Mexican Peso sinks due to US election woes, Mexico’s judicial reform

- Mexican Peso falls to a six-week low as former President Trump leads US election polls, threatening a 200% tariff on Mexican cars.

- Fears of a constitutional crisis in Mexico intensify after President Sheinbaum defies a court ruling to remove a judicial reform decree.

- Investors shift focus to upcoming economic data from both Mexico and the US with Retail Sales and inflation figures in the spotlight.

The Mexican Peso plunges more than 0.50% against the US Dollar amid a risk-off impulse and increasing odds that former President Donald Trump leads the polls. Rising fears of a constitutional crisis in Mexico weighed on the emerging market currency, which extended its fall to a six-week low. At the time of writing, the USD/MXN trades at 19.95 after bouncing off a daily low of 19.82.

Financial markets' focus has shifted toward the US election. Traders are putting aside Q3 earnings until the election passes. Recently published polls suggest the race is tightening, and former President Donald Trump looks more capable of winning the presidential election on November 5. Last week, he said he would impose a 200% tax on Mexican-made cars. Such a move has weighed on the Mexican currency, which is about to hit three-month lows.

On the Mexican front, last Thursday the 19th District Court based in Coatzacoalcos, Veracruz, and led by Judge Nancy Juarez Salas, granted a definitive suspension, ordering Mexican President Claudia Sheinbaum and the director of el Diario Oficial de la Federacion (the Government’s official gazette) Alejandro Lopez Gonzalez to remove the decree that validates the judicial reform from the official gazette.

In response, President Sheinbaum said that the judge is “not above” the country and declared, “We are not going to lower the publication,” adding that they will file a complaint with the Federal Judicial Council.

As of writing, the decree hasn’t been removed from the Mexican official gazette, which has sparked fears of a probable constitutional crisis.

Meanwhile, an absent economic docket on both sides of the border keeps investors digesting China’s stimulus to boost the economy. China’s central bank, the People’s Bank of China (PBoC), lowered rates for the one and five-year Loan Prime Rate (LPR). Trump announced on the campaign trail that he would impose tariffs on the country if China invades Taiwan.

Meanwhile, Dallas Fed President Lorie Logan commented that money markets are close to or just above interest on reserves rate. She favors a gradual approach to easing policy if the economy meets forecasts.

Mexico’s economic schedule will be slightly busy ahead of the week with the release of the Economic Activity indicator, Retail Sales, and Mid-Month Inflation for October.

On the US front, Fed speakers, jobs data and S&P Global Flash PMIs should influence the USD/MXN direction.

Daily digest market movers: Mexican Peso on the defensive ahead of crucial data

- Mexico’s Economic Activity is expected to slow from 3.8% to 0.9%.

- October Mid-Month Inflation is expected to drop from 3.95% to 3.83%, and underlying inflation is expected to fall from 4.66% to 4.63%.

- The International Monetary Fund (IMF) projected the Mexican economy to grow 1.5% in 2024, lower than in its previous forecast. The IMF estimates a deeper economic slowdown for the next year, estimating 1.3% GDP growth, and forecasts inflation to hit Banxico’s 3% goal in 2025.

- The IMF said that a recent judicial reform creates "important uncertainties about the effectiveness of contract enforcement and the predictability of the rule of law."

- US Initial Jobless Claims for the week ending October 19 are foreseen rising from 241K to 247K.

- US business activity for October is expected to edge up in the manufacturing sector, according to S&P Global. Services PMI is foreseen dipping from 55.2 to 55.

- Data from the Chicago Board of Trade, via the December Fed funds rate futures contract, shows investors estimate 46 bps of Fed easing by the end of the year. This is somewhat lower than a week ago.

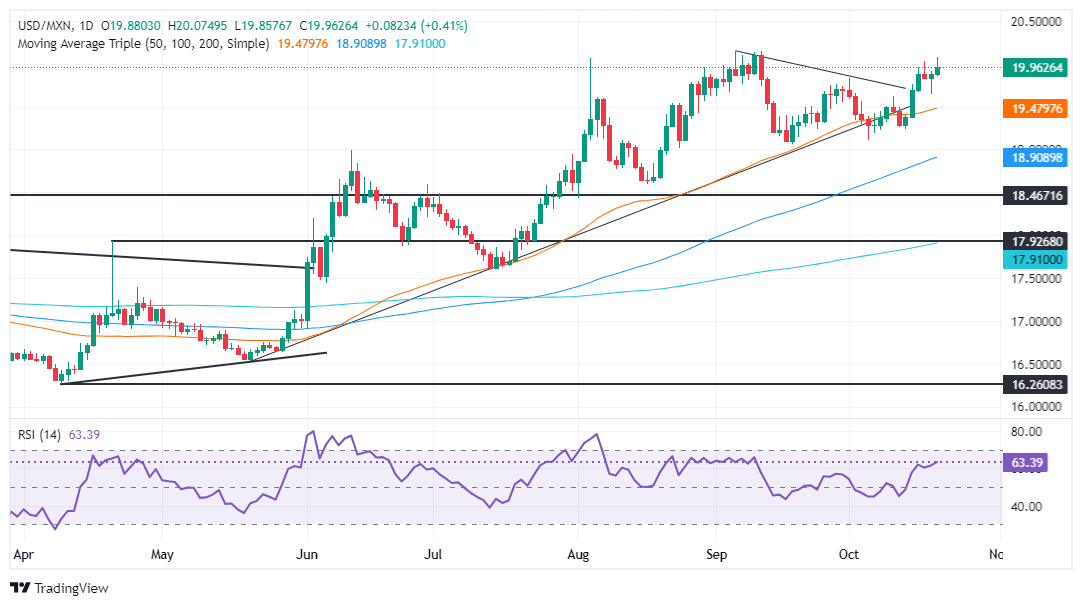

USD/MXN technical outlook: Mexican Peso dives as USD/MXN climbs above 19.90

The USD/MXN exotic pair is upwardly biased, and it could test the year-to-date (YTD) high at 20.22 in the near term. Momentum remains bullish, as the Relative Strength Index (RSI) portrays.

If USD/MXN clears the September 5 high at 20.14, the next resistance would be the YTD high at 20.22. On further strength, the next stop would be 20.50, followed by the 21.00 figure.

Conversely, if the USD/MXN tumbles below 20, the next support would be an October 18 low of 19.64. A breach of the latter will expose the October 10 daily peak at 19.61, followed by the October 4 swing low of 19.10 before testing 19.00.

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.