- Remark Holdings´stock price has been falling for four consecutive days.

- Hopes and concerns about its AI technology are eyed.

- Elevate usage of thermal scanners for reopening the economies also provides hope.

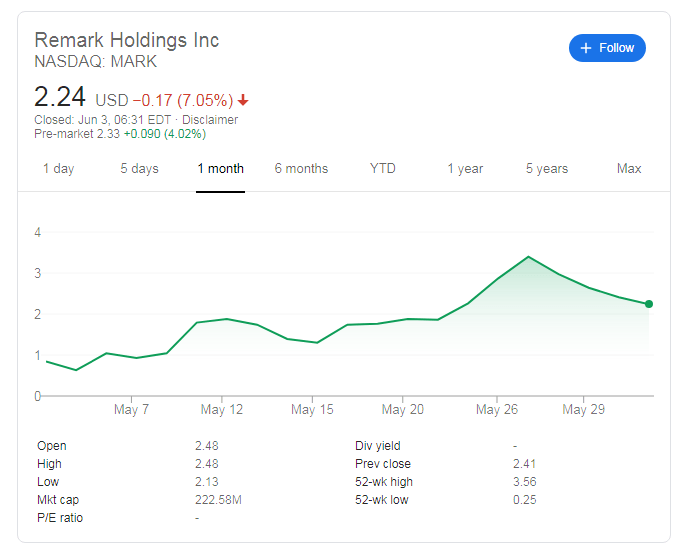

What goes around comes around – at least partially. NASDAQ: MARK surged from around $0.50 in early May to a close of $3.40 on May 27 but has been falling in the past four trading sessions. At a closing price of $2.24 on Tuesday, shares of the Las Vegas-based firm are already down by around a third.

Pre-market trading suggests a recovery, albeit a modest one.

Mark stock news

The most recent development came via a partnership to supply Artificial Intellenginece technology in China. While the world's second-largest economy is a vast market, some have raised concerns that collaborating with a country that is becoming growingly authoritarian and follows its citizens too closely may backfire.

The anti-China sentiment is rife in America, primarily driven by President Donald Trump, but also egged on by Democrats. That may limit the firm's ability to expand.

The bulk of the surge came from the usage of MARK's thermal scanners for monitoring potential COVID-19 patients. The devices can run over 120 people per minute, which it claims to be ten times faster than more expensive manual fever measurements.

Nevertheless, the kit is used only for the reopening phase. If things improve, the equipment may become useless. And if a second wave hits Western countries, they may reimpose lockdowns, removing the need for scanning, or at least limiting its scope.

Overall, Remark Holdings Inc faces sobering challenges that put in doubt the recent enthusiasm. On the other hand, the company is worth only around $222 million according to its close price. Showing decent revenues from its products may cause a rethink and send shares to a higher valuation.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD defends gains above 0.6400 as US Dollar finds fresh demand

AUD/USD is retreating from near YTD highs but defends minor bids above 0.6400 early Tuesday. Hopes that the US will start to announce some trade deals remain supportive of a positive risk tone and renewed US Dollar demand, capping the pair's upside.

USD/JPY bounces back to near 142.50 amid light trading

USD/JPY rebounds toward 142.50 in the Asian session on Tuesday as a positive risk tone undermines safe-haven assets such as the Japanese Yen while providing support to the US Dollar. However, the further upside appears elusive amid a Japanese holiday-led thin trading conditions.

Gold bull-bear tug-of-war continues ahead of key US data

Gold price replicates Monday’s early moves in Asian trading on Tuesday, testing the critical daily support line at $3,330. Resurgent US Dollar (USD) demand amid an upbeat market mood seems to be weighing on the Gold price.

TRUMP meme coin on-chain activity surged following dinner announcement: Kaiko

Kaiko Research published a report on Monday highlighting the significant impact of TRUMP's team dinner announcement on the meme coin sector. The announcement triggered a surge in on-chain activity and trading volumes, with TRUMP accounting for nearly 50% of all meme coin trading volume.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.