Market shake-up alert: Will this game-changing rotation rock the S&P 500? [Video]

![Market shake-up alert: Will this game-changing rotation rock the S&P 500? [Video]](https://editorial.fxstreet.com/images/Markets/Equities/SP500/wall_street_nyse1-637299020939878938_XtraLarge.jpg)

Watch the video extracted from the WLGC session before the market open on 23 Jan 2024 below to find out the following:

-

The characteristics that could suggest a temporary pullback or consolidation in the market.

-

How is the Russell 2000's recent outperformance impacting the broader market dynamics?

-

Is the recent breakout signaling a genuine bullish trend, or are there potential pitfalls ahead?

-

The upside target for the S&P 500 and the key levels to watch out for.

-

and a lot more...

The bullish vs. bearish setup is 455 to 80 from the screenshot of my stock screener below. This is again back to a positive and healthy market environment based on the number of setups available.

However, the key remains in the market breadth, discussed in detail during the live session (How to Judge If The Rally Is Sustainable with the Market Breadth).

The breakout as discussed in the tweet below was finally resolved on last Friday:

"If it close below the low right there, then likely it will come back down and to test the swing low level.

— Ming Jong Tey (@MingJong) January 18, 2024

The market breadth keep decreasing. That is not a good sign for a sustaining run. A long waited pullback or correction of the index is yet to come." $ES #SP500 $SPX pic.twitter.com/CLN4iu9hNn

7 “low-hanging fruits” (WSM, FLT, etc…) trade entries setup + 16 others (UBER etc…) plus 11 “wait and hold” candidates have been discussed during the live session before the market open (BMO).

WSM

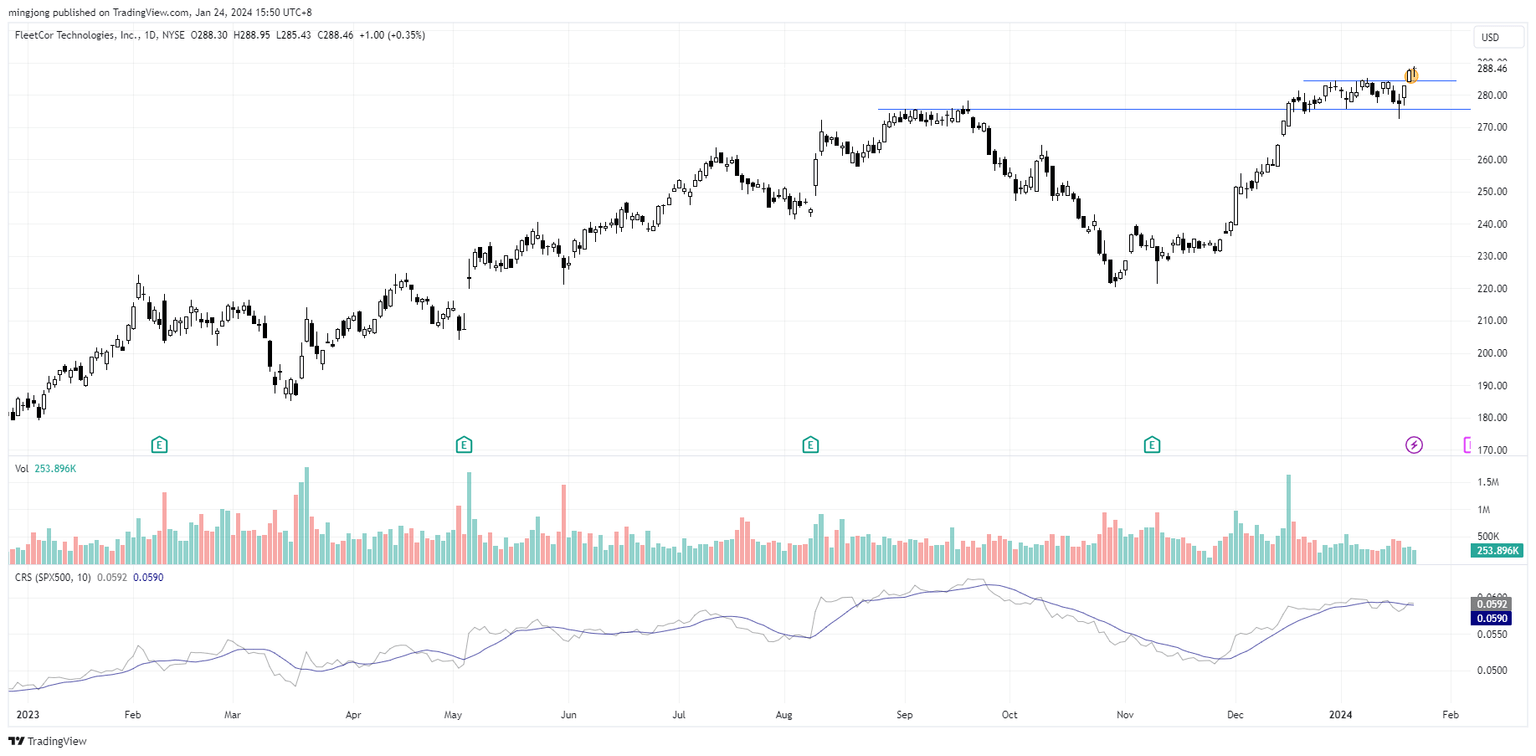

FLT

UBER

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.