Mexican Peso depreciates ahead of Banxico meeting

- The Mexican Peso drifts lower on the eve of the Bank of Mexico policy meeting.

- The overwhelming majority of economists don’t expect the Banxico to cut interest rates.

- USD/MXN forms a bullish two-bar reversal pattern and could correct higher.

The Mexican Peso (MXN) falls in its most traded pairs on Wednesday ahead of the key event on the radar for the Peso: the Bank of Mexico (Banxico) monetary policy meeting on Thursday.

At the time of writing, one US Dollar (USD) buys 18.19 Mexican Pesos, EUR/MXN is trading at 19.44, and GBP/MXN at 23.00.

Mexican Peso eases ahead of Banxico meeting

The Mexican Peso eases ahead of the Banxico policy meeting on Thursday, although the overwhelming majority of economists expect the central bank to maintain its policy interest rate at its current 11.00% level.

The high interest-rate differential between Mexico and most major economies is advantageous for the Mexican Peso as it attracts greater capital inflows. Deciding not to cut interest rates, therefore, would be considered bullish for the Peso.

According to a Bloomberg survey of economists, 23 of the 25 expect Banxico to hold tight. A recent survey by Mexican lender Citibanamex showed most respondents also expected Banxico to leave rates unchanged at 11.00% at the June meeting – although they did expect a cut in August.

"Banco de Mexico meets Thursday and is expected to keep rates steady at 11.0%,” Dr. Win Thin, Global Head of Markets Strategy at Brown Brothers Harriman (BBH), said in a note on Tuesday. “Recent weakness in MXN is an upside risk to inflation and will keep the bank cautious. The swaps curve has adjusted higher since the May meeting and is pricing in only 75 bp of easing over the next 12 months vs. 125 bp at the start of May,” he added.

Rabobank’s Senior Strategist Christian Lawrence had expected Banxico to cut interest rates by 0.25% at the June meeting. However, he changed his opinion in light of the sharp devaluation of the Mexican Peso since the election, which “has acted as a de facto cut,” says Lawrence.

Economists at Standard Chartered see imported inflation from the post-election depreciation in the Mexican Peso as preventing Banxico from pressing the trigger on rate cuts, supporting the Peso in the process.

“We now expect Banco de México (Banxico) to stay on hold instead of cutting by 25bps at its 27 June meeting, amid sharp currency depreciation driven by elevated political noise and fiscal uncertainty,” says the bank.

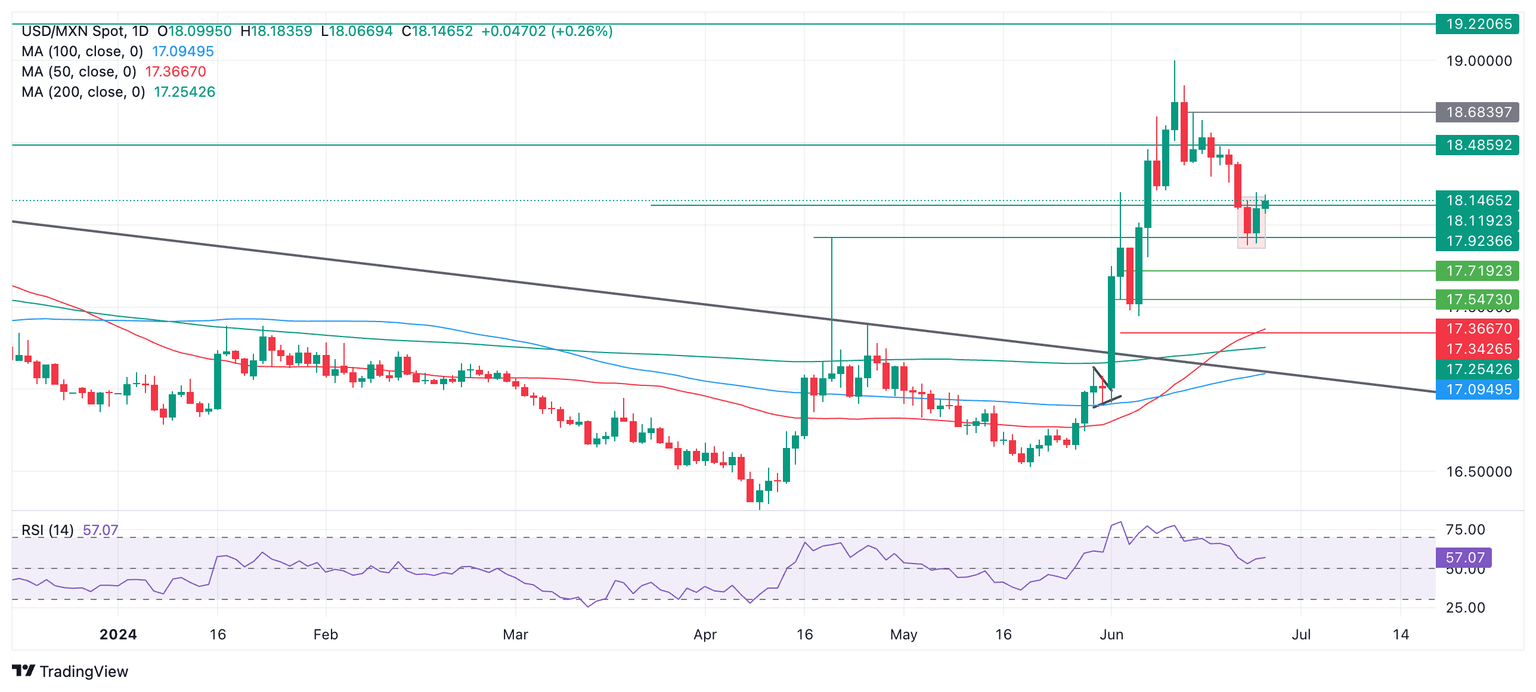

Technical Analysis: Two-bar reversal could signal recovery for USD/MXN

USD/MXN forms a two-bar reversal pattern (shaded rectangle in the chart below) which is a fairly reliable indicator of a short-term reversal in the trend.

If Wednesday ends as a green day, it will enhance the signal from the two-bar reversal and suggest a continuation higher, although the distance such a corrective move might go is indeterminate.

USD/MXN Daily Chart

One possible level USD/MXN could rally up to is the June 18 low at 18.30.

At the same time, the short-term trend remains bearish, leaving the pair at risk of a recapitulation lower.

A break below 17.87 (June 24 low) would invalidate the two-bar pattern and probably result in a continuation of the short-term downtrend to a target at 17.71 (a low made in the 4-hour chart on June 4), followed by 17.54 if stronger, the June 4 swing low.

The direction of the long and intermediate-term trends remains in doubt.

Economic Indicator

Central Bank Interest Rate

The Bank of Mexico announces a key interest rate which affects the whole range of interest rates set by commercial banks, building societies and other institutions for their own savers and borrowers. Generally speaking, if the central bank is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive, or bullish, for the Mexican Peso.

Read more.Next release: Thu Jun 27, 2024 19:00

Frequency: Irregular

Consensus: 11%

Previous: 11%

Source: Banxico

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.