Mexican Peso finishes Friday’s strong, but weak on the week

Most recent article: Mexican Peso dives in anticipation of Mexico’s GDP report

- Mexican Peso strengthens for third day, bolstered by strong trade balance and weak US PCE figures.

- Mexico's sizable December trade surplus and robust job market underscore economic strength amid global uncertainty.

- US Fed's core PCE index falling below 3% fuels May rate cut expectations, benefiting emerging currencies like MXN.

The Mexican Peso (MXN finished Friday’s session with a solid gains day versus the US Dollar (USD) after data from Mexico suggested the Trade Balance expanded more than expected, while inflation data in the United States (US) was softer. That has kept the odds of a rate cut by the US Federal Reserve (Fed) high, while capping the Greenback (USD), pressured as the interest rate differential would likely support the emerging market currency. The USD/MXN trades at 17.16, down 0.23% on the day., though finished up 0.53%.

The National Statistics Agency (INEGI) in Mexico revealed the country posted a surplus in December. That data and strong labor market data revealed on Thursday portray the economy's strength bolstered by the prospects of nearshoring.

In the meantime, the Fed’s preferred gauge for inflation, the Personal Consumption Expenditures (PCE) Price Index, was unchanged, though the core annualized figure dipped below the 3% threshold, a sign that the restrictiveness of policy is driving prices down. That said, investors seem convinced that the Fed will cut rates in May by 25 basis points (bps), according to the CME FedWatch Tool.

Daily Digest Market Movers: Mexican Peso continues to recover and trim weekly losses

- Mexico’s Trade Balance clocked a surplus in December of $4.242 billion, exceeding the previous reading and forecasts of $1.4 billion.

- During the last week, economic data from Mexico witnessed mixed readings in the mid-month inflation report, with headlines exceeding forecasts and the core Consumer Price Index (CPI) slipping below the 5% threshold. That could prevent the Bank of Mexico (Banxico) from cutting rates in the first quarter of 2024, even though two of its members expressed interest in December.

- Mexico’s Economic Activity shrank in November, while annual figures slid from 4.2% to 2.3%, less than forecast.

- The labor market in Mexico remains strong as the Unemployment Rate dropped from 2.7% to 2.6%.

- The economy in Mexico is beginning to show the impact of high rates set by Banxico at 11.25%, even though most analysts estimate the economy will grow above 2% in 2024. Nevertheless, retail sales missing estimates, the economy growing below 3% in November and inflation reaccelerating puts a stagflationary scenario in play.

- On January 5, a Reuters poll suggested the Mexican Peso could weaken 5.4% to 18.00 per US Dollar in the 12 months following December.

- Across the border, on Friday, the US PCE rose 2.6% in the 12 months to December, unchanged and as expected, while core PCE dipped from 3.2% to 2.9% and below forecasts.

- Latest data in the United States (US) suggests the economy remains robust and resilient after growing 3.3% in Q4 of 2023, exceeding estimates of 2%, while expanding 2.5% for the full year.

- Nevertheless, mixed readings in other data suggest that risks have become more balanced. That is reflected by investors speculating that the Fed will cut rates by 139 basis points during 2024, according to the Chicago Board of Trade (CBOT) data.

- The US Department of Commerce announced that Durable Goods Orders in December remained stagnant, recording a 0% change. This is a notable decrease from the 5.5% increase seen in November, primarily due to a downturn in transportation equipment manufacturing.

- The US Bureau of Labor Statistics disclosed that Initial Jobless Claims for the week ending January 20 increased to 214K, exceeding both the figures from the previous week and the anticipated 200K.

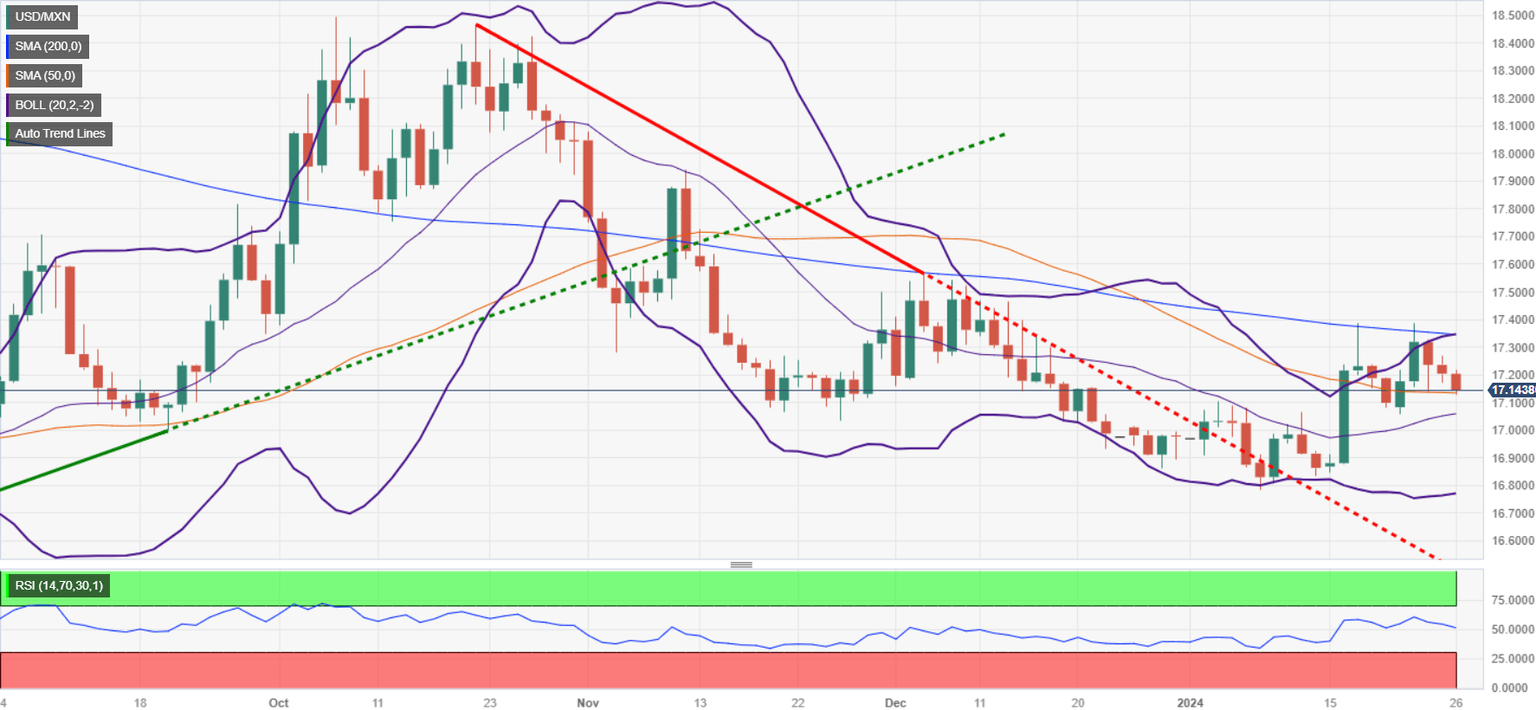

Technical Analysis: Mexican Peso gains traction as USD/MXN slumps below 17.15

The USD/MXN has accelerated to the downside after printing losses for three straight days, but it continues to exchange hands above strong support from the 50-day Simple Moving Average (SMA) at 17.13. A breach of the latter will expose the January 22 low, followed by the 17.00 psychological figure.

On the flip side, if buyers reclaim the next resistance level at the 200-day SMA at 17.34, that could open the door to challenge the 100-day SMA at 17.41. Further upside is seen above the psychological 17.50 figure, ahead of rallying to the May 23 high from last year at 17.99.

USD/MXN Price Action – Daily Chart

Central banks FAQs

What does a central bank do?

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

What does a central bank do when inflation undershoots or overshoots its projected target?

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

Who decides on monetary policy and interest rates?

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Is there a president or head of a central bank?

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.