MCD Elliott Wave technical analysis

- Function: Trend.

-

Mode: Impulsive.

-

Structure: Motive.

-

Position: Wave (3) of 5.

-

Direction: Upside within wave (3).

-

Details:

-

Seeking confirmation of wave (2) bottom after a clear three-wave move.

-

Expecting further upside into wave 1 of (3) to validate wave (3)’s uptrend continuation.

-

McDonald’s Corp. (MCD) Elliott Wave analysis – Daily chart

MCD Elliott Wave technical analysis

- Function: Trend.

-

Mode: Impulsive.

-

Structure: Motive.

-

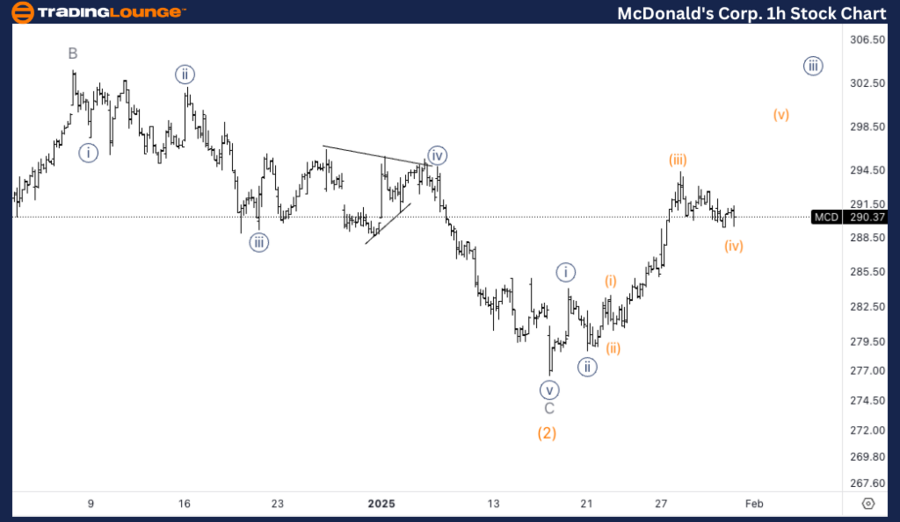

Position: Wave (iv) of {iii}.

-

Direction: Upside in wave (v).

-

Details:

-

Anticipating wave (iv) completion soon.

-

Expecting further upside in wave (v) toward TradingLevel3 at $300.

-

This Elliott Wave Analysis of McDonald's Corp. (MCD) provides insights based on both the daily and 1-hour charts, helping traders understand market trends and price forecasts.

McDonald’s Corp. (MCD) Elliott Wave analysis – One-hour chart

Summary

The analysis outlines key trends across multiple equities, indicating both corrective and impulsive movements. The S&P 500 stocks examined here exhibit a mix of trend continuations and corrections, providing trading opportunities across different phases of the Elliott Wave Cycle.

McDonald’s Corp. (MCD) Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

Gold price extends fresh record run toward $3,500

Gold price continues to build on its record rally, closing in on the $3,500 mark in Asian trading on Tuesday. Investors continue to flock to safety in the traditional store of value, the Gold price, amid no confidence in the US Dollar and Trump’s attacks on Fed Chairman Powell.

AUD/USD holds steady above 0.6400 amid a tepid US Dollar bounce

AUD/USD consolidates above 0.6400 in the Asian session on Tuesday. The US Dollar attempts a tepid bounce amid the uncertainty over Trump's trade policies and the weakening confidence in the US economy. Concerns about the rapidly escalating US-China trade war act as a headwind for the Aussie.

USD/JPY mires in multi-month low near 140.50

USD/JPY stays defensive near 140.50 in the Asian session on Tuesday, consolidating Monday's downfall to seven-month lows. Trade war concerns, global recession fears, hopes for a US-Japan trade deal, and the divergent BoJ-Fed bets could continue to underpin the Japanese Yen despite a broad US Dollar rebound.

ARK Invest integrates Canada's 3iQ Solana Staking ETF into its crypto funds

Asset manager ARK Invest announced on Monday that it added exposure for Solana staking to its ARK Next Generation Internet exchange-traded fund and ARK Fintech Innovation ETF through an investment in Canada's 3iQ Solana Staking ETF.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.