Mexican Peso rallies to two-day high as US inflation frenzy dissipates

Most recent article: Mexican Peso prints back-to-back positive weeks against US Dollar, stays below 17.00

- Mexican Peso remains on the defensive after Mexico’s Industrial Production figures disappointed investors.

- US inflation exceeds forecasts, impacting speculation of dovish US Federal Reserve.

- USD/MXN is volatile in the session as traders digest recent economic data released on both sides of the border.

The Mexican Peso (MXN) erases its losses against the US Dollar (USD) on Thursday following a hotter-than-expected inflation report in the United States. Bets that the US Federal would cut rates in March remained largely unchanged at around 61.4%, though the Mexican currency is gaining traction on Thursday. The USD/MXN posts losses of 0.34% and trades at 16.91 after hitting a four-day high of 17.07.

Mexico’s economic docket featured Industrial Production that missed the mark set by economists, a headwind for the Peso. The US Bureau of Labor Statistics (BLS) revealed that US inflation in December rose above the mark, which could prevent the Fed from easing policy. At the same time, unemployment claims for the last week were lower than expected, indicating the labor market is softening.

Daily digest market movers: Mexican Peso took a toll on weak Mexican data and strong US inflation

- Industrial Production in Mexico plunged -1.5% MoM in November, worse than the -0.2% estimated. The annual figure slumped -3.1%, its lowest reading since August.

- The December US Consumer Price Index (CPI) rose b y 3.4% YoY, above forecasts and November’s 3.1%. Core CPI climbed 3.9% YoY, lower than the 4% achieved in the previous reading but higher than the 3.8% projected by the consensus.

- Initial Jobless Claims for the week ending January 6 rose by 202K, less the previous week's 203K and forecasts of 210K.

- Given the fact that Industrial Production plunged in Mexico, the scenario of the country is becoming uncertain, which could weigh on the Mexican Peso. Even though Gross Fixed Investment climbed, other key economic indicators like inflation edging up and an economic slowdown pose challenges that could prevent the economic growth foreseen by analysts.

- On Wednesday, the World Bank revised its economic projections for Mexico in 2024. The updated forecast anticipates that Mexico's Gross Domestic Product (GDP) will grow by 2.6%, an increase from the bank’s initial prediction of 1.9%. Analysts at the bank attribute this expected growth to the rise in near-shoring activities, which they believe will positively impact the Mexican economy.

- Although the recent meeting minutes from Banxico (the Central Bank of Mexico) suggest that the central bank might contemplate easing its monetary policy, the inflation report for December could hinder any move toward policy relaxation.

- On Tuesday, Mexico's Consumer Price Index (CPI) recorded a YoY increase of 4.66% in December, surpassing the expected 4.55%. This is a significant jump from November's figure of 4.32%.

- Core inflation figures, which exclude volatile items like food and energy, showed a YoY increase of 5.09%, which was slightly lower than the consensus and the previous month's figures of 5.15% and 5.30%, respectively.

- On January 5, a Reuters Poll suggested the Mexican Peso could weaken 5.4% to 18.00 per US Dollar in the 12 months following December.

- Last week’s Federal Reserve officials expressed that interest rates should remain at current levels. Fed’s Bostic emphasized that policy needs to stay tight, while Fed’s Bowman added that policy is sufficiently restrictive.

- Upcoming ahead, USD/MXN traders are eyeing Friday's US Producer Price Index (PPI) report, which is expected to rise modestly.

- The US economy continues to paint a mixed economic outlook as the latest US jobs data was mixed, while business activity in manufacturing contracted and the service sector deteriorated. Although a soft-landing scenario looms, the chance of a mild recession has increased, so caution is warranted.

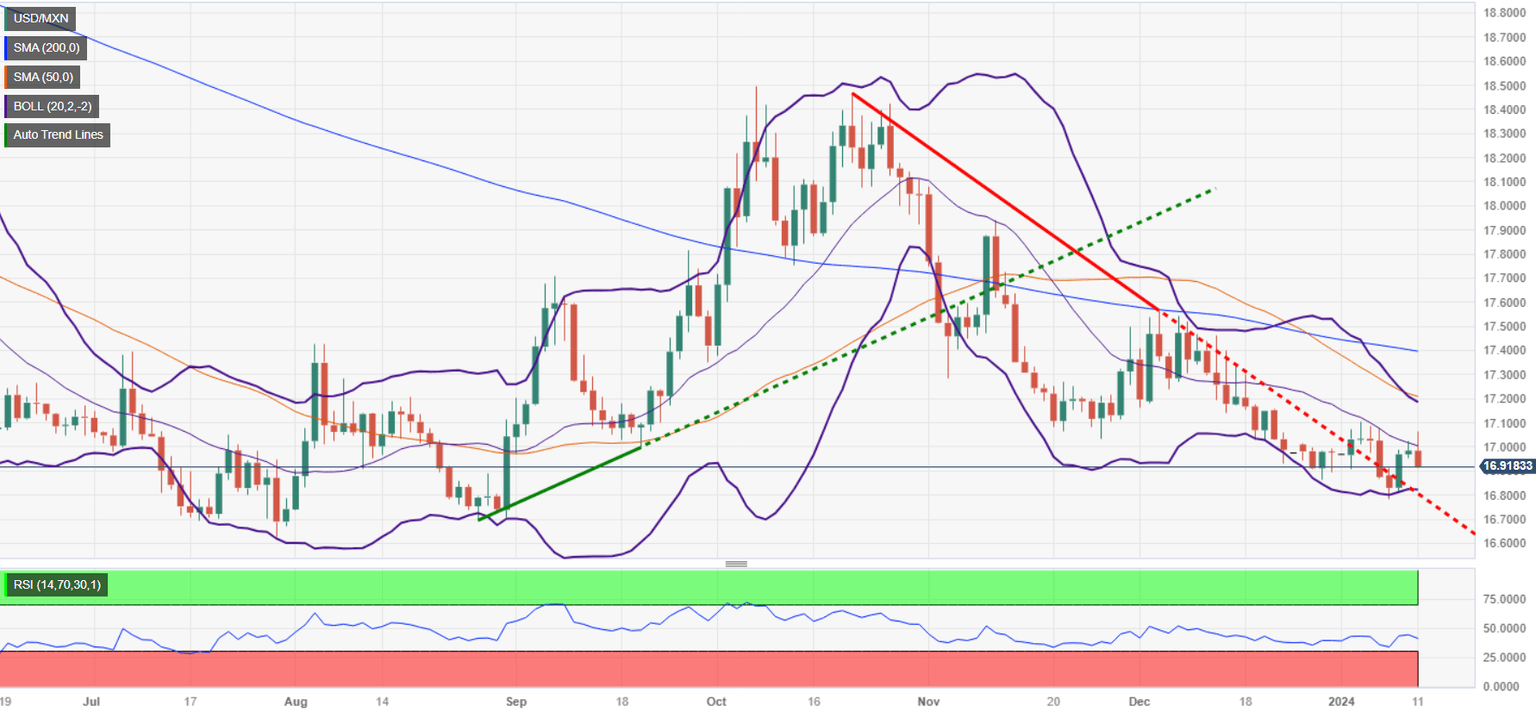

Technical analysis: Mexican Peso trims some of its losses as USD/MXN slides below 17.00

The USD/MXN is bearishly biased even though it hit a new weekly high of 17.04, but the exchange rate has fallen below the 17.00 figure even though the Greenback continues to trade higher as shown by the US Dollar Index (DXY).

If buyers fail to lift the exotic pair above the 17.00 figure and achieve a daily close, that would pave the way for further losses. The first key support level would be the January 10 daily low of 16.92, followed by the latest cycle low of 16.78. Further downside is seen at last year’s low of 16.62.

Conversely, if buyers keep the USD/MXN exchange rate above 17.00, that could pave the way to test the 17.20 mark, followed by the 50-day Simple Moving Average (SMA) at 17.22, ahead of challenging the confluence of the 100 and 200-day SMAs at around 17.40.

USD/MXN Price Action – Daily Chart

Risk sentiment FAQs

What do the terms"risk-on" and "risk-off" mean when referring to sentiment in financial markets?

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

What are the key assets to track to understand risk sentiment dynamics?

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

Which currencies strengthen when sentiment is "risk-on"?

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

Which currencies strengthen when sentiment is "risk-off"?

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.