Most consistent gainer

Using the VolatilityMarkets software to structure a Merck trend following trade idea

Part 1) Introduction

VolatilityMarkets suggests trend-inspired trades that capitalize on market trends.

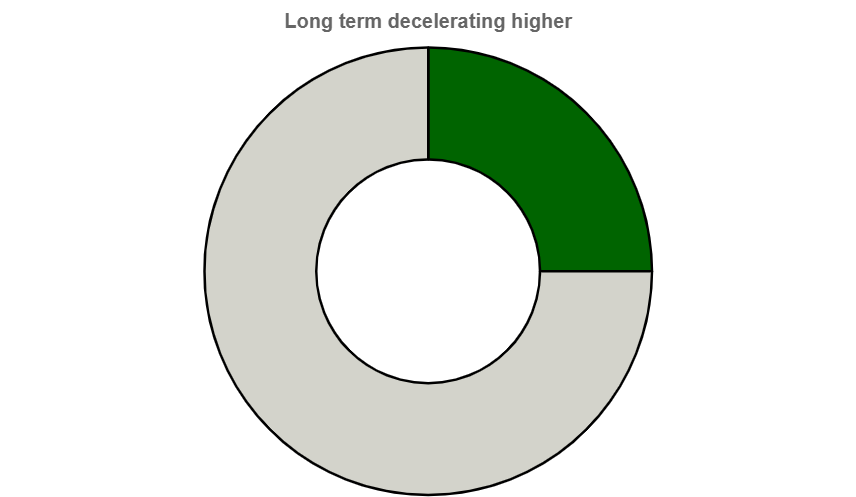

In the short term Merck has been accelerating higher. In the long term Merck has been decelerating higher. With the long term trend being the stronger of the two, we propose a long trade idea with a time horizon.

Part 2) Trade Idea Details

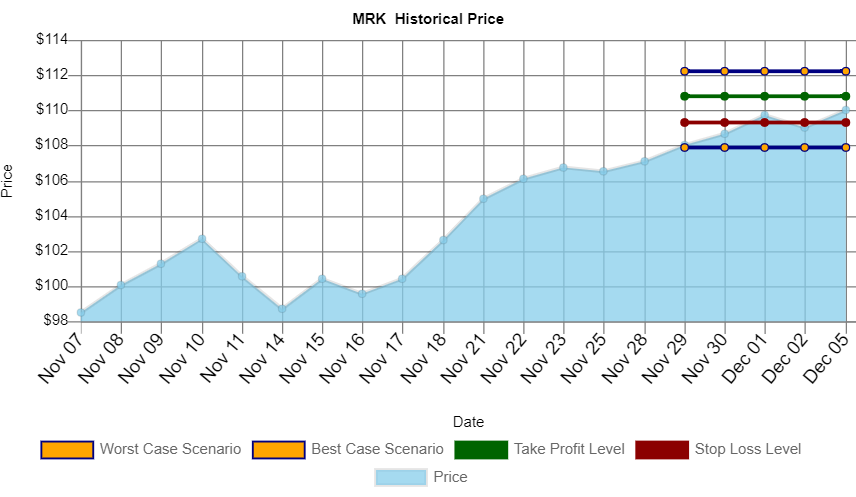

2A) Trade Idea Graph

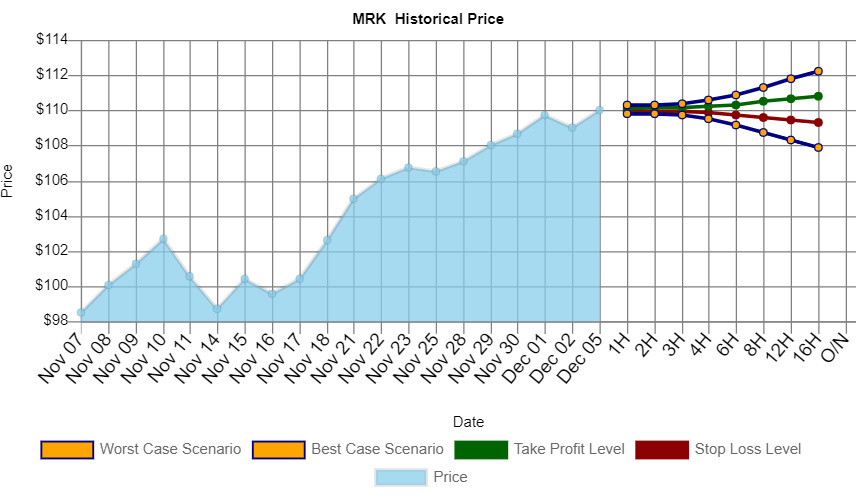

2b) Intraday Predictions

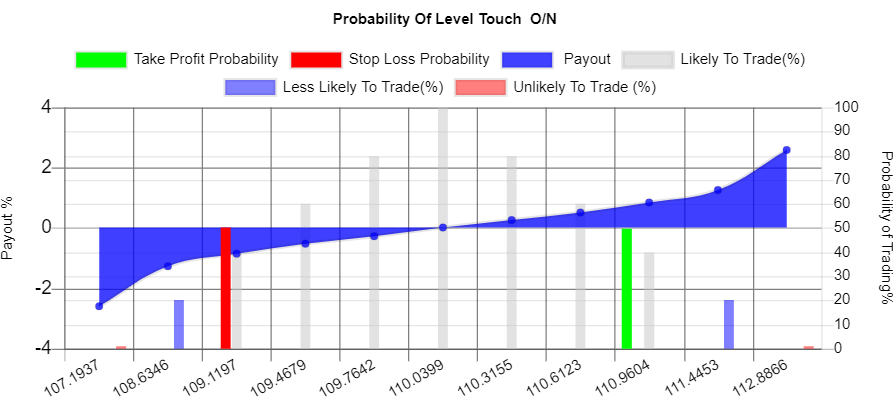

Buy $ 149,380 USD of Merck, take profit at $ 110.7768 level with 49.99% odds for a $ 1,000 USD gain,stop out at $ 109.3034 with 50.0% odds for a $ 1,000 USD loss through O/N time horizon

Part 3) MRK Trend Analysis

MRK last price was $ 110.04. The long-term trend decelerating higher is stronger than the short-term trend accelerating higher. This trade goes long when the price was moving higher but decelerating over the past 19 days.

Part 4) MRK value analysis

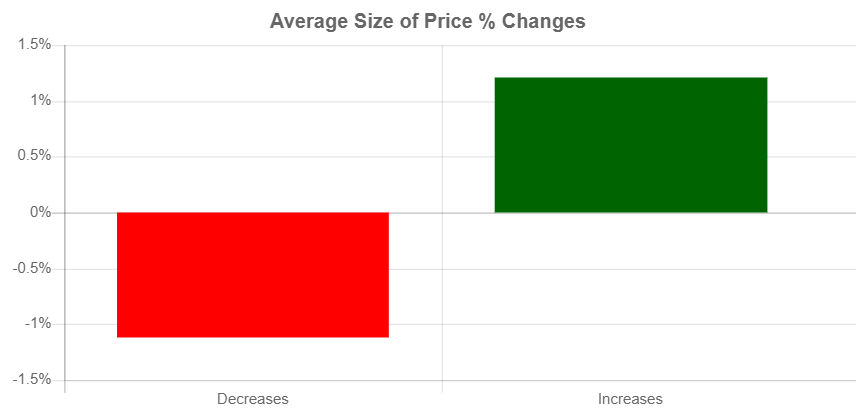

Over the past 19 days, the MRK price increased 14 days and decreased 5 days. For every up day, there were 0.36 down days. The average return on days where the price increased is 1.2041% The average return on days where the price decreased is -1.1223% Over the past 19 Days, the price has increased by 11.72% percent. Over the past 19 days, the average return per day has been 0.6168% percent.

Part 5) MRK worst/best case scenario analysis

Within 1 week, our worst case scenario where we are 95% certain that this level won't trade for MRK, is $ 107.8817 , and the best case scenario overnight is $ 112.1983 . levels outside of this range are unlikely, but still possible, to trade. We are 50% confident that $ 109.3034 could trade and that $ 110.7768 could trade. These levels are within statistical probability.

Key takeaways

-

Price today $ 110.04.

-

Over the past 19 days, the MRK price increased 14 days and decreased 5 Days.

-

For every up day, there were 0.36 down days.

-

The average return on days where the price increased is 1.2041%.

-

The average return on days where the price decreased is -1.1223%.

-

Over the past 19 Days, the price has increased by 11.72% percent.

-

Over the past 19 days, the average return per day has been 0.6168% percent.

-

Over the past 19 days, The price has on average been decelerating: $ -0.0294 per day higher.

-

Over the last session, the price increased by $ 1.04.

-

Over the last session, the price increased by 0.9451 %.

-

Over the last session, the price accelerated by $ 0.29.

Volatility Markets provides trend following trade ideas for momentum traders. The Volatility Markets Newswire measures the direction and acceleration of a security and then structures a trade idea to capitalize on the trend. While trends have been shown to exist in markets over the past 100 years, they are no guarantee of future asset prices. You should take these ideas lightly and at your own risk.

Recommended content

Editors’ Picks

Japanese Yen rises following Tokyo CPI inflation

The Japanese Yen (JPY) gains ground against the US Dollar (USD) on Friday. The USD/JPY pair pulls back from its recent gains as the Japanese Yen (JPY) strengthens following the release of Tokyo Consumer Price Index (CPI) inflation data.

AUD/USD weakens to near 0.6200 amid thin trading

The AUD/USD pair remains on the defensive around 0.6215 during the early Asian session on Friday. The incoming Donald Trump administration is expected to boost growth and lift inflation, supporting the US Dollar (USD). The markets are likely to be quiet ahead of next week’s New Year holiday.

Gold price remains subdued despite increased geopolitical tensions

Gold edges lower amid thin trading following the Christmas holiday, trading near $2,630 during the Asian session on Friday. However, the safe-haven asset could find upward support as markets anticipate signals regarding the US economy under the incoming Trump administration and the Fed’s interest rate outlook for 2025.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.