- Li Auto (LI) stock jumps 10% in two days to close the week.

- Li Auto announced orders for its Li9 SUV are strong.

- Chinese stocks were also boosted by hopes for a delisting deal.

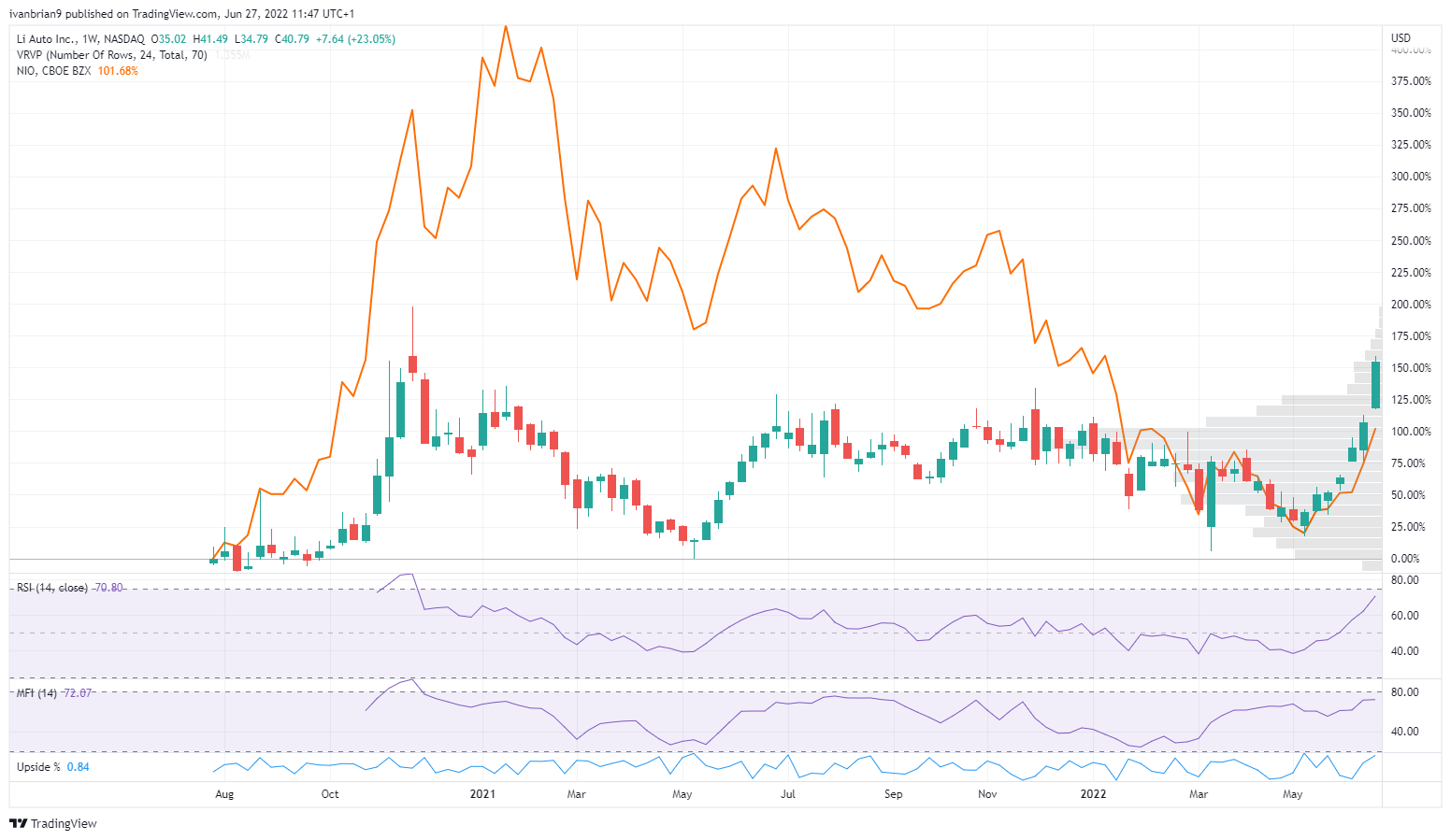

Li Auto (Li) impressively closed last week as it added to Thursday's 6% gain with another 4% on Friday. That has meant LI stock is now up 22% on the week and a whopping 81% over the last month. LI Auto stock has moved from $18.83 in early May to close Friday at $40.79.

LI Auto Stock News: Li L9 SUV orders said to be strong

LI said on Friday that orders for its new SUV, the L9, have surpassed 30,000 within three days of orders being opened for reservations.

From the press release: " orders for Li L9, its flagship smart SUV, have exceeded 30,000 in 72 hours since the vehicle was available for reservation, demonstrating the outstanding product appeal of the vehicle for family users."

The news was enough to send shares in Li Auto (LI) higher on Friday to add to an impressive run for the stock as detailed above. Chinese tech stocks had been strongly sold off this year as many were listed by the SEC for potential delisting due to problems with the Holding Foreign Companies Accountable Act (HFCAA). The SEC had issues in particular with audit access to Chinese tech firms and listed many retail favorites for potential delisting. Recent conciliatory tones from Bejing led investors to upgrade their odds that delistings could be avoided and saw a surge in Chinese tech stocks.

This is most obvious from the KWEB China Internet ETF. The chart below is up over 30% in the past month. KWEB includes many SEC stocks flagged for potential delisting. Chinese stocks have also been boosted by loose monetary policy and proposed economic stimulus measures announced by Chinese authorities.

An article in last Thursday's South China Morning Post, "China considers extending EV tax exemption to put industry back on track after Covid-19 lockdown", also naturally helped Chinese EV names LI, NIO and others.

KWEB chart, daily

LI Auto stock forecast

The strong performance has seen LI stock retrace nearly back to pandemic highs, one of the few meme stocks to do so. That naturally makes us wary, and we also notice LI is showing an overbought signal on the Relative Strength Index (RSI) and Money Flow Index (MFI).

LI chart, daily

NIO by contrast remains miles away from its pandemic highs

NIO chart, weekly

NIO seems to have caught the meme frenzy a lot more than LiAuto, so naturally NIO had further to fall.

Weekly NIO (orange line) versus LI Auto chart

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0800 after German inflation data

EUR/USD struggles to gain traction and trades in a narrow channel above 1.0800 on Monday as the risk-averse market environment helps the US Dollar stay resilient against its rivals. Meanwhile, the data from Germany showed that the annual CPI inflation declined to 2.2% in March, as expected.

Gold sits at record highs above $3,100 amid tariff woes

Gold price holds its record-setting rally toward $3,150 in the second half of the day on Monday. The bullion continues to capitalize on safe-haven flows amid intensifying global tariff war fears. US economic concerns weigh on US Treasury bond yields, allowing XAU/USD to push higher.

GBP/USD stays in range near 1.2950 as mood sours

GBP/USD fluctuates in a narrow channel at around 1.2950 at the beginning of the new week. Growing concerns over US President Donald Trump's tariffs igniting inflation and dampen economic growth weigh on risk mood and don't allow the pair to gain traction.

Seven Fundamentals for the Week: “Liberation Day” tariffs and Nonfarm Payrolls to rock markets Premium

United States President Donald Trump is set to announce tariffs in the middle of the week; but reports, rumors, and counter-measures will likely dominate the headline. It is also a busy week on the economic data front, with a full buildup to the Nonfarm Payrolls (NFP) data for March.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.