McDonald’s Corp. Elliott Wave technical analysis [Video]

![McDonald’s Corp. Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/Food/food-supermarket-637322928260977595_XtraLarge.jpg)

MCD Elliott Wave Analysis Trading Lounge.

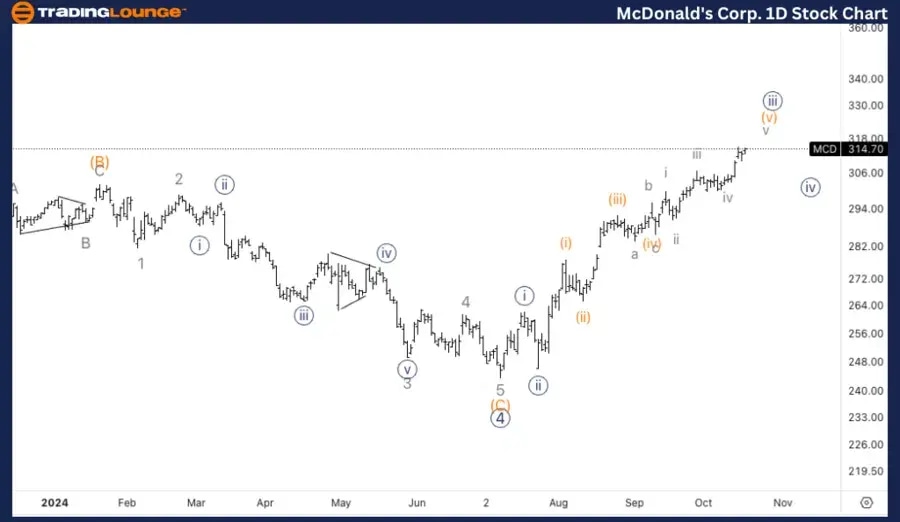

McDonald’s Corp., (MCD) Daily Chart.

MCD Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave 1 of (1).

Direction: Upside 1.

Details: Looking at upside thrust after the bottom in a long lasting correction in Primary wave 4.

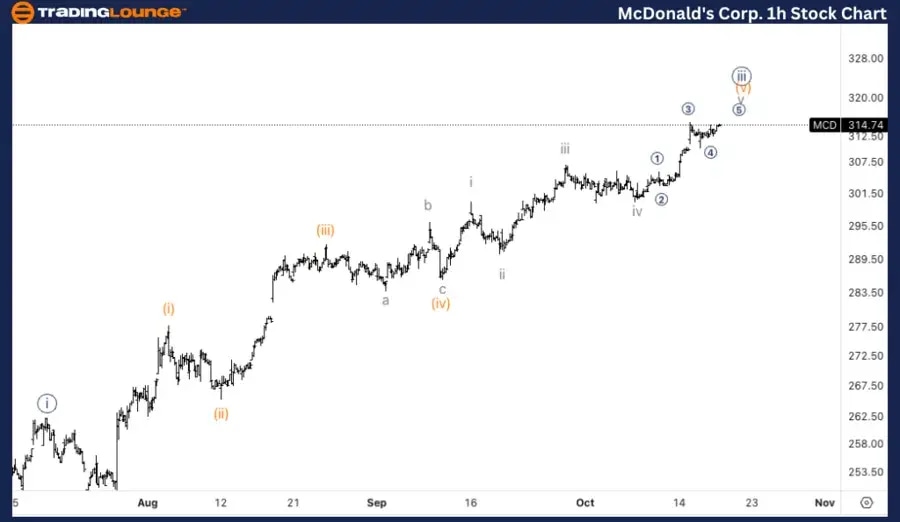

McDonald’s Corp., (MCD)1H Chart.

MCD Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave {iii} of 1.

Direction: Top in wave {iii}.

Details: Digging into the subdivision of Minute wave {iii} as we seem to be having further upside to come, which could potentially end as we hit the middle of MinorGroup1 at 320$.

This analysis of McDonald’s Corp., (MCD) focuses on both the daily and 1-hour charts, using the Elliott Wave Theory to assess current market trends and forecast future price movements.

MCD Elliott Wave technical analysis – Daily chart

On the daily chart, McDonald’s is currently in Wave 1 of (1), marking the early stages of an impulsive move following the end of a long correction in Primary Wave 4. This correction appears to have bottomed, leading to a strong upside thrust in the new bullish phase. The focus is now on further upside development as the first impulsive wave unfolds.

MCD Elliott Wave technical analysis – One-hour chart

On the 1-hour chart, MCD is currently within Wave {iii} of 1, with further upside expected. The subdivision of Minute Wave {iii} indicates that the wave is approaching completion, potentially nearing a top as it reaches the middle of MinorGroup1 at the 320$ level. After this top, a small corrective phase might unfold before further advances within the larger trend.

Technical analyst: Alessio Barretta.

MCD Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.