Mexican Peso appreciates Banxico member’s hawkish comments

- Mexican Peso gains traction on Wednesday, sponsored by Banxico Deputy Governor comments.

- Jonathan Heath wants higher rates for some time, disregarding a recession.

- President Sheinbaum has pledged to be fiscally responsible.

The Mexican Peso climbed for the second straight day on Wednesday against the US Dollar following hawkish comments of Bank of Mexico (Banxico) Deputy Governor Jonathan Heath, who voted against lowering rates by 25 basis points at the September 26 monetary policy meeting. The USD/MXN trades at 19.37, down by 1.18%.

Heath appeared on Banorte’s podcast and said that policy should remain at the current level for “more time” while acknowledging that core inflation is coming toward the target. He added that the US Federal Reserve’s (Fed) rate cut wouldn’t directly impact Banxico’s policy path and does not believe Mexico is close to a recession.

Mexico’s docket revealed that Business Confidence deteriorated in September, while July's Gross Fixed Investment figures improved in monthly and annual terms.

In addition, President Claudia Sheinbaum began her six-year term. In her inaugural speech, she reassured investors that their investments were secure and added that she would respect Banxico’s autonomy to dictate its policies.

Sheinbaum pledged fiscal responsibility and defended the judiciary reform approved in September. According to foreign analysts and investors, this reform threatens the rule of law, and that sentiment has injured the Peso in recent months.

“Disciplined management of the budget and of state-owned enterprises, progress on public security, and safeguarding the integrity of key institutions will be key to preserving market sentiment and sovereign debt ratings,” said Alberto Ramos, head of Goldman Sachs Latina America economic research team.

In the US, ADP National Employment Change data for September exceeded estimates after registering five months of soft readings.

Daily digest market movers: Mexican Peso ignores mixed data to advance

- Mexico’s Business Confidence in September rose by 51.9, lower than August’s 53.1, its lowest reading since January 2023.

- Gross Fixed Investment in July expanded by 1.8% MoM, up from -1% contraction the previous month. From 12 months to July, it recovered from a 1.3% shrinkage and climbed 6.4%.

- Mexico’s business activity in the manufacturing sector contracted, according to S&P Global. The September Manufacturing PMI dipped from 48.50 to 47.30, highlighting the ongoing economic slowdown.

- ADP National Employment Change in September came in at 143K, up from the upwardly revised 103K the previous month and exceeding forecasts of 120K.

- According to the swaps markets, Banxico is expected to lower borrowing costs by 175 bps by the end of 2025.

- Market participants have put the odds of a 25 bps cut at 63.8%. According to the CME FedWatch Tool, the chances for a larger 50 bps cut diminished to 36.2%.

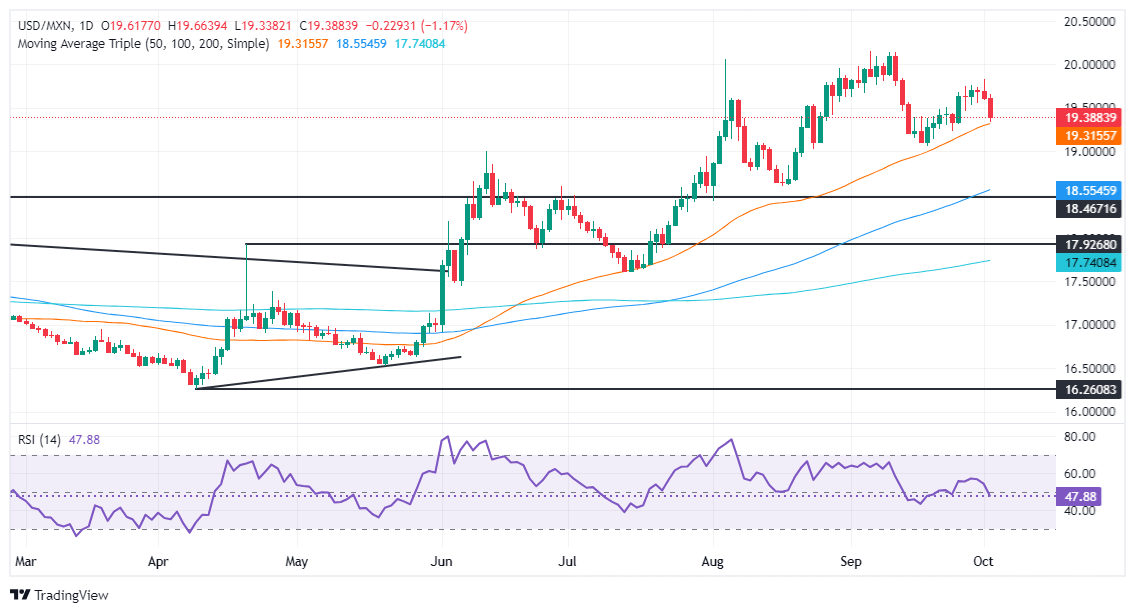

Technical analysis: Mexican Peso rallies as USD/MXN drops below 19.40

The USD/MXN uptrend remains in place, but the ongoing pullback would likely test the 50-day Simple Moving Average (SMA) at 19.30. According to the Relative Strength Index (RSI), momentum has shifted negatively.

The RSI plunging below its neutral line and indicates that sellers are in charge.

If USD/MXN clears the 50-day SMA, the next support would be the September 24 swing low of 19.23 before the pair moves toward the September 18 daily low of 19.06. Once those levels are surpassed, the 19.00 figure emerges as the following line of defense.

On the other hand, if USD/MXN clears 19.50, this could sponsor a test of the current week’s peak at 19.82. On further strength, the next resistance will be the psychological 20.00 figure, followed by the YTD high peak of 20.22.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.