The Congressional Budget Office, (CBO), released a study showing the US economy will return to pre-pandemic levels even without another shot of stimulus.

However, the CBO projects the unemployment rate falling to 5.3% by year-end. While down from the 8.4% forecast by the CBO back in July.

In recent trade, the US Treasury Secretary, Janet Yellen, has said to have stated that the economic aid package is desperately needed, likely referring to the fact that there will still be millions out of work who will need financial assistance.

It ''will be years before us reaches full employment again based,'' she said.

Meanwhile, the US President Joe Biden has been rising the prospects, along with a group of ten Republican Senators, for a $618 bln alternative to his $1.9 trln proposal.

However, the US Senate Democratic Leader Chuck Schumer said Biden told Democrats the proposal that the ten Senate Republicans have made for $600 billion in COVID-19 relief is "way too small."

While this is the grounds for a probable compromise for something in the region of just over $1trln, Democratic lawmakers are still forging ahead with the idea of passing much of Biden’s proposal via the budget reconciliation process.

Only a simple majority passage in both houses could clinch the deal.

Meanwhile, looking ahead, all eyes are on the Nonfarm Payrolls data at the end of the week.

A clue for Friday jobs data yesterday came yesterday.

While headline ISM manufacturing PMI eased to 58.7 from a revised 60.5 (was 60.7 in December), the employment component rose to 52.6 from a revised 51.7 (was 51.5) in December which was the best reading since June 2019.

However, Services PMI today will be more critical, but the economy is starting the year off on pretty firm footing and will potentially keep the US dollar underpinned in its plight for higher grounds.

In positioning data, a short squeeze could be on the cards if the CFTC data is finally going to catch up with the bid in the spot market.

Indeed, with the first Federal Reserve interest decision meeting of the year now out of the way, the market will be focussed on the size of the Biden fiscal bonanza and the success of vaccine roll-out programmes.

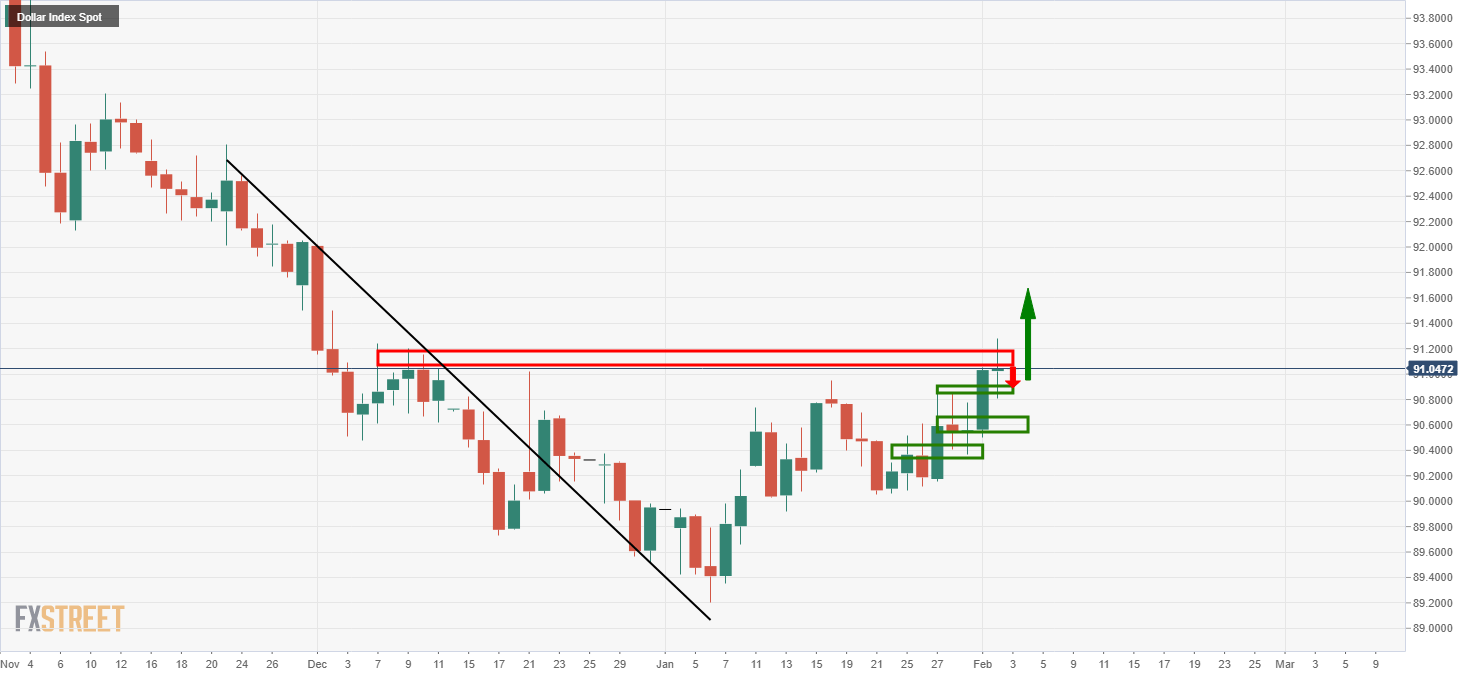

DXY daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: Next upside target comes at 0.6550

AUD/USD managed well to shrug off the marked advance in the Greenback as well as geopolitical tensions, regaining the area above the 0.6500 hurdle ahead of preliminary PMIs in Australia.

EUR/USD: Further losses now look at 1.0450

Further strength in the US Dollar kept the price action in the risk-associated assets depressed, sending EUR/USD back to the 1.0460 region for the first time since early October 2023 prior to key releases in the real economy.

Gold faces extra upside near term

Gold extends its bullish momentum further above $2,660 on Thursday. XAU/USD rises for the fourth straight day, sponsored by geopolitical risks stemming from the worsening Russia-Ukraine war. Markets await comments from Fed policymakers.

Ethereum Price Forecast: ETH open interest surge to all-time high after recent price rally

Ethereum (ETH) is trading near $3,350, experiencing an 10% increase on Thursday. This price surge is attributed to strong bullish sentiment among derivatives traders, driving its open interest above $20 billion for the first time.

A new horizon: The economic outlook in a new leadership and policy era

The economic aftershocks of the COVID pandemic, which have dominated the economic landscape over the past few years, are steadily dissipating. These pandemic-induced economic effects are set to be largely supplanted by economic policy changes that are on the horizon in the United States.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.