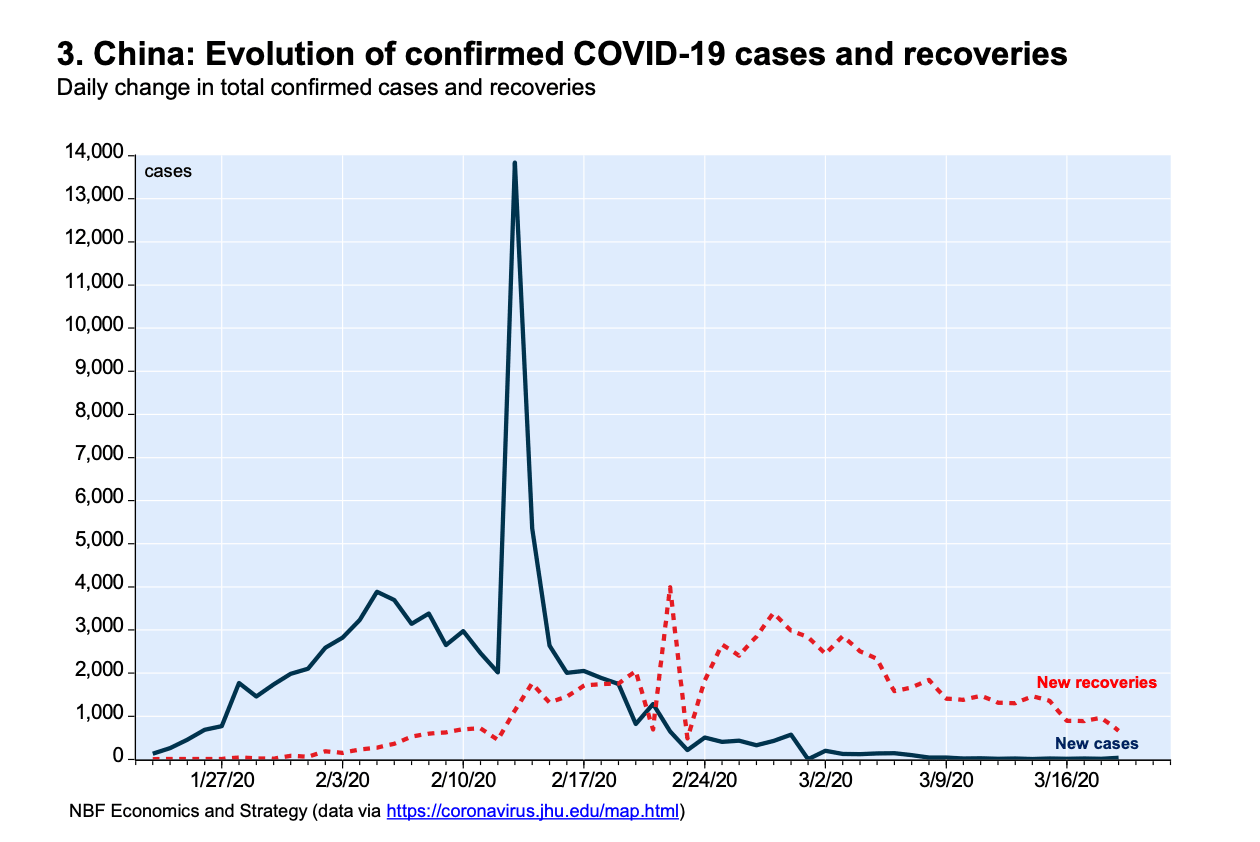

Mainland China's total number of confirmed coronavirus cases hits 80,967 as of end-March 19 – Reuters News

The latest data in China's COVID-19 cases is out and there is another consecutive day where Hubei province reports zero new cases on March 19 vs zero on March 18.

- Mainland China reports 39 new confirmed cases of coronavirus on March 19 vs 34 on March 18.

- Mainland China reports 3 new coronavirus deaths on march 19 vs 8 on March 18.

- Mainland China's total number of confirmed coronavirus cases hits 80,967 as of end-March 19.

- Mainland China's total number of coronavirus deaths reaches 3,248 as of end-March 19.

- Mainland China's imported coronavirus cases at 228 as of end-march 19, up 39 from day earlier.

- China's Hubei province reports zero new cases on march 19 vs zero on March 18.

- China's Hubei province reports 2 new deaths on march 19 vs 8 on March 18.

- Death toll from coronavirus outbreak in china's Hubei at 3,132 as of end-March 19.

- Beijing recorded six imported COVID19 infections on Thursday, one from the #US and five from the UK, totaling the capital’s imported cases to 70.

Market implications

It is good news that the prior epicentre if COVID-19 is in recovery:

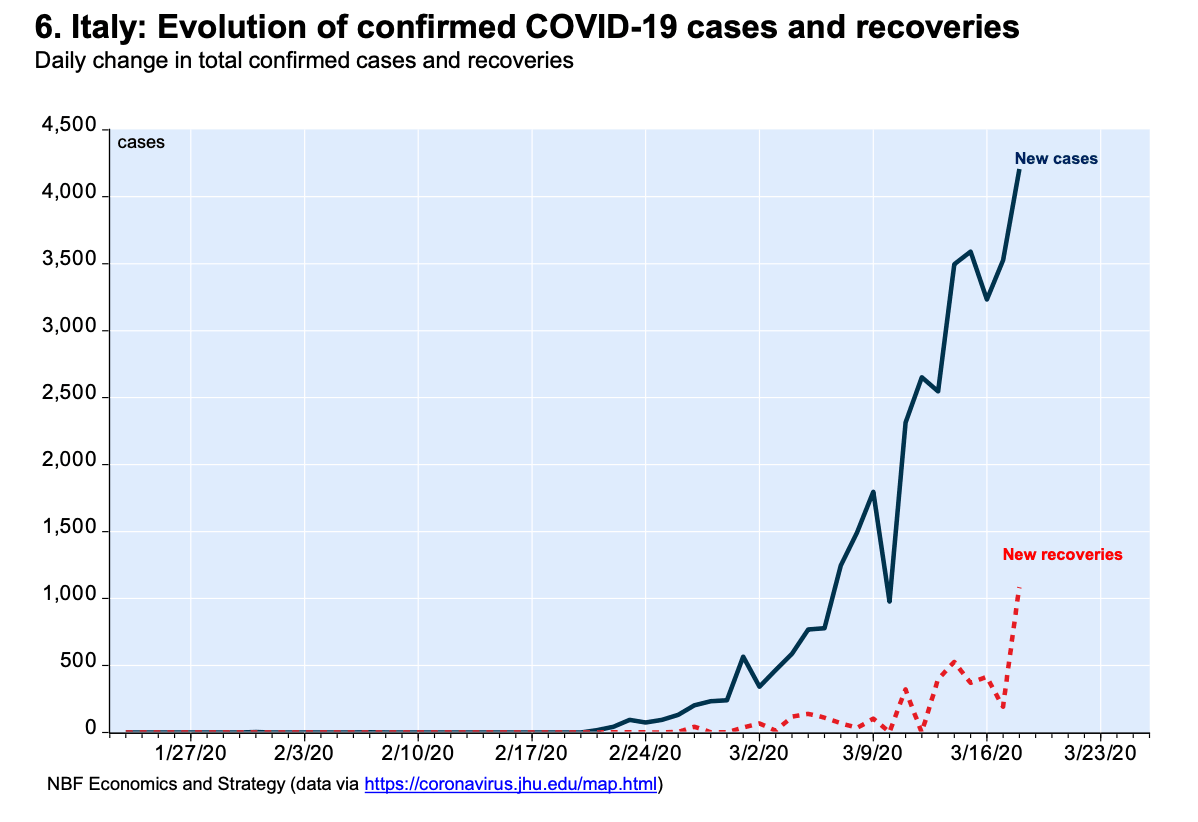

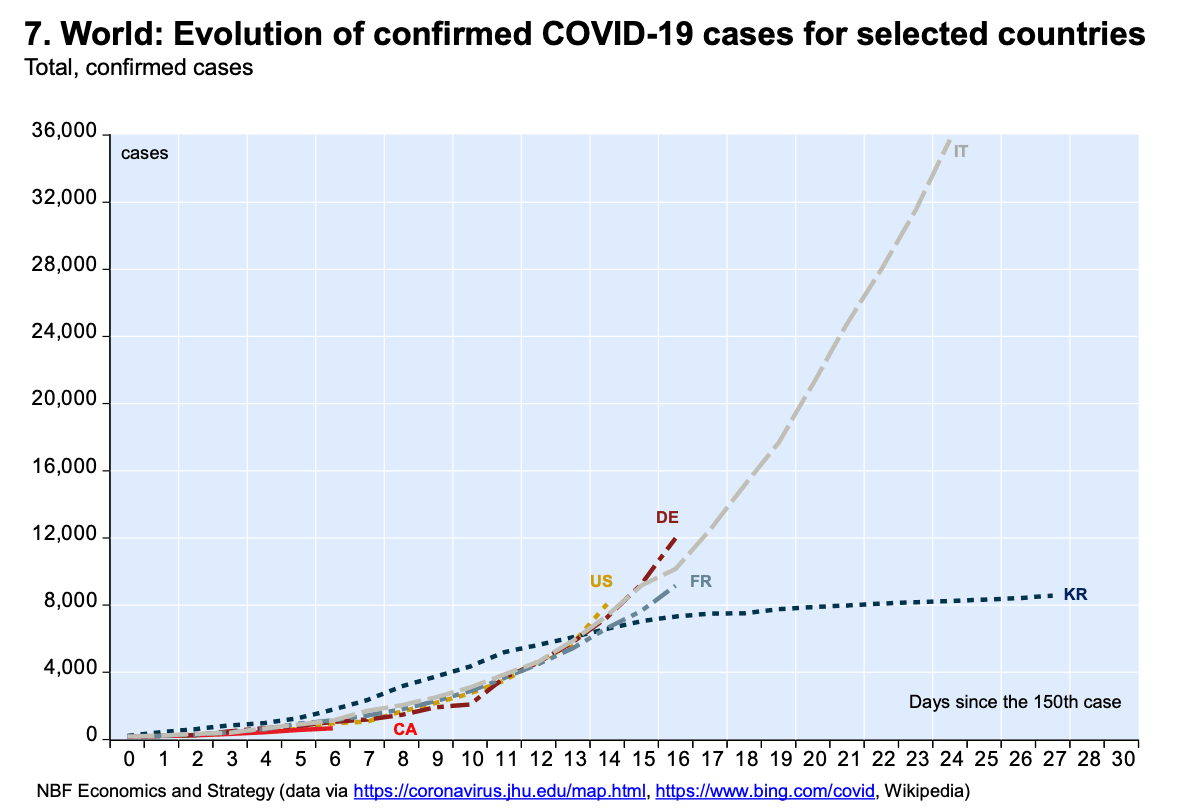

However, Italy is going through the apocalypse, now the world epicentre of COVID-19 and the rest of the world's case are growing exponentially:

Markets in the US were slightly higher on Thursday, but risks are firmly skewed tot he downside with another 65% of losses to go until the 2008 lows in the Dow: Wall Street Close: Benchmarks higher in corrective and choppy markets

On the upside, following on from yesterday's news, Remdesivir could be approved very soon for COVID-19, while speaking to reporters at a news conference at the White House, US President Donald Trump said Gilead's Remdesivir seems to have very good results fighting the coronavirus. Gilead Sciences' shares rose sharply following these comments but the company hasn't yet published an official statement on the experimental COVID-19 therapy.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.