McDonald’s Corp. (MCD) Elliott Wave technical analysis

MCD Elliott Wave technical analysis

Function: Trend

Mode: Impulsive

Structuue: Motive

Position: Wave {iii} of 1.

Direction: Upside into wave 1.

Details: Looking for a five wave move completion within wave 1 as we are now approaching TradingLevel3 at 300$.

MCD Elliott Wave technical analysis – Daily chart

In the daily chart, McDonald's is showing a clear impulsive trend, currently progressing within Wave {iii} of 1. This suggests the stock is in the midst of a strong upside move. As the price approaches the critical level at $300, known as TradingLevel3 (TL3), we are looking for the completion of a five-wave move within this initial wave 1.

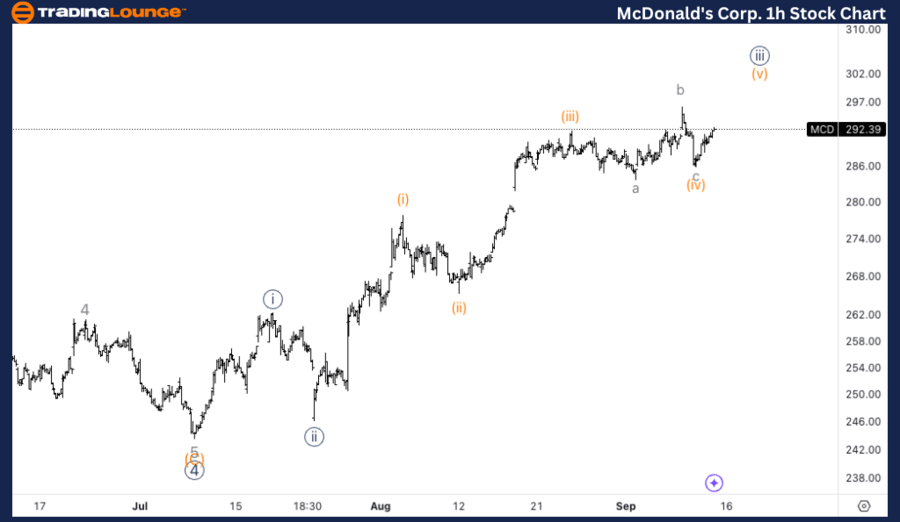

MCD Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Strucutre: Motive.

Position: Wave i of (v).

Direction: Looking for upside into wave (v).

Details: Looking for upside into wave (v) as we seem to have a flat in wave (iv) and we found support on top of the end of Minor Group 2 at 280$.

MCD Elliott Wave technical analysis – One-hour chart

On the 1-hour chart, MCD appears to be progressing within Wave i of (v), signaling that we are likely entering the final leg of the current impulsive sequence. The recent Wave (iv) formed a flat corrective structure, and the stock found key support around $280, which corresponds to the end of MinorGroup2.

In this Elliott Wave analysis of McDonald’s Corp. (MCD), we assess its current price action and wave structure using Elliott Wave Theory to help identify trading opportunities. Both the daily and 1-hour charts are examined to provide a comprehensive outlook for traders.

McDonald’s Corp. (MCD) Elliott Wave technical analysis

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.