Lose 22.28% on Dow Jones Industrial Average, in a year? What are the odds?

What are the odds? estimating Dow Jones Industrial Average's worst case scenario

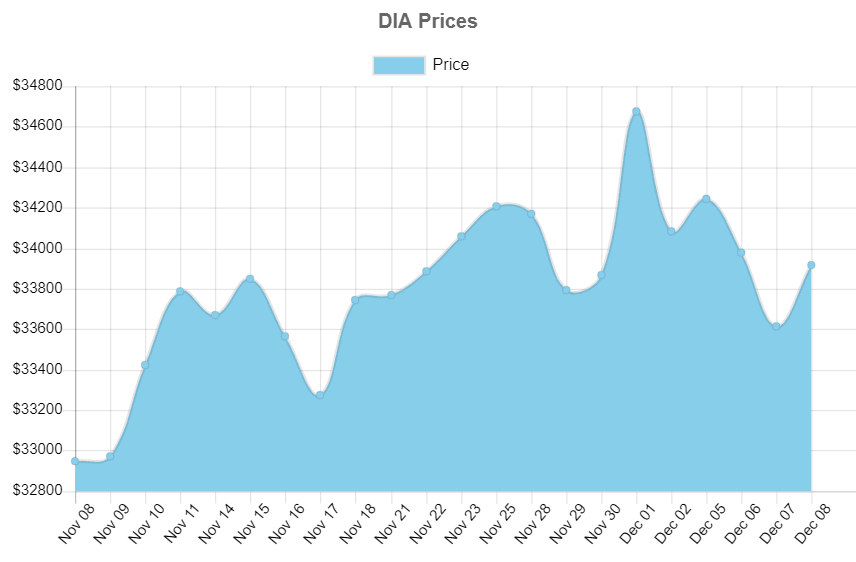

Over the past 22 days, Dow Jones Industrial Average historical volatility performed at 18.5057% This roughly translates into an expectation of a 1.1566% move in price per day. If markets remain as volatile as they have been, what's the worst case scenario for Dow Jones Industrial Average?

Executive summary

-

The last spot price was $ 33,918.50.

-

Over the past 22 days, historical volatility performed at 18.5057 % This roughly translates into an expectation of a 1.1566% move in price per day.

-

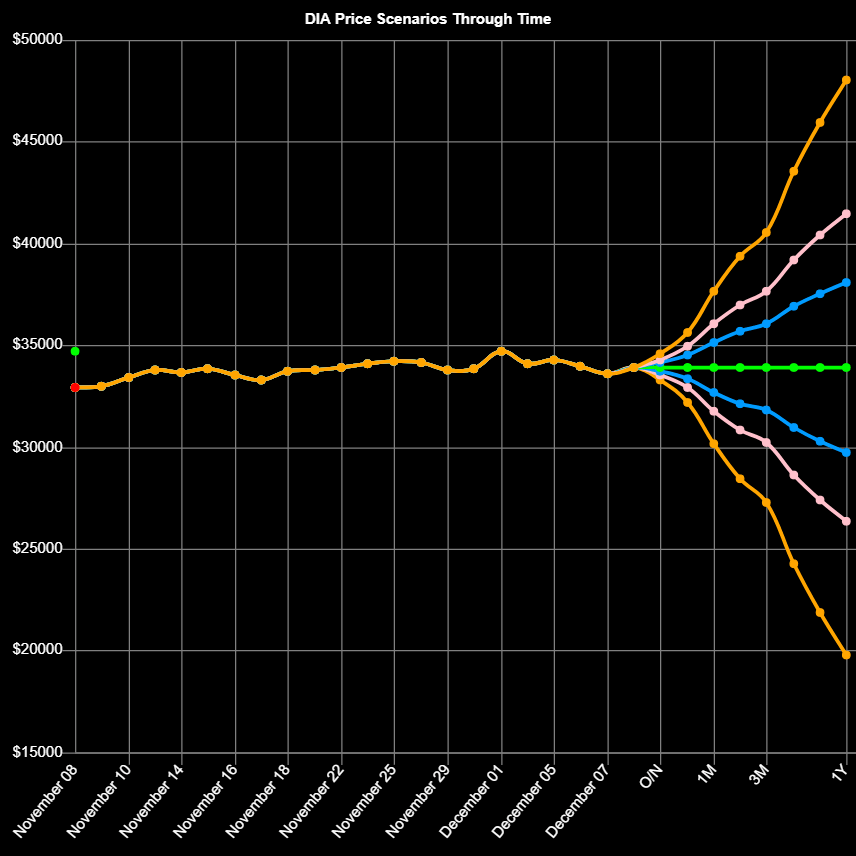

If markets remain as volatile as they have been, we are 95% sure that the price won't trade higher to the $48058.5458 level within the next 1Y.

-

If markets remain as volatile as they have been, we are 95% sure that the price won't trade lower to the $19778.4542 level within the next 1Y.

-

If markets remain as volatile as they have been, we are 95% sure that the price won't make or lose more than 41.6883% within the next 1Y.

-

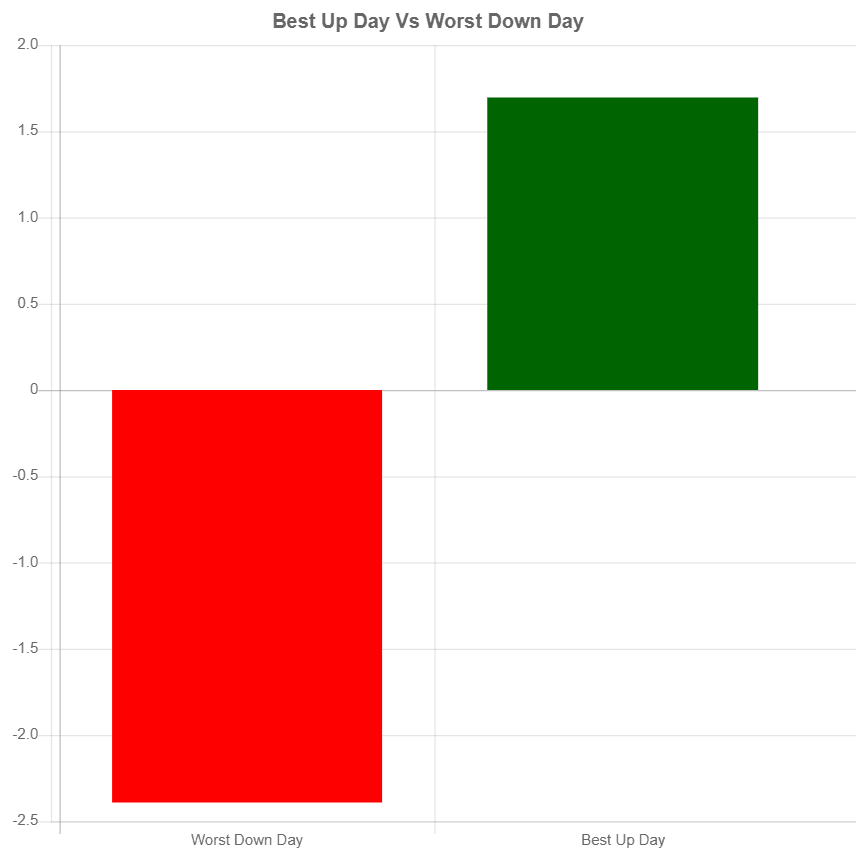

The largest drawdown in the dataset was -2.3918%.

-

The largest up day in the dataset was 1.6986%.

Market skew

-

The largest drawdown in the dataset was -2.3918%.

-

The largest up day in the dataset was 1.6986%.

Worst case scenario price

-

If markets remain as volatile as they have been, we are 95% sure that the price won't trade higher to the $48058.5458 level within the next 1Y.

-

If markets remain as volatile as they have been, we are 95% sure that the price won't trade lower to the $19778.4542 level within the next 1Y.

-

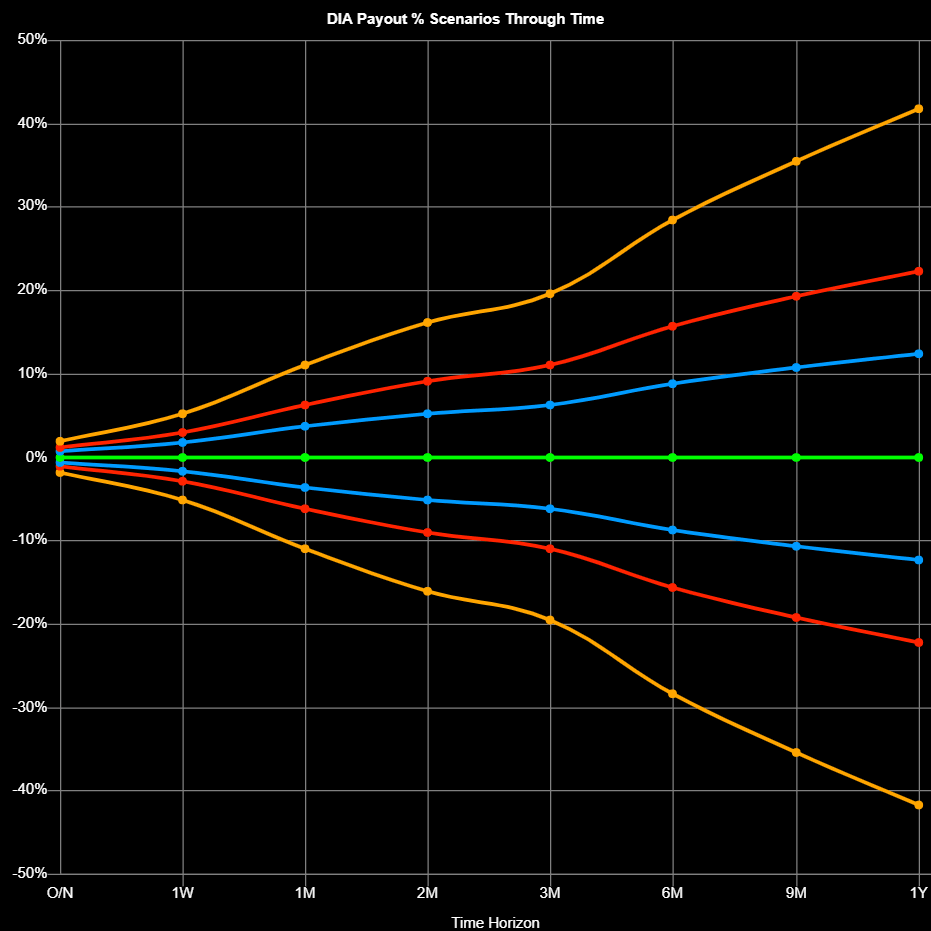

If markets remain as volatile as they have been, we are 95% sure that the price won't make or lose more than 41.6883% within the next 1Y.

Worst case scenario payout 33918.5

If markets remain as volatile as they have been, we are 95% sure that the price won't make or lose more than 41.6883% within the next 1Y.

Author

Barry Weinstein

Volatility Markets Newswire

Barry Weinstein was a forex derivatives trader at BlueCrest Capital which was one of the largest hedge funds in Europe and then joined Credit Suisse where he assisted in running one of the largest FX Options portfolios in Europe.