- Lyft's stock price has been moving higher alongside the broader stock market.

- Working on deliveries is one of the reasons for a potential increase in value.

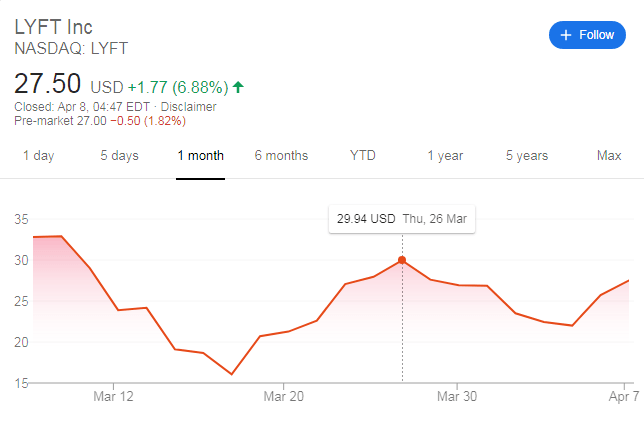

- Breaking above $30 would confirm a bottom for the share.

Lyft's share price has been catching a bid to the upside, rising by nearly 7% on Tuesday. The San-Francisco based company had previously seen its shares plummet as people are confined to their homes amid the COVID-19 crisis.

Here are four reasons for the rise:

1) Bargain-hunting. Shares may have fallen to much, and bargain hunters have jumped to buy Lyft's stock as well as others.

2) Less debt than Uber: The ride-hailing firm is often compared with rival Uber, with the latter being present outside the US. However, the rival's largest size is also been in a more significant debt pile, which is weighing on it and makes Lyft more attractive.

3) Amazon partnership: Another factor that provides hope to investors is that Lyft is still in use for deliveries. Lyft has partnered with Amazon, the world's largest online retailer, to help the giant fulfill its growing shipping demands. Amazon has been unable to handle the surge in business.

4) Potential opening up of the economy: President Donald Trump has considered opening up parts of the economy or parts of the US which have been less affected by a coronavirus. If that happens, demand for Lyfts services could rise.

Overall, there are reasons to be cheerful.

Lyft stock price chart

Lyft's stock price is nearing critical resistance at the $30 level, which was a temporary peak before the most recent plunge. Being able to break above this level would set a higher high and put the share on a recovery path. Failing to do so would create a lower high and downtrend.

The 52-week high was $74.99, and the company is now worth just over a third of that price. On the other hand, the 52-week low was $14.56, and the NASDAQ-traded equity is now worth nearly double.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD weakens to near 0.6200 ahead of Chinese Services PMI release

The AUD/USD pair softens to near 0.6210 during the early Asian session on Monday. The rising bets that the Reserve Bank of Australia will be compelled to start cutting interest rates exert some selling pressure on the Australian Dollar.

USD/JPY eyes multi-month top amid divergent BoJ-Fed policy outlook

USD/JPY remains close to a multi-month high touched in December amid the BoJ's cautious approach towards raising interest rates and a bullish USD, which shot to a multi-year top on the back of the Fed's hawkish outlook. Bulls, however, might wait for a breakout through a two-week-old range.

Gold holds below $2,650 as traders await fresh catalysts

Gold price struggles to gain ground near $2,640 during the early Asian trading hours on Monday. The stronger US Dollar after the US ISM Manufacturing Purchasing Managers Index weighs on the yellow metal.

Week ahead: US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.