- META swings to 20% gain after Q4 earnings beat on Friday.

- Meta Platforms raised its Q1 guidance range to as much as $37 billion.

- US Nonfarm Payrolls come in hot for January, reducing chance of March rate cut.

- Mark Zuckerberg introduces $50 billion buyback policy, $0.50 quarterly dividend.

Meta Platforms (META) stock closed up 20.3% on Friday, one penny shy of $475. The mega cap social media giant saw its stock bounce like a small-cap after it posted a surge of advertising revenue for Q4 and announced a new dividend on top of a $50 billion buyback scheme.

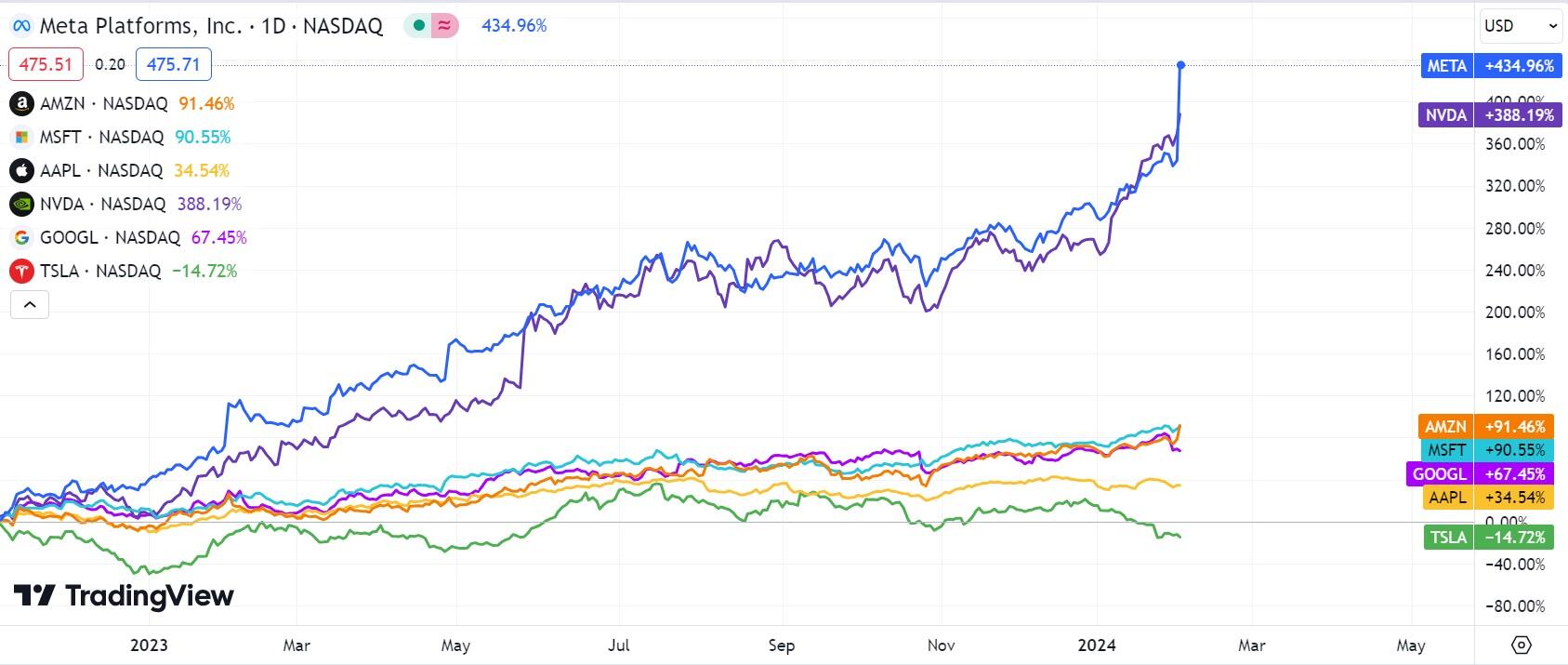

Meta is now far and away the best-performing of the Magnificent Seven tech stocks since it bottomed out on November 3, 2022. With CEO Mark Zuckerberg’s triumph of a fourth-quarter earnings release late Thursday, the stock has soared as much as 22% on Friday, and shares of META have gained 435% since its nadir 15 months ago. That performance even surpasses Nvidia (NVDA), which until now has been in a league of its own.

The wider market was a lot less sanguine on Friday morning due to a red-hot Nonfarm Payrolls (NFP) report for January. The US Bureau of Labor Statistics reported that the US economy added 353K jobs on a seasonally-adjusted basis, which far surpassed the 180K figure that was expected by economists.

The Russell 2000, and especially the Dow Jones, reacted poorly to the tight jobs market in Friday’s morning session as it reduced expectations that the Federal Reserve (Fed) will begin cutting interest rates in March. However, most equity indices, including the S&P 500 and NASDAQ Composite, blasted higher later in the day due to rallies from Meta Platforms and Amazon (AMZN). The S&P 500 gained 1.07%, while the NASDAQ Composite has gained 1.74%.

Meta Platforms becomes the most magnificent of all the cowboys

CEO Mark Zuckerberg couldn’t have dreamed of a better quarter for the social media titan. The owner of Facebook, Instagram and Whatsapp, Meta Platform’s advertising segment, which bankrolls the entire firm, brought in $38.7 billion, up 24% compared to a year ago.

Meta produced GAAP earnings per share (EPS) of $5.33 in Q4, which beat Wall Street consensus by $0.39. Revenue of $40.1 billion beat analyst expectations by $940 million.

Daily active users across Meta's Family of Apps rose 8% YoY to 3.19 billion in December, while monthly active users in December rose 6% to 3.98 billion.

META stock blasted off to the extent it did, however, based mostly on its guidance for the current quarter or Q1 2024. Management said they were now expecting revenue between $34.5 billion to $37 billion, which put the floor of the range above prior consensus of $33.87 billion.

Meta Platforms introduced its first quarterly dividend of $0.50 per share, which added to shareholder appreciation and demonstrated that management was confident in its balance sheet. Additionally, the company pushed its share repurchase allowance up by $50 billion. These two announcements have resulted in Meta now looking much more shareholder friendly than in previous years where the directors focused entirely on investment and growth.

Nasdaq FAQs

What is the Nasdaq?

The Nasdaq is a stock exchange based in the US that started out life as an electronic stock quotation machine. At first, the Nasdaq only provided quotations for over-the-counter (OTC) stocks but later it became an exchange too. By 1991, the Nasdaq had grown to account for 46% of the entire US securities’ market. In 1998, it became the first stock exchange in the US to provide online trading. The Nasdaq also produces several indices, the most comprehensive of which is the Nasdaq Composite representing all 2,500-plus stocks on the Nasdaq, and the Nasdaq 100.

What is the Nasdaq 100?

The Nasdaq 100 is a large-cap index made up of 100 non-financial companies from the Nasdaq stock exchange. Although it only includes a fraction of the thousands of stocks in the Nasdaq, it accounts for over 90% of the movement. The influence of each company on the index is market-cap weighted. The Nasdaq 100 includes companies with a significant focus on technology although it also encompasses companies from other industries and from outside the US. The average annual return of the Nasdaq 100 has been 17.23% since 1986.

How can I trade the Nasdaq 100?

There are a number of ways to trade the Nasdaq 100. Most retail brokers and spread betting platforms offer bets using Contracts for Difference (CFD). For longer-term investors, Exchange-Traded Funds (ETFs) trade like shares that mimic the movement of the index without the investor needing to buy all 100 constituent companies. An example ETF is the Invesco QQQ Trust (QQQ). Nasdaq 100 futures contracts allow traders to speculate on the future direction of the index. Options provide the right, but not the obligation, to buy or sell the Nasdaq 100 at a specific price (strike price) in the future.

What Factors Drive the Nasdaq 100

Many different factors drive the Nasdaq 100 but mainly it is the aggregate performance of the component companies revealed in their quarterly and annual company earnings reports. US and global macroeconomic data also contributes as it impacts on investor sentiment, which if positive drives gains. The level of interest rates, set by the Federal Reserve (Fed), also influences the Nasdaq 100 as it affects the cost of credit, on which many corporations are heavily reliant. As such the level of inflation can be a major driver too as well as other metrics which impact on the decisions of the Fed.

Meta Platforms stock forecast

Meta Platforms stock is up 435% since closing near $88 a share on November 3, 2022. Friday’s spike in the value of META stock has even pushed it higher than Nvidia’s performance over that time period. Besides Tesla (TSLA), which is down 14% over that time period, most of the Magnificent Seven stocks have performed quite well.

This is funny to investors who remember how much Zuckerberg was lambasted in 2022 for his massive investments in the metaverse. That industry is one you don’t hear much of anymore as Meta has pivoted back to its social media advertising model.

The Magnificent Seven - META, AMZN, MSFT, AAPL, NVDA, GOOGL, TSLA daily chart

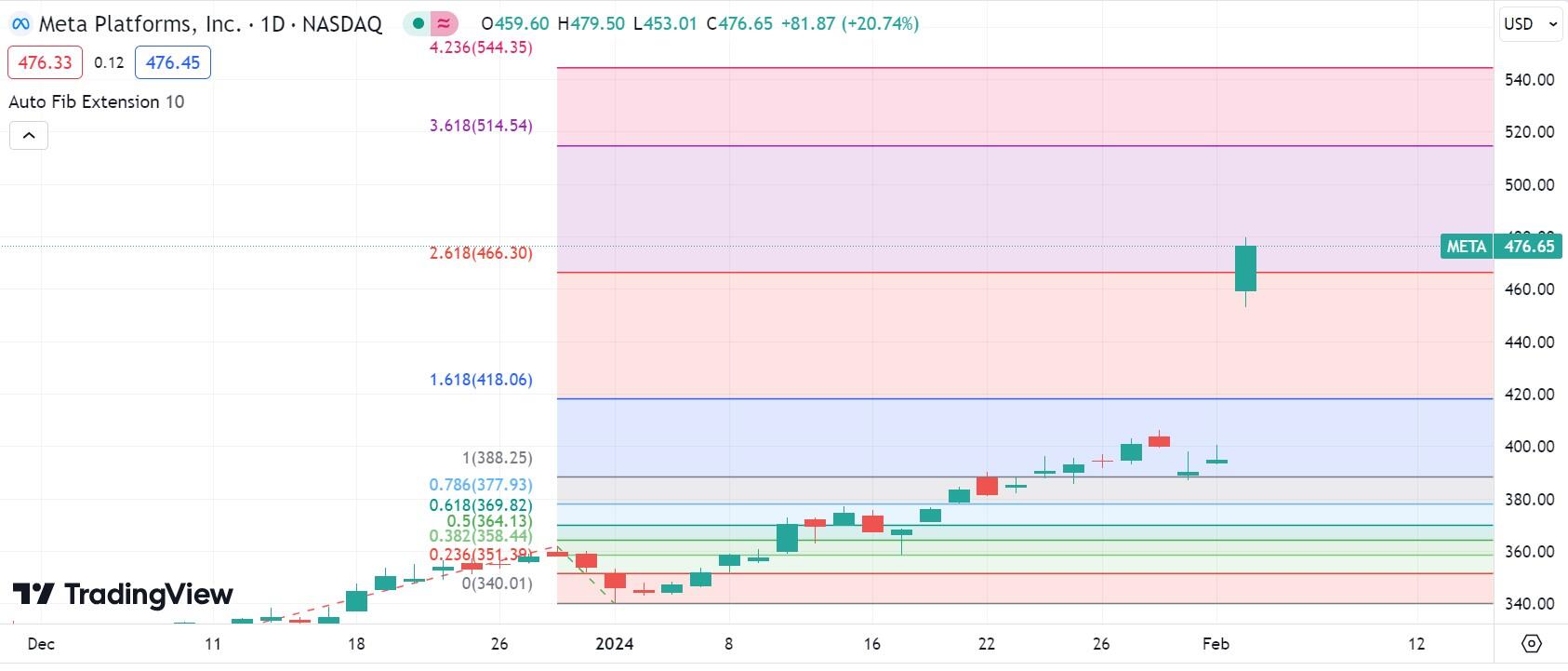

When a stock blasts off to a new all-time high like this, it can be hard to predict where it will go next. This is why analysts often rely on Fibonacci Extensions charts like the one below.

It shows that META found support at the 100% level ($388.25) just two days ago before breaking above the 161.8% Fibo ($418.06) and trading on Friday on both sides of the 261.8% Fibo ($466.30). If it can hold onto this level, then META stock might attempt a run at the 361.8% Fibo at $514.54.

META daily chart - Fibonacci Extension

(This story was corrected on February 5 at 02:30 GMT to say that the stock's Fibonacci 161.8% extension level is at $418.06, not $18.06.)

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD keeps the offered bias near 1.1360

EUR/USD remains under pressure in the mid-1.1300s following the press conference by the ECB’s Lagarde on Thursday, all after the central bank matched estimates and unanimously lowered its policy rates at its event.

GBP/USD advances to daily highs past 1.3250

GBP/USD is picking up extra upside impulse and is revisiting the 1.3250 zone, or daily peaks, as the US Dollar is trimming part of its earlier advance. The move in Cable remains propped up by a firm tone in the risk complex.

Gold loses traction and revisits the $3,320 zone

Gold burst to another all‑time high, teasing the $3,360 mark per ounce before easing back to the $3,320 zone per troy ounce as the Greeback staged a comeback and Treasury yields firmed across the curve.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.