling pressure continues

- Gross Fixed Investment in Mexico increased from 0.7% to 0.8% MoM in March. On a yearly basis, it showed a deceleration, expanding by just 3%, down from 12.5%.

- September should be a crucial month for the Mexican Congress. Morena’s majority could push bills blocked by the opposition, including the reduction of lawmakers and plans for direct election of the Supreme Court members.

- Morgan Stanley noted that if Mexico’s upcoming government and Congress adopted an unorthodox agenda, it would undermine Mexican institutions and be bearish for the Mexican Peso, which could weaken to 19.20.

- Speculation of another Banxico rate cut in June could pave the way for further upside in the USD/MXN.

- US JOLTs Job Openings in April edged lower from 8.355 million to 8.059 million, below estimates of 8.34 million.

- US Durable Goods Orders increased 0.6% MoM in April, below estimates and the previous reading of 0.7%

- The futures markets suggest the Federal Reserve might cut rates by 35 basis points in 2024, according to the December 2024 fed funds future rate contract.

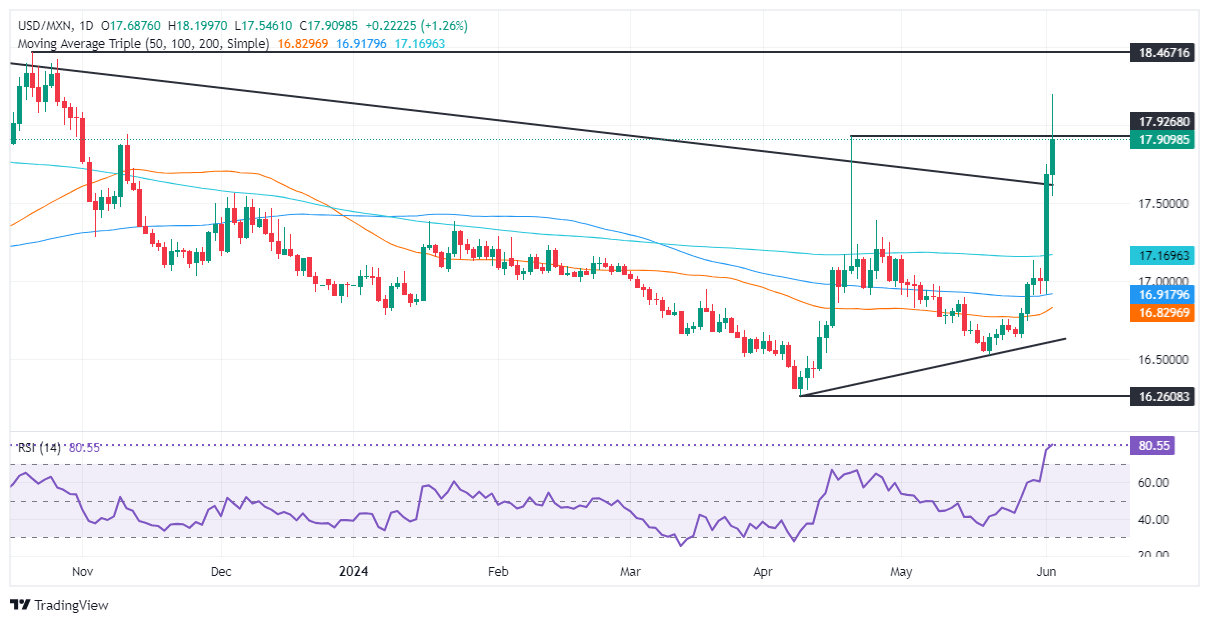

Technical analysis: Mexican Peso depreciates as USD/MXN rallies above 17.90

As mentioned on Monday, “The USD/MXN downtrend begins to be threatened due to political uncertainty.”

The pair has decisively broken above the 200-day Simple Moving Average (SMA) and continued to extend its gains. The pair hit 18.19 during the European session but recovered some ground during the North American session.

Even though the Relative Strength Index (RSI) is strongly overbought, momentum has shifted to the upside.

That said, if the USD/MXN clears the psychological 18.00 figure, up next would be the year-to-date (YTD) high of 18.15. Further gains are seen above the latter, on October 6, 2023, at a high of 18.48, before the exotic pair trends up toward the 19.00 figure.

On the downside, if sellers push the exchange rate below the 17.00 figure, that could pave the way to test the YTD low of 16.25.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.