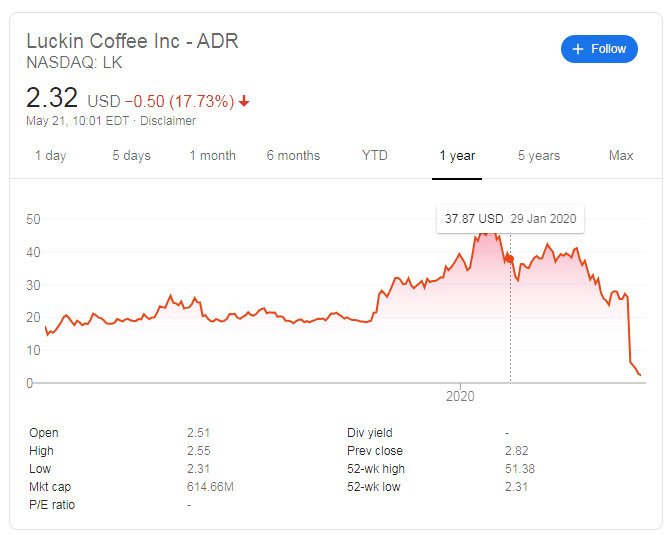

LK Stock Price: Luckin Coffee Inc extends its unlucky strike, will it find bargain-seekers?

- Luckin Coffee's shares are tumbling once again after trade resumed on Wednesday.

- Doubts about its survival seem to scare even the bravest bargain-seekers.

- The coffee-chain is now worth less than $1 billion and lost some 95% peak to trough.

No luck for Luckin Coffee. Trading in NASDAQ:LK resumed on Thursday with shares tumbling down. There is no mercy on Thursday, with another fall. The chain of some 4,507 coffee shops in China – more than Starbucks in the world's second-largest economy was hit by the coronavirus pandemic.

However, the bigger downer came from its accounting scandal. Muddy Waters Research published an 89-page report claiming that the firm falsified operational and financial figures. The company initially denied the allegations but in early April it admitted the fabrication – worth some $310 million – and trading halted afterward.

After a management shakeup and a delisting notice from NASDAQ, trading finally resumed on Wednesday and not in a good way. The ongoing plunge is showing that concerns over the coffee chain's viability amid the scandal are prevalent.

China has mostly returned to normal activity, yet some consumers are afraid of entering public places. Even if the firm cleans up the financial mess, it would take time for a revival. If Luckin Coffee is lucky to survive, its equity will find buyers – yet when and at what price remains muddy. Those who held onto shares so far are unlucky.

LK Coffee Stock

Luckin Coffee's stock price is dropping some 17% at the time of writing, adding to its misery and just above $600 million. Shares are changing hands at around $2.33, down from a 52-week low of $51.38.

The S&P 500 enjoyed significant gains of 1.67% on Wednesday, boosted by hopes for further stimulus from the Federal Reserve and as investors were shrugging off doubts about Moderna's vaccine candidate. The mood soured later on as Sino-American tensions escalated again. However, investors seem more optimistic as markets open on Thursday. The 3,000 mark seems within reach.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.