Mexican Peso seesaws between gains and losses ahead of Banxico meeting

- The Mexican Peso seesaws between gains and losses ahead of the Bank of Mexico May meeting.

- Data showed core Mexican inflation eased on a monthly basis in April, and undershoot estimates, headline however marginally beat estimates.

- USD/MXN continues bumping along the bottom of a short-term range.

The Mexican Peso (MXN) seesaws between tepid gains and losses on Thursday after the release of key inflation data and ahead of the Bank of Mexico (Banxico) policy meeting, scheduled for later in the day.

Mexican Core Inflation in April rose 0.21% month-over-month, falling short of estimates of 0.24% and well below the previous month's 0.44% rise, according to data from INEGI. Headline Inflation, meanwhile, eased to 0.20% which was slightly higher than the 0.19% forecast but lower than the 0.29% of the previous month.

Although the fall in Core Inflation may marginally increase the chances of Banxico cutting interest rates, the overall consensus from the analyst community remains that Banxico will leave interest rates unchanged at 11.00%, after cutting 0.25% it in March. Lower interest rates are negative for a currency whilst higher rates are positive as they attract more foreign capital inflows.

USD/MXN is exchanging hands at 16.91, EUR/MXN at 18.20 and GBP/MXN at 21.14, at the time of publication.

Mexican Peso trades mixed ahead of Banxico meeting

Banxico cut interest rates from 11.25% to 11.00% at its previous meeting in March but said further rate cuts would be data dependent. In the time since, neither inflation nor growth have shown any further substantial declines – in fact growth in Q1 was slightly higher-than-expected.

In addition, Deputy Banxico Governor Jonathan Heath said in April that the central bank would probably hit pause on cutting interest rates in May due to strong Q1 growth.

Commerzbank does not expect Banxico to cut interest rates but sees a possibility it may revise up its exceedingly low inflation forecasts for the second half of 2024, which appear “optimistic” given the data so far. That said, its forecasts for Q1 were accurate.

“..the question of whether there will be a pronounced cycle of rate cuts is more likely to depend on whether inflation will continue to follow Banxico's forecast in the coming quarters. This is because it expects the year-on-year rate to fall quite significantly in the coming quarters; for example, the core rate is expected to average only 3.5% year-on-year in the fourth quarter (compared to 4.57% in March),” says Commerzbank FX Analyst Michael Pfister.

Overall, a slowdown in economic growth is likely to be the main driver for Banxico eventually cutting interest rates, according to Commerzbank.

“To sum up, inflation argues against significant rate cuts, but slowing growth suggests that a slight correction in rates is likely - especially if Banxico revises downward its rather optimistic growth forecast of 2.8% for this year on Thursday,” says Pfister.

Banxico to hold – Wells Fargo

Wells Fargo also expects Banxico to leave interest rates unchanged.

It points out that inflation has not really shifted lower since the March meeting, and “..services inflation remains elevated, edging up to 5.37%. Meanwhile, stubborn U.S. inflation has seen the expected timing for Fed easing pushed back over the past several weeks.”

“Considering still-elevated domestic inflation, an initial Fed rate cut that is likely still several months away, and some sensitivity to the possibility of a weaker Mexican currency, we believe Banxico policymakers will opt to hold their policy rate steady at 11.00% next week,” Wells Fargo concludes.

Technical Analysis: USD/MXN on the floor of short-term range

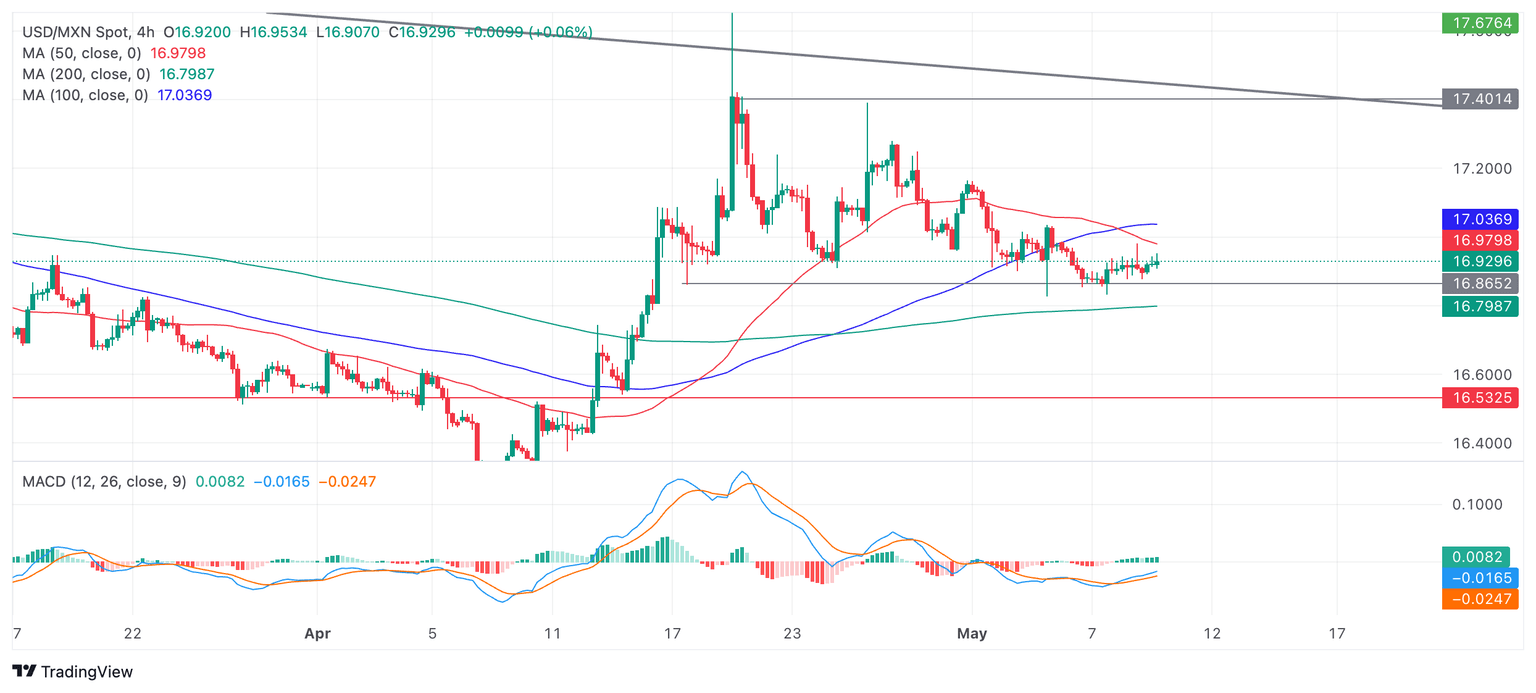

USD/MXN – the cost of one US Dollar in Mexican Pesos – continues to bump along the bottom of a short-term range, with a floor at 16.86 and a ceiling at 17.40.

USD/MXN 4-hour Chart

The short-term trend is sideways, and given the old adage that the “trend is your friend”, it is expected to continue, suggesting the next move may be an oscillation higher.

The Moving Average Convergence Divergence (MACD) momentum indicator has crossed above its signal line, suggesting an increased chance of an up move evolving. The signal is enhanced by the fact that the MACD is more reliable in sideways trending markets.

A rise up within the range could take the USD/MXN to the 50 Simple Moving Average (SMA) on the 4-hour chart at 16.97, followed by the lower high at 17.15. A clear break above the zone of resistance around 17.15-17.18 might see further gains up towards the range highs again.

A decisive breakout of the range – either below the floor at 16.86, or the ceiling at 17.40 – would change the directional bias of the pair.

Given the overall bearish backdrop in the medium and long-term, odds favor a breakdown from the range.

A break below the range floor could see further downside to a target at 16.50, followed by the April 9 low at 16.26.

On the other side, a break above the top would activate an upside target first at 17.67, piercing a long-term trendline and then possibly reaching a further target at around 18.15.

A decisive break would be one characterized by a longer-than-average green or red daily candlestick that pierces above or below the range high or low, and that closes near its high or low for the period; or three green/red candlesticks in a row that pierce above/below the respective levels.

Economic Indicator

Central Bank Interest Rate

The Bank of Mexico announces a key interest rate which affects the whole range of interest rates set by commercial banks, building societies and other institutions for their own savers and borrowers. Generally speaking, if the central bank is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive, or bullish, for the Mexican Peso.

Read more.Next release: Thu May 09, 2024 19:00

Frequency: Irregular

Consensus: 11%

Previous: 11%

Source: Banxico

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.