Lucid Group Stock Price and Forecast: LCID shares recover after dropping to $25.90

- Lucid Group shares continue to slide after reaching our $30 target.

- LCID stock looks set for more losses and could reach $20.

- LCID shares are down nearly 30% YTD.

UPDATE: LCID shares briefly fell below $26 in the early part of Tuesday's session, but since then shares have climbed back up toward Monday's close. At the moment they are up 0.3% at $27.07. Shares dropped to an intraday low of $25.90 on Tueday and are down 29% year to date.

Lucid Groups (LCID) shares continue to slide as the high growth EV sector sees more and more headwinds. Lucid is set to release earnings in a couple of weeks, but as far as we know no final date has been set for the release. The report will need to be blowout though to turn sentiment toward the stock and the sector. Lucid has not had a good start to the year and things are only getting worse.

Again on Monday yields continued to pick up as more and more hawkish commentary comes off the wires from central bankers. Higher yields make investors more and more nervous over their holdings in high growth stocks. Tesla, the sector leader, is also suffering some headwinds of its own, which is not going to help Lucid.

Lucid Group Stock News

Lucid has suffered as high growth tech stocks continue to fall out of favour. It also suffers by comparison with some of the Chinese EV makers. NIO, XPeng (XPEV) and Li Auto (LI) all released strong delivery data last month that showed continued strong YoY growth. Chinese EV names, however, have been punished due to regulatory concerns surrounding Chinese tech and growth stocks. On a relative valuation basis though, the two most well-known, new US EV stocks of 2021, Lucid and Rivian, fall short of the Chinese names. This may make potential investors shy away from the sector or from LCID or RIVN stock.

Lucid Group Stock Forecast

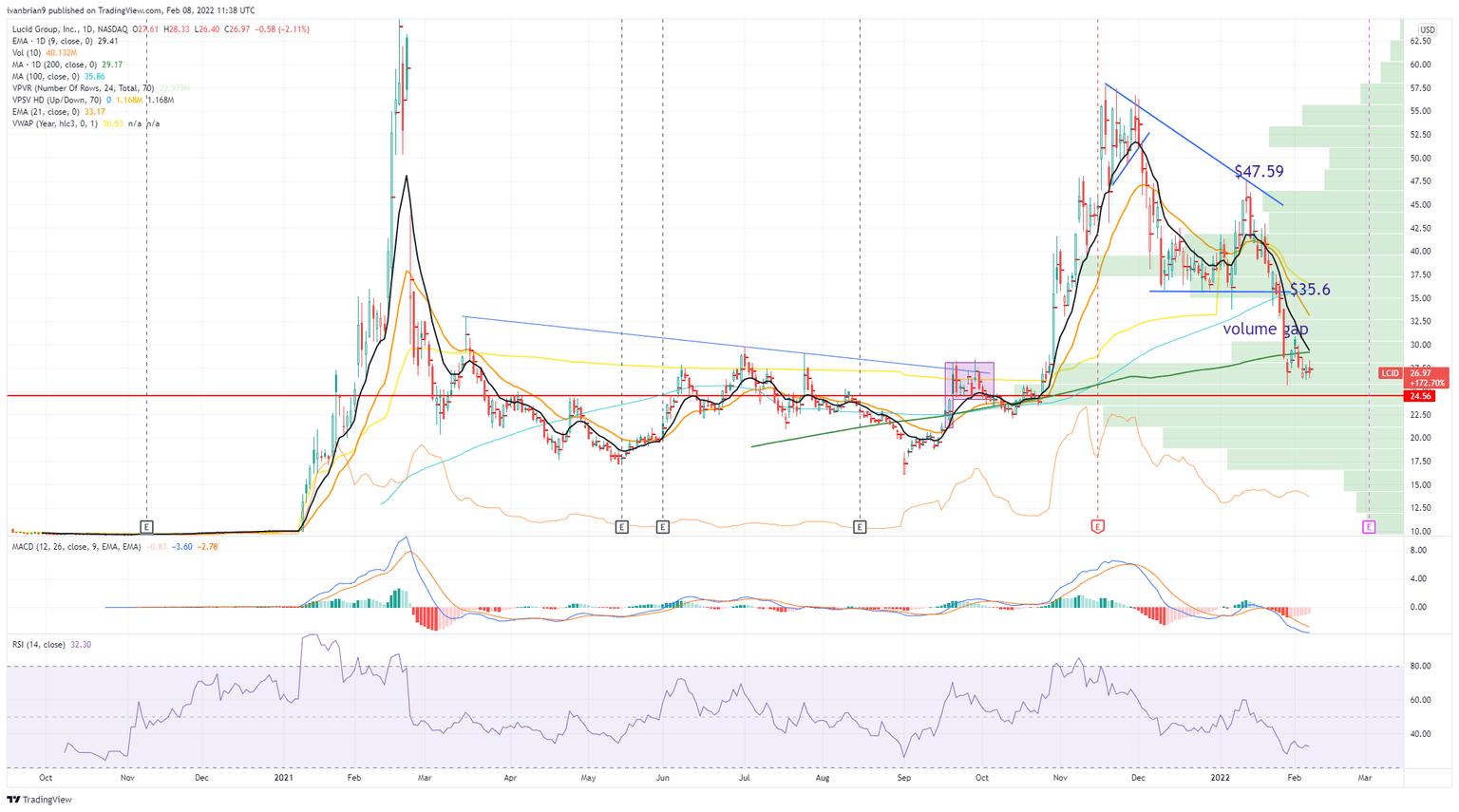

We had identified $30 as the likely target once momentum started to fail and yields began to rise. We do not see that situation changing anytime soon and note that yields and sentiment continue to move against high growth names. LCID has broken below the 200-day moving average at $29.17, and the 9-day moving average is about to cross below the 200-day. This is strongly negative and should lead to more losses. The only positive is the amount of historic volume at current levels. the point of control is $24.56: see the large volume profile bars on the chart below. Volume generally means equilibrium, so any further losses are likely to be more steady.

Lucid (LCID) chart, daily

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.