Mexican Peso trades mixed into the weekend as data and events rock peers

- The Mexican Peso pares gains main from resilient Q3 GDP growth and nears the weekend mixed.

- Multiple risk factors weigh including the risk of Trump tariffs, Banxico interest-rate cuts and domestic political jitter.

- USD/MXN faces tough resistance just above the key 20.00 handle as bulls try to push higher.

The Mexican Peso (MXN) trades mixed across its key pairs on Friday impacted by data and market events for its peers. In the UK investors mulled the recent Budget from the new labor government which led to a rise in Gilt yields but a delayed sell-off in the Pound Sterling (GBP) before the currency recovered on Friday.

The Peso is marginally higher against the US Dollar (USD) after the release of US Nonfarm Payrolls (NFP) data showed only a 12K increase in October, which fell well below the 113K expected and the revised-down 223K of September. The lower payrolls figure increases the chances of the Fed implementing aggressive cuts to interest rates which is usually Dollar negative.

This was followed by US Institute of Supply Managers (ISM) Manufacturing Purchasing Manager Index (PMI) survey data, which showed a fall to 46.5 in October, from 47.2 in September and was below the 47.6 expected.

The ISM Manufacturing Prices Paid Index, meanwhile, registered a rise to 54.8 in October from 48.3 previously and was above the 48.5 forecast. The higher prices suggests inflationary pressures which could limit the extent of easing the Fed decides to implement and may have acted as an antidote to the NFP undershoot.

Mexican Peso strength could be capped by political risk factors

The Mexican Peso upside may be limited as fears persist that a victory for former president Donald Trump in the US presidential election will lead to increased tariffs on imported Mexican goods.

Concerns are easing, however, with the realization that Trump’s threats may be more rhetorical than realistic given how intertwined the two countries' supply chains are after three decades of free trade. Goods made in Mexico generally contain a substantial quantity of US or Canadian components and involve multiple border crossings to be manufactured, suggesting a trade war with Mexico would cause a self-inflicted wound on the US economy.

Mexico’s lawmakers tighten grip on power

A further potentially negative risk factor for the Peso comes in the form of moves by the Mexican legislature to limit the power of the Supreme Court to suspend or block its reforms, according to El Financiero.

The move risks reviving market concerns about the rule of law and balance of power in the country, impacting its ability to attract foreign investment. It follows the news recently that eight out of Mexico’s eleven Supreme Court judges handed in their resignations, effective from August 2025.

Banxico expected to still cut in November – Capital Economics

Mexico’s surprise growth in Q3 does not “preclude another rate cut in November” from the Bank of Mexico (Banxico), according to Kimberley Sperrfechter, Emerging Markets Economist at London-based advisory service Capital Economics.

If the Banxico was to go ahead with a 25 basis point (bps) (0.25%) cut to Mexico’s relatively high 10.50% key interest rate, it might put pressure on the Peso since lower interest rates attract less capital inflows.

“We still think the conditions are currently in place for Banxico to press ahead with another interest rate cut at its November meeting. But a lot will depend on the outcome of the US election. A Trump victory – and higher US Treasury yields and a stronger Dollar – would probably prompt Banxico to halt,” added Sperrfechter in the note.

According to Christian Borjon Valencia, an analyst at FXStreet, “Money market futures hint that the Bank of Mexico (Banxico) is expected to cut rates between 175 to 200 basis points over the next 12 months.”

Data out on Friday includes Mexican Business Confidence for October, the Unemployment Rate for September, and the S&P Manufacturing PMI for October.

Technical Analysis: USD/MXN faces tough resistance in the 20.00 zone

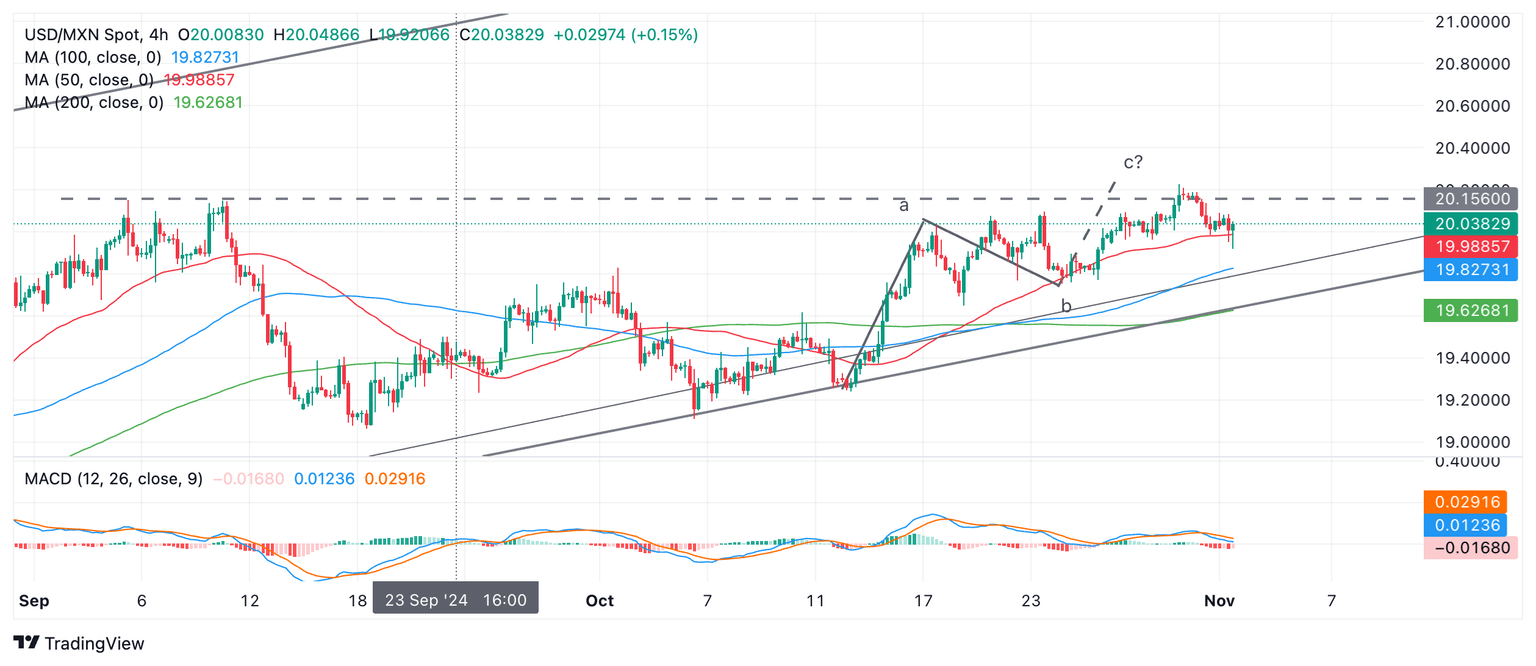

USD/MXN seems to have stalled and retreated after stretching a foreshortened “c wave” higher of a bullish “abc” pattern, which began at the October 14 swing low.

Whilst it is still possible wave c could reach its minimum upside target at 20.29 – the Fibonacci 61.8% extension of the length of wave “a” – resistance in the 20.00 region is making lives difficult for bulls.

USD/MXN 4-hour Chart

USD/MXN is probably still in an uptrend on a short, medium and long-term basis and it is trading in a rising channel. Given the technical dictum “the trend is your friend,” the odds favor a continuation higher. Thus, a resumption higher is still possible.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Last release: Fri Nov 01, 2024 12:30

Frequency: Monthly

Actual: 12K

Consensus: 113K

Previous: 254K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.